Property firm Savills estimates that £330bn is needed to implement all advised energy efficiency improvements to the UK residential housing sector as it seeks to meet targets set by government including a desire to get all homes to EPC level C by 2035.

The latest research which analyses EPC certificates to estimate the cost of implementing all advised energy efficiency improvements highlights the limitations of current grant schemes and the need for more radical intervention.

Between 2004 and 2017 CO2 emissions from residential property fell by 26% – but they have risen again by 9% between 2014 and 2020 according to government data. As a result, the UK’s residential housing sector was responsible for emitting 67.7 metric tonnes of carbon dioxide equivalent (MTCO2e) in 2020, which is over one-fifth of all UK CO2 emissions.

The vast majority (70%) of this comes from heating properties – the bulk of the issue lies with older homes that present the greatest challenge. 30% of homes in England and Wales built pre-war still carry an EPC rating of E or below, increasing to 47% for those built pre-1900, according to Savills research.

Average impact on housing values

The payback on many energy improvements remains unattractive, even if grant can be accessed to underwrite some of the cost. The estimated cost of upgrading a home with an EPC D rating is £6,472 – but with an average annual cost saving of £179, it will take 36 years to pay back the initial investment according to the English Housing Survey.

As a result, for the majority of homeowners, the impact that upgrading a home’s EPC rating will have on its value is limited.

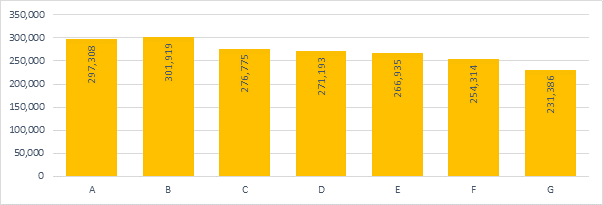

At a national level, there’s just a £9,840 difference between an average home with an EPC C & E rating based on Savills analysis. Though this increases to £47,605 when comparing EPC B to F, the opportunities to make such a large change are far rarer.

Average value for a 1,000 sq ft three-bedroom property at a national level

Savills suggests that grants and green finance initiatives alone are unlikely to facilitate the step-change in investment in energy efficiency needed to meet government targets.

“Existing regulation provides a framework to require landlords to ensure their stock meets the increasing minimum standards for energy efficiency in the rented sector, however, it will place a significant liability on both private and affordable landlords that is likely to result in significant restructuring of their portfolios,” said Lucian Cook, head of residential research at Savills.

“Decarbonising heating sources needs to go alongside improving the energy efficiency of our homes, but as things stand, energy cost savings and small changes to home values are currently not enough of an incentive for many homeowners who won’t see enough of a return on investment compared to other home improvements, to warrant the expenditure.

“With the government likely to impose EPC targets for lenders, the cost and terms on which mortgage finance can be obtained have the potential to change the equation for those with a mortgage. However, even this will not go far enough. More than 10 million homes are owned outright – increasing by 1.6 million in just the past 10 years. These homes are typically older, less energy-efficient and change hands infrequently.

“This may mean discounts and surcharges on property-specific taxes such as stamp duty and council tax have to be considered by policymakers. These have the potential to increase the ‘green premium’ and ‘brown discount’ of housing, providing a greater incentive for owners to invest in energy efficiency improvements. However, they are likely to be highly politically sensitive, requiring, among other things, concessions for heritage properties.”