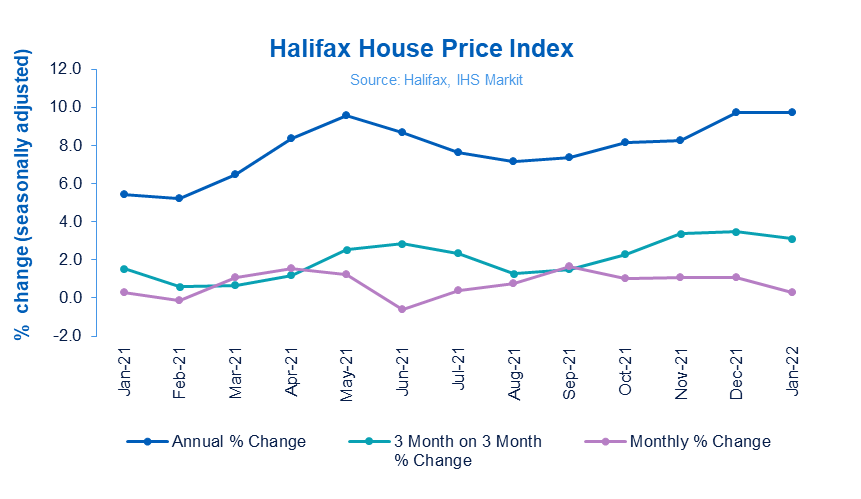

Monthly house price growth fell to 0.3% in January, the lowest rise since June 2021 but house prices still managed to hit a new record high, according to the Halifax house price index.

The annual rate of growth remains steady at 9.7% with the average cost of a house now standing at £276,759.

Halifax’s figures come as transaction volumes return towards pre-Covid levels.

Russell Galley, managing director, Halifax, said: “House price growth slowed somewhat at the start of the year, rising by just 0.3% in January, the smallest monthly increase since June 2021.

“This followed four consecutive months of gains above 1%, and with annual growth remaining at 9.7%, the average UK house price was little changed, edging up slightly to a new record high of £276,759. Overall prices remain around £24,500 up on this time last year, and £37,500 higher than two years ago.

“Following the peak activity of 2021, transaction volumes are returning to more normal levels. Affordability remains at historically low levels as house price rises continue to outstrip earnings growth. Despite record levels of first-time buyers stepping onto the ladder last year, younger generations still face significant barriers to home ownership as deposit requirements remain challenging.

“This situation is expected to become more acute in the short-term as household budgets face even greater pressure from an increase in the cost of living, and rises in interest rates begin to feed through to mortgage rates. While the limited supply of new housing stock to the market will continue to provide some support to house prices, it remains likely that the rate of house price growth will slow considerably over the next year.”

Regions and nations house prices

In keeping with last year, Wales kicked off 2022 as by far the strongest performing nation or region in the UK. With annual house price inflation of 13.9%, down marginally from December, the average house price fell slightly to £205,253.

Northern Ireland also continues to record strong price growth, with prices up 10.2% on last year, giving an average property value in January of £170,982.

House price growth remains strong in Scotland too, though the annual rate of inflation slowed somewhat to 8.9%, with the average property price edging down to £192,698.

In England, the North West was once again the strongest performing region (up 12.0% year-on-year, average house price of £213,200) and now has the second highest rate of annual growth in the UK.

While London remains the weakest performing area of the UK, the capital continued its recent upward trend with annual house price inflation accelerating for a third straight month to now stand at 4.5%. This was double the rate recorded in December and its strongest performance in over a year.

Reaction

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“2021 was a bumper year for the housing market and was always going to be a tough act to follow. Monthly house price growth may have fallen slightly, but nevertheless the year has also got off to a good start with confidence in the housing market remaining, supported by relatively cheap mortgages, even though interest rates are edging up from all-time lows.

“While rates have increased since the autumn where we saw the historical low point for fixes, there is still some incredible value in ten-year fixes in particular, with several lenders launching deals recently or reducing pricing.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Though price growth is slowing, these figures demonstrate the underlying strength of the market and how likely it is to withstand increasingly stretched affordability.

“We know from what’s happening on the ground that the double-whammy of rising inflation and interest rates are already prompting some who thought prices could only go one way to request valuations and make properties available for sale.

“On the other hand, supply still can’t keep up with demand, especially for family houses, and with around 50% of homes owned outright there are many who are relatively unaffected by interest rate rises.”

Tomer Aboody, director of property lender MT Finance:

“Although the monthly growth in house prices in January wasn’t as high as in recent months, prices are still rising as buyers chase the few properties currently making it onto the market.

“With interest rates already rising and continuing to do so this year, already-stretched affordability is only going to become more of an issue with younger buyers struggling to get on the ladder.

“We need to encourage more homes to be sold and a restructure of stamp duty levels might just help with that, encouraging downsizers to make a move by reducing the duty they need to pay.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“Affordability is set to be the defining narrative of 2022. High prices, coupled with rising interest rates and the soaring cost of living, mean lenders are looking at people’s finances in forensic detail.

“Even though the pandemic is now two years old, its impact on the psychology of homeowners is still only beginning.

“What people want from their homes has changed dramatically and that continues to drive demand, despite the numerous headwinds. 2022 is likely to see milder growth than 2021 but the chronic shortage of stock will support prices.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“The rate of price growth may have cooled slightly in January but the market still hit another record high.

“The cooldown in price growth is likely to continue throughout 2022 as the cost of living crisis and rising interest rates make buyers and lenders alike more conservative. But average property values are unlikely to fall as mortgage rates are still phenomenally competitive and supply levels are obscenely low.

“People are also keener than ever to leave the rental market, where prices are often painfully high. Though it has been at the back of the pack for some time, London is now starting to hit its stride.”

Lee Griffiths, managing director at Hinckley-based estate agents Saxon Paddock Estates & Homes:

“Price growth in January may have dipped but the resilience of the property market in the face of rising interest rates and inflation is still remarkable.

“The extraordinary lack of stock is the key driver of prices but we are finally starting to see a slight increase in valuation enquiries. When properties come onto the market, they are hoovered up by ravenous demand.

“Though prices are unlikely to fall in 2022, a degree of stabilisation is almost certain and we started to see that in January. Interest rates and inflation are both rising and that will temper price growth.”

James Humphries-Stone, director of Midlands-based estate agency, The Avenue:

“Though the rate of price growth fell slightly in January, demand is massively outstripping supply and that will support values throughout 2022.

“As long as supply remains as low as it is, it’s hard to see prices falling despite soaring inflation and rising interest rates. The race for space will continue to drive activity levels throughout 2022, just as it did in 2021.”

Andrew Simmonds, director at Bristol-based Parker’s Estate Agents:

“The more moderate growth in January is likely to set the tone for the rest of 2022 due to rising interest rates, impending National Insurance tax rises and the increased cost of living. What we’re seeing a lot of is vendors selling and moving to rented with a view to purchasing later in 2022 or 2023. In the current market you need to be hot to trot or you have little chance of securing a property.”

Toby Fields, co-founder of Bristol-based Langley House Mortgages:

“Inflation and interest rates are on the rise but the one thing that isn’t is the number of houses for sale. Frighteningly low stock levels are supporting prices and keeping the market strong, even though the rate of growth is slowing.

“While the economic fundamentals should be weighing down on it, the property market remains robust and resilient as it has been throughout the pandemic. The only way prices will fall is through a surplus of supply and that’s unlikely any time soon given the glacial pace at which we build new homes.”

Imran Hussain, director at Nottingham-based Harmony Financial Services:

“Price growth may have cooled slightly in January but the number of first-time buyers is the strongest I’ve ever seen, with extortionate rents driving a great escape from the rental market. Even though rates are rising and the cost of living is very high, there are roughly 20 buyers for each property so prices are unlikely to drop.”

Scott Taylor-Barr of Shropshire-based Carl Summers Financial Services:

“Prospective buyers are increasingly conflicted. It’s hard not to be when all people are reading about is rising interest rates, record high inflation, tax increases and soaring energy costs. It’s not surprising that people are approaching a big ticket purchase like a house with a little less of a gung-ho attitude in the current fraught climate.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“January was all about first-time buyers as the rental market is increasingly seen an absolute no-no. With this in mind, it’s vital first-time buyers get their ducks in order before they even think about looking to buy.

“With some properties having upwards of 20 offers within a day of hitting the market and many deals going to sealed bids, the early bird catches the worm. 2022 is shaping up to be another strong year for the property market, as the extreme lack of supply counteracts the high cost of living and interest rate rises.”

Rob Gill, founder of London-based Altura Mortgage Finance:

“Despite rising interest rates and skyrocketing inflation, the great reset due to the pandemic changing what people want from property is still unfolding.

“Borrowing rates may be going up but they are still exceptionally low. The scarcity of property available to buy means house prices are likely to remain fairly buoyant despite the many challenges facing the economy.”

Jason Tebb, chief executive officer of property search website OnTheMarket.com:

“While some of the heat of last year has tailed off, there are still good numbers of buyers keen to move. January saw a rise in terms of new applicants, viewings and valuation requests, as motivated buyers and sellers who didn’t make the move last year remain keen to do so.

“It’s uncertain whether last week’s interest rate rise, coming so soon after the first rate increase in more than three years, will impact buyer confidence, particularly given greater pressure on budgets from an increase in the cost of living.

“But with mortgage rates still comparatively cheap and many on fixed-rate products, positive sentiment should prevail for now although it’s possible that the growth in average prices may continue to slow over the next few months.

“However, that may not be such a bad thing as the true health of the housing market is better measured in transaction volumes than in house price growth.”

Sundeep Patel, director of sales at specialist lender, Together:

“With house prices at an all-time high in over 17 years, January’s growth remained steady at 9.7%, setting the average at £276,759

“House prices grew exponentially in 2021, and still continued to rise in January, and we now find ourselves plunged into a cost-of-living crisis, while the market remains highly inflated with demand outstripping available properties. This could mean difficulties, particularly for first time buyers.

“And there’s more tough news for borrowers. Those with fixed rate mortgages will avoid the impact of the latest rise in interest rates but the same can’t be said for those with variable rates, who could face higher costs. The picture is still uncertain, but it’s likely we’ll see the market start to cool off as we head into spring as households juggle squeezed finances.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“The cost-of-living crisis puts the brakes on runaway house price rises. Prices were still going up in January, but far slower than for the previous three months, and the number of sales dropped back to the kinds of levels we saw before the pandemic.

“Back-to-back interest rate rises haven’t moved mortgage rates far off their record lows, and with four in five mortgage holders protected by fixed rate deals, most haven’t yet faced the impact of rate increases. However, it’s persuading buyers to think twice about how they can afford higher house prices at a time of rising rates.

“At the same time, the looming threat of an incredible £693 hike in energy prices in April, coupled with tax hikes, and the rising cost of everyday essentials like petrol and food, means we’re worried about making ends meet as it is – let alone stretching ourselves to move up the property ladder.

“The Bank of England is committed to slow and steady interest rate rises through the year, so at the moment we don’t foresee the kind of rate shock that would send prices tumbling. However, we can expect monthly price rises to peter out, and annual rises to drop back as we go through 2022.

“If you need to buy a new home, there’s little point in trying to second-guessing market movements to time a purchase perfectly, because there are so many unknowns that make it impossible to identify the ideal moment to buy until it has passed. However, it’s worth considering carefully how affordable the move is after rate rises and bill hikes, so you deal with the really difficult questions before you commit.”

Karen Noye, mortgage expert at Quilter:

“Any predictions that house prices were going to start to pull back once the stamp duty holiday was no longer in play have been proved very wrong.

“However, the Halifax house price index released today shows that significant house price rises are starting to slow with only a 0.3% month on month rise, which is the lowest since June 2021.

“While forecasts of a housing price reduction have not yet fully materialised it seems inevitable that there will be some sort of slowdown in the coming year.

“With energy prices soaring, inflation running riot and interest rates likely to rise in the very near future people are going to start to feel less financially stable than they were before, and this will translate into fewer property purchases.

“House price growth continues to far outstrip wage growth and now with a cost-of-living crisis looming the run of ever-increasing property prices is simply unsustainable.

“Another force on the property market that remains very unpredictable is how businesses will react to the dropping of all office restrictions. While many businesses feel the pandemic has caused an permanent change in how we work, others will mandate a stricter office return.

“This may reverse the trend that has seen city centre flats become less desirable compared to more rural detached houses. How we exit the pandemic and the behaviours we all adopt will exert pressure on different sections of the property market.

“However, while a slowdown in the medium term is likely, a huge drop in property prices is probably not on the cards unless something completely unforeseen happens.

“At present the UK is still suffering from a lack of housing stock and the laws of supply and demand will keep house prices relatively high for the time being. The last couple of years have been anything but predictable and this will continue into 2022.”