Sellers were typically asking £354,564 for a property in March, which is 1.7% or £5,760 more than in February.

This represents the biggest monthly increase seen in spring since March 2004.

The most expensive property type, those with four or more bedrooms, saw prices jump by 3.8% – an average of over £23,619 – with 12% more new listings in this sector than at this time last year.

The property portal does however predict the market could slow in the back end of the year.

Tim Bannister, Rightmove’s director of property data said: “There’s a hat-trick of reasons for home-owners to follow the normal trend and make it their goal to sell this spring. Firstly, the potential to achieve a record price for their property.

“Secondly, the imbalance between high buyer demand compared to low available property supply is the greatest that we have ever seen for the start of a spring market, meaning that the chance of being able to pick and choose between several suitable buyers is strong.

“Thirdly, the proportion of properties finding a buyer within the first week is also at an all-time high for this time of year, so sellers with an appropriately priced and well-presented property can expect a shorter marketing period than the norm.

“Those who weren’t ready to take advantage of last year’s rush now have another chance to get on the market while these conditions last.

“Many of those who are selling in this record-breaking market obviously also face the prospect of buying again in the same market, and being in fierce competition against other buyers.

“Having a buyer for your own property, subject to contract, puts those who are buying again in a powerful position compared to buyers who have yet to sell, and agents report that these ‘power buyers’ are more likely to get the property that they want and negotiate the best deal on price.”

Reaction

Tomer Aboody, director of property lender MT Finance: “With another jump in asking prices, buyers are not risking hanging around in order to secure their new home, prepared to pay record prices due to lack of supply.

“Motivated buyers are taking advantage of current low mortgage rates before further, anticipated increases, are introduced.

“Sellers are cautious about not being able to find a home for themselves to buy, but some are taking the risk, selling at record prices with the view to waiting for the market to cool a little and renting in the meantime.

“They may hope that there will be less competition at this point, and therefore they will be able to buy at a lower price point.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Although Rightmove reports that asking prices aren’t rising quite as rapidly this month compared with last, overall the numbers are still strong, reflecting the continuing huge mismatch between supply and demand.

“In our offices, we have found stronger interest in higher value, larger family homes where buyers seem to find it easier to shrug off concerns about rising interest rates and events in Ukraine having an even more serious impact on household expenditure than previously. Nevertheless, transaction numbers are down a little from the heady days of most of last year, and transaction times are lengthening.

“Flats are a different story, particularly those without outside space and good connectivity, where stretched affordability and deposit raising is more of an issue.

“As a result, flat prices will probably soften rather than correct but are certainly not going out of fashion completely now hybrid work patterns are more firmly established.”

Conor Murphy, CEO, Smartr365:

“A combination of high-demand and low-availability, coupled with the looming presence of further increases in interest rates, has contributed towards a rapid increase in house prices in March.

“Spurred by the threat of costlier rates later in the year, prospective buyers are choosing to bite the bullet and complete home purchases, but in doing so continue to pay record prices due to the short supply of available properties.

“Much of this activity is governed by continued fears around the predicted impacts of a cost-of-living crisis and a rise in interest rates, but as the picture becomes clearer over the coming months we should enter a calmer, levelling off period.

“Ultimately, today’s figures speak of a reassuring demand for UK property unhampered by external factors and reflect positively on the future of the market.”

“Looking ahead, channelling positive demand should emerge top of advisers’ list of priorities. Intermediaries need to make the process as efficient as possible, by easing the mortgage journey for borrowers who may be daunted by pressures, such as the cost-of-living crisis, for example.

“Furthermore, mortgage tech can be used to support on some of the more time-consuming day-to-day tasks, leaving intermediaries with greater capacity to offer valuable expert advice.”

Myron Jobson, Senior Personal Finance Analyst, interactive investor:

“Property prices continue to defy expectation, with values hitting the ceiling of what many buyers can afford to pay.

“Many wannabe homeowners have failed to turn their dream of getting onto the property ladder into a reality as house prices accelerate ever skywards and price them out of the market.

“The latest jump in house prices piles on more misery for first-time buyers who have struggled to save up enough for a deposit.

“Ballooning inflation means that we have to spend more to maintain current levels of expenditure, but there is little wriggle room for first time buyers living on a bare bones budget to bolster their property savings pot.

“The Bank of Mum and Dad is also facing its own cost-of-living challenges and can’t be relied on to provide much needed financial support.

“Property prices may appear unsustainable and will eventually have to come down, but would-be buyers will have to face the fact that seemingly every facet of life is getting more expensive.

“Higher interest rates could take the heat out of the red-hot property market but could also deter first-time buyers worried about mortgage payments. However, with properties in short supply, the current high demand means that property prices could remain elevated for the foreseeable future.

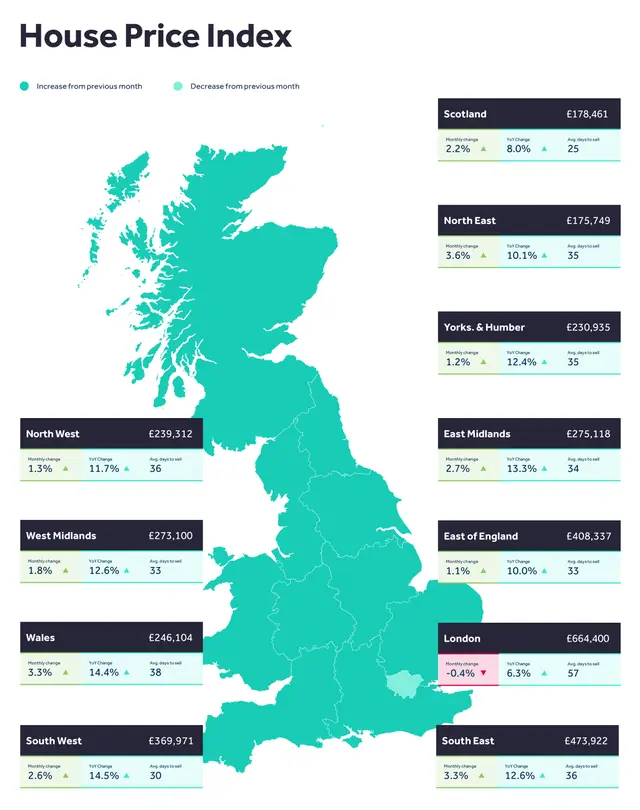

“The headline figure for house price growth masks the dramatic variation across regions of the UK.

“Many employers are embracing flexible hybrid working options, which could result in sustained demand for spacious properties.

“However, some estate agents have reported that city-centre flats are making a bit of a comeback now that working and commuting patterns have been formalised for many.”