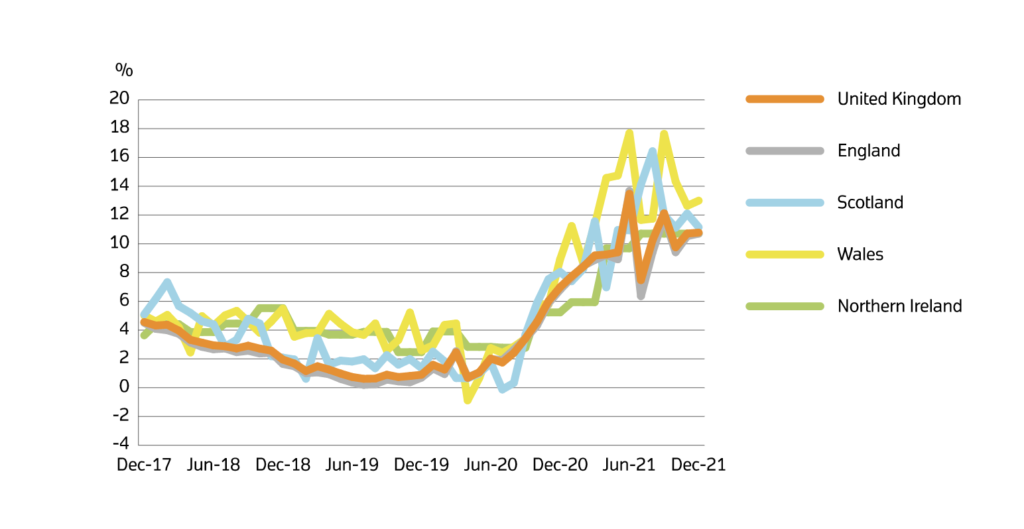

House prices increased by 0.8% between November and December of last year and 10.8% year-on-year, according to the latest figures from the Office for National Statistics (ONS).

The average price of a property in the UK during the same period stood at £274,712. House price growth was strongest in Wales where prices increased by 13.0% in the year to December 2021.

The lowest annual growth was in London, where prices increased by 5.5% in the year to December 2021.

The average house price in Northern Ireland increased by 10.7% over the year to Quarter 3 (July to September) 2021.

And Northern Ireland remains the cheapest UK country to purchase a property in, with the average house price at £159,000.

| Country and government office region | Price | Monthly change | Annual change |

|---|---|---|---|

| England | £293,339 | 1.1% | 10.7% |

| Northern Ireland (Quarter 4 – 2021) | £159,109 | 3.0% | 10.7% |

| Scotland | £180,485 | -1.8% | 11.2% |

| Wales | £204,835 | 2.0% | 13.0% |

| East Midlands | £235,004 | 1.1% | 12.1% |

| East of England | £339,502 | 0.4% | 11.7% |

| London | £521,146 | 0.2% | 5.5% |

| North East | £147,214 | -1.5% | 5.9% |

| North West | £200,172 | 0.6% | 10.2% |

| South East | £380,237 | 1.6% | 12.6% |

| South West | £314,037 | 1.9% | 13.6% |

| West Midlands Region | £238,238 | 2.6% | 11.5% |

| Yorkshire and The Humber | £196,877 | 1.8% | 9.8% |

Reaction

Emma Cox, sales director at Shawbrook Bank:

“Despite house prices continuing to remain at unprecedented levels and limited supply, persevering buyers have not been deterred. Demand remains strong in previously less sought-after locations as a result.

“However, interest rate rises and the rising cost of living are making the property landscape challenging and may only get more difficult as the year progresses. For all potential buyers, securing a competitive mortgage with a fixed rate will be imperative.

“First-time buyers are likely to be the biggest losers as prices and affordability challenges bite. The market needs to find a level of harmony, where renters have access to quality rental properties, but homeownership is within reach for those looking to get onto the housing ladder. The UK must build more quality, affordable housing to refocus the market and offer stability to all.”

Chris Hutchinson, CEO of Canopy:

“Inflationary pressures continue to weigh heavy on individuals as the cost of living crisis takes hold. While homeownership may have felt out of reach before, it could now feel a million miles away as many feel stuck in a cycle of renting spending a large chunk of their salary each month on rent.

“It is, therefore, more important than ever that the Government and the housing industry work together to encourage positive financial habits from the moment people begin renting.

“The increasing cost of living is bringing more challenges to the table for potential homeowners in an already fiercely competitive market. Building a stronger credit score and financial resilience will be vital to ensure an edge over the competition.”

Colin Bell, co-founder and COO, Perenna:

“Today’s news will be welcomed by existing homeowners but not by first-time buyers or home movers, who are already battling record inflation and rising interest rates in their bid to step onto the property ladder or move home.

“The sector needs to rethink the way it supports first-time buyers if we are to ensure homeownership remains a viable goal for all, rather than a few.

“Offering more high loan to income and low deposit mortgages will go some way to help these underserved borrowers. And allowing people to move home and trade up will release properties for first-time buyers as well.

“Periods of high inflation remind us of the value in the peace of mind offered by long-term fixed repayments – as such, I think 2022 will be a watershed year for homeowners locking into long-term deals.”

Stuart Law, CEO of the Assetz Group:

“House prices are still on the rise while wages fail to keep pace with inflation. This is a dangerous dynamic for the market and particularly worrying for low income and first-time buyers.

“I expect interest rate growth to be cautious this year despite inflationary pressures, allowing low-cost mortgages to fuel market activity. But, this can’t continue indefinitely. If current dynamics persist, we will see more and more people locked out of the housing market unless we urgently tackle chronic undersupply.

“Following the Chief Planner’s statement this week we are now awaiting updates on planning reform in the Spring. We really can’t afford any more delays. Planning is a huge barrier for housebuilders, especially SMEs already struggling with high build costs.

“At the same time, we need to make sure that developers can navigate current cost pressures by gaining access to a broad range of financial products that meet their needs. This goes beyond bank funding and includes peer-to-peer lending and other specialist finance providers who bring billions in funding to the market each year, creating bespoke solutions that aren’t on offer from traditional lenders.

“Specialist finance is essential to support housebuilding, which is why we’re boosting our SME housebuilder lending to £1bn in 2022. At the same time, we need to disrupt the mainstream finance market to find ways to inject capital into underserviced sectors like supported living, where more, high quality specialist accommodation is desperately needed for people facing hardship, health issues or with mental or physical disabilities.

“Tackling this problem is a key focus for our Assetz Exchange platform, which is quickly expanding its activity to make more properties available to charities and housing associations across the country.”

Tomer Aboody, director of property lender MT Finance:

“As property prices continued to rise in December, there is a danger that affordability is stretching beyond the means of many would-be buyers.

“With inflation rising again to 5.5%, and expectations that it could climb considerably further, the possibility of a further interest rate rise in March looks even more likely.

“The housing market is likely to continue to be busy into the spring as buyers fight for every house to make the most of cheap rates before they disappear. That said, we don’t expect a further increase to result in any major hike in mortgage pricing overnight.

“Areas outside of London continue to see the most significant levels of growth, with Wales witnessing the strongest house price growth while London saw the lowest annual growth.

“However, with the starting price point lower outside of the capital, any change will be more significant. With more people starting to return to work in the office, it will be interesting to see whether this will impact those numbers and whether the allure of London will return.”

Clare Beardmore, head of broker and propositions at Legal & General Mortgage Club:

“Despite the usual slight slowdown in activity around Christmas, it comes at little surprise that demand for property continues to run high.

“The past two years have dramatically changed what people want from their homes and these new-found preferences are still supporting high levels of transaction activity. Of course, price growth remains underpinned by a chronic lack of supply, creating a fiercely competitive market for house-hunters.

“These themes are likely to continue to dominate the market in 2022. While tax rises and rising inflation have begun to squeeze households’ spending power, the market has shown over the last few years that it can remain resilient, even in the face of unexpected headwinds.

“Although some lenders are starting to shift mortgage rates upwards, pricing remains competitive, and many borrowers would benefit from speaking to an adviser to weigh up their options. Doing so could help them secure a deal that is well-aligned with their circumstances and safeguards their finances.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“On the face of it, these figures show the housing market continuing its inexorable rise but maybe that isn’t the case.

“Looking behind the numbers we see prices, though a little historic, are virtually unchanged from the previous month. Buyers are coming to terms with reduced affordability which is compromising confidence to take on yet more debt as inflation hits record highs and interest rates are on the up too.

“At the sharp end, we are still finding lack of stock is holding back transactions but increasing energy costs in particular are starting to encourage potential downsizers to think more seriously about the long-term suitability of their present homes, which should help to balance out supply and demand.’

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“There is further speculation that the Bank of England will raise interest rates again at its March meeting in order to curb runaway inflation, and it remains to be seen what impact this will have on buyer confidence.

“Despite the global pandemic, the housing market thrived last year and there are still those who have not yet made their purchases. Squeezed affordability, however, would be a major issue, preventing first-time buyers in particular from getting on the ladder.

“Low mortgage rates have been one of the contributing factors to the housing boom and although some lenders are tweaking mortgage rates upwards on the back of higher money market rates, pricing remains competitive.”

Michael Bruce, CEO and founder of Boomin:

“It’s only fitting that house prices should continue to climb in December, as the curtain falls on what has been quite an extraordinary year for the property market.

“However, while the scales of supply and demand remain firmly tipped in favour of the nation’s home sellers, there’s a good chance that the high rate of house price growth seen during the pandemic will now subside, replaced by more incremental gains during the year ahead.”

Kimberley Gates, head of corporate partnerships at Sirius Property Finance:

“We’ve seen many buyers push their budget that little bit further over the last 12 months due greater levels of mortgage affordability and a stamp duty saving. This has helped drive top line house price growth across the UK and we’ve seen the market continue to go from strength to strength as a result.

“With interest rates increasing and the opportunity of a stamp duty saving now long gone, we expect to see a more measured market performance over the coming year.

“While there’s certainly no reason to panic, the monthly cost of a mortgage will start to climb for those that aren’t locked into a fixed rate and this will impact the price buyers are willing to pay to climb the property ladder.”

Geoff Garrett, director of Henry Dannell:

“The general expectation is that the Bank of England will impose at least two further interest rate increases over the course of this year. This will bring the base rate up to one percent at the very least and while this remains comparably low to historic highs, those on tracker or variable rates will notice the monthly cost of their mortgage climb significantly.

“We’ve already seen a huge uplift in the number of lenders withdrawing or increasing their fixed rate offerings and we believe this will continue. So for those considering a purchase in 2022, it’s important not to overstretch financially and the best plan of action is to enter the market with plenty of breathing room to help absorb this hike in the cost of borrowing.”

Jonathan Samuels, CEO of Octane Capital:

“The market remains in fine form having defied all expectations during the pandemic and there is little sign of any significant decline on the horizon.

“Increasing interest rates and a sharp jump in the cost of living will, of course, have some impact.

“We expect this will come in the form of a more conservative approach to borrowing from the nation’s homebuyers in contrast to the gung ho approach seen during much of the pandemic, as they are no longer buoyed by the race for more space and a stamp duty saving.

“The result of which will be a slow in the rate of house price growth rather than a property market crash.”

Chris Hodgkinson, managing director of HBB Solutions:

“We’re yet to see a let up in the torrential downpour of homebuyer demand that has washed over the property market pretty much since the start of the pandemic. As a result, those looking to sell are achieving a very good price which is driving property values ever higher.

“Current market conditions are so strong that even when transactions are falling through, sellers are securing another buyer immediately and for a higher price than they had agreed during their original sale.

“This won’t last forever though and those entering the market this year should tread with a little more caution. Although demand levels are likely to remain robust, buyers will start to feel the pinch caused by an increase in both the cost of living and borrowing. So sellers who persist with unrealistic asking price expectations will struggle to see them met.”

Marc von Grundherr, director of estate agent Benham and Reeves:

“The market outlook for the year ahead remains positive despite dark cloud gathering in the form of increasing interest rates and an inflated cost of living. While these factors will certainly influence the market to some extent, they are unlikely to dampen our appetite for homeownership and with stock levels remaining insufficient, market values are unlikely to decline anytime soon.

“That said, it is likely that the wider UK market will now shift down a gear or two where the rate of house price growth is concerned, with early signs suggesting that London is once again poised to take house price pole position.

“Buyer demand for central London flats has picked up considerably and this is a very promising sign given it’s really the core segment of the central London market. This growing demand will continue to be bolstered by a return to the workplace and most notably, the return of foreign buyers and renters, with these factors continuing to pull London out of the doldrums where it’s sat for much of the pandemic.”

James Forrester, managing director of estate agent Barrows and Forrester:

“It’s hard to remember a time when the property market has been firing on all cylinders for such a sustained period and we continue to see numerous areas driving top line market performance forward at quite some rate.

“Of course, this rate of growth isn’t sustainable for ever and we expect to see some natural correction in the coming months. This certainly won’t come in the form of a house price collapse, but those thinking of selling would be wise to do so sooner, rather than later.

“There is currently an incredible shortage of stock available on the market and we’re seeing numerous buyers fight it out over a single property. With such an imbalance, those that do bring their home to market are sure to achieve very close to asking price and, in some cases, quite a bit more.”

Miles Robinson, head of mortgages at online mortgage broker Trussle:

“While continued house price growth is positive news, many homeowners are concerned about their finances, as soaring inflation and the cost of energy are putting households under extreme pressure. In addition, measures taken to tackle inflation could also be adversely impacting homeowners, with the BOE’s further interest rate rise potentially adding up to £331.56 onto mortgage products annually.

“Now is a good time for homeowners to review their outgoings and explore all their options. Those in a position to remortgage could make a huge saving of up to £325 per month on their mortgage.

“Alternatively, if you’re just about to take out a new mortgage, you might want to consider taking a longer 5-year fixed term mortgage to give some certainty to your financial situation. These have increased in popularity during the pandemic and can be a great way of giving you peace of mind that your monthly payments will be fixed for the foreseeable future.”

Ian Hewett, founder of The Bearded Mortgage Broker:

“Over the past year I’ve watched endless borrowers scrimp and save to achieve the magical 5% deposit required to buy a shoe box, only to then see the prices of property being driven higher and higher. The lack of stock is borderline cruel, the competition to buy intense and prices have shot upwards due to the Stamp Duty holiday and the ongoing ‘race for space’.

“The look of anguish and annoyance as first-time buyers realise they don’t have enough of a deposit to reach their dream of owning a home is hard to bear. To top it all off, interest rates are now rising and the cost of living is having a real impact on lenders’ affordability criteria.

“The hope for first-time buyers is that the market stabilises, or even drops, as the base rate goes up and more properties come back onto the market. The market is incredibly tough at the moment for first-time buyers and is driving many into an existential despair.”

Jonathan Burridge, founding adviser at hybrid mortgage adviser, We Are Money:

“With the property market, the simple rules of supply and demand rule supreme and that’s reflected in the December data.

“At the moment supply is low and demand strong, and this is supporting prices despite the cost of living crisis highlighted by the latest inflation data.

“The post-Brexit bumpy road for property forecast by many was delayed due to the Stamp Duty holiday introduced during the pandemic. We are likely to see some regional adjustments during 2022, as there are a lot of headwinds facing the economy at present. London house prices are starting to recover from the Covid dip, but other areas may not do so well.”

Luke Loveridge, CEO at Bristol-based property specialist, Propflo:

“Given the hellish increase in the cost of living, prices are likely to come off the boil in 2022. However, I expect we will start to see prices increase more rapidly for highly energy-efficient homes. A growing numbers of lenders will lend larger sums against these homes as they help increase affordability for buyers.”

Dominik Lipnicki, director of Your Mortgage Decisions:

“The housing market saw double digit increases in 2021, including a strong finish to the year. Despite inflation being at a 30-year high, it is likely that we will see further house price rises in 2022, albeit they are likely to be more modest. Demand is strong and supply simply too weak.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“Houses prices continued their inexorable march in December but affordability is set to be the defining narrative of 2022. High prices, coupled with rising interest rates and the soaring cost of living, mean lenders are looking at people’s finances in forensic detail. 2022 is likely to see milder growth than 2021 but the chronic shortage of stock will support prices.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“It’s no surprise that the market rose even further in December, as demand was exceptionally strong and supply critically low. However, we expect the market to start to cool throughout 2022 as the cost of living crisis and rising interest rates makes buyers and lenders alike more conservative. But average property values are unlikely to fall too much as mortgage rates are still phenomenally competitive and supply levels are obscenely low. People are also keener than ever to leave the rental market, where prices are often painfully high.”

Graham Cox, founder of the Bristol-based Self-Employed Mortgage Hub:

“With everything more expensive right now, including mortgages, common sense would dictate that house prices can only go one way, namely south. But this government seems hell bent on propping up the housing market at all costs. After help to buy and the stamp duty holiday, it’s surely only a matter of time before Rishi announces his next hare-brained scheme. Failing that, we expect prices to fall in 2022.”

Imran Hussain, director at Nottingham-based Harmony Financial Services:

“The property market in December was as buoyant as ever and showed no signs of slowing, with first-time buyers the major driver. As long as supply shows no sign of keeping up with demand, prices are likely to remain solid. But the impact of inflation is really now starting to bite and that could see prices finally come off the boil in 2022 and the beginning of a more moderate growth climate.”

Rob Peters, director of Altrincham-based Simple Fast Mortgage:

”What goes up must come down. But so far the housing market has defied the laws of economic gravity due to demand and political intervention. The question everyone is asking is, will house prices drop, when, and by how much? During December and January we saw normal seasonal changes in house buying activity, but nothing that indicated a more meaningful shift in the relentless demand for homes. And it’s difficult to see this changing in the short-term, given the current backdrop of poor supply of stock.”

Rhys Schofield, managing director at Peak Mortgages and Protection:

“Supply shows no sign of keeping up with demand and that just means prices will continue to rise for the foreseeable future.

“We even have some would-be buyers on our books who have offered full asking price on over five houses and not been successful in getting any of those offers accepted. Without real action to boost supply, prices will continue to rise. And if anyone thinks purchase prices have gone bonkers, rental prices are going up even faster.”

Karen Noye, mortgage expert at Quilter:

“Any hopes of a downward tick in house prices have once again been dashed. This morning’s UK house price index showed that average UK house prices increased by 10.8% over the year to December 2021, up from 10.7% in November 2021. The average house price reached £275,000 in December 2021, £27,000 higher than this time last year.

“While prices still increased, the rate at which they are rising continues to slow. On a seasonally adjusted basis, prices increased by 0.9% between November and December 2021. The previous month had seen an increase of 2.0%.

“While a reduction in house prices has not yet materialised, it seems inevitable that there will be a slowdown during the coming year and there are many factors currently at play that could contribute.

“This morning’s CPI data showed inflation is now sat at a 30 year high of 5.5.%, and the Bank of England is largely expected to further hike interest rates to combat the spiralling figures.

“Alongside inflation and the threat of a further rate rise, energy prices continue to soar and many people are beginning to feel the stretch financially. If people begin to feel less financially stable than they were before, this could translate to fewer property purchases and we may see the start of a slowdown in house prices.

“Additionally, with the return of the government’s ‘Plan A’ at the end of January, many people began to make the transition back to the office. While many people and businesses feel the pandemic caused a permanent change in the way we work and are willing to embrace it, others will mandate a stricter office return. The ‘race for space’ seen previously could well be diminished, and the formerly less desirable city centre flats could regain popularity. How we exit the pandemic and the behaviours we adopt will likely exert new pressures on the property market.

“If the BoE does opt to increase rates for a third time, mortgage rates will rise and buying a new home will be pushed further out of reach for many. While a slowdown in property prices is anticipated, prices are expected to see a gradual fall as opposed to a huge drop – particularly as the laws of supply and demand will keep house prices relatively high for the time being as the UK continues to suffer from a lack of housing stock.

“While we can hope the property market will begin to make a return to some semblance of normality, the last couple of years have been anything but predictable and 2022 will likely be no different.”

Paul Stockwell, chief commercial officer at Gatehouse Bank:

“Persistent strong demand to move home coupled with low supply meant house prices soared again at the end of last year, but the housing market is beginning to look out of place with what is happening in the wider economy.

“Buyers continue to bid up the price of homes despite the cost of living squeeze, and there remains a strong pipeline of future borrowing, with mortgage approval rates recorded by the Bank of England last December still surpassing pre-pandemic norms.

“It’s a sign that buyers have a lot of faith in the resilience of the property market, and believe housing continues to offer a great deal of financial security, even at a time of wider economic uncertainty.”

Paul Coss, co-founder of Haysto:

“The cost of living crisis, coupled with the continuous growth in house prices is putting homeownership further out of reach for many. Being able to raise the necessary funds for a deposit while also being in a strong financial position is now proving harder than ever with an even larger proportion of salary being spent on household bills and rental payments, not to mention the fact that we are now entering the third year of a pandemic that has had a devastating impact on the finances of many.

“Help for those in precarious credit situations is scarce, as they are constantly being brushed aside in their pursuit of homeownership.

“It is important to make these individuals aware that they are not alone in their fight and help is on hand, no one should have their dreams of getting on the property ladder crushed because of technicalities, especially when these are sometimes out of their control.”

Andy Sommerville, director at Search Acumen:

“December’s figures represent a full year of rising house prices across the UK, driven by sustained demand which has progressively outstripped supply during the course of the year. Traditionally a quieter month for the property market, house prices continued to defy expectations and climbed 10.8% in the final month of the year.

“The relentless market conditions which have come to characterise the property market during 2021 are evidence of the pandemic’s impact on where and how people want to live.

“While we expect people to continue to relocate to homes more compatible for living in a post-pandemic world of hybrid working and life outside of cities, there are also some notable headwinds as we enter 2022 that might impact the market.

“Since the pandemic has struck, wage growth has lagged behind house price growth and the Bank of England’s increase in inflation rates is only set to aggravate this gap. Added to this, prospective buyers and existing homeowners are facing a cost-of-living crisis. We are seeing rising prices in sectors from food and drink to energy and telecommunications, all of which are set to impact how people spend their money in the year ahead.

“To effectively manage the squeeze on consumer’s budgets as well as the cost pressures felt by property businesses, property professionals and clients would do well to take advantage of the cost efficiencies offered by digital solutions. A digital-first mindset and the right technological tools will help the market to function at its most cost-effective which will be paramount as we face inflated costs.”