One of our advisers has had the following experience while arranging a mortgage for a client with Virgin Money, and we thought we ought to share this with everyone.

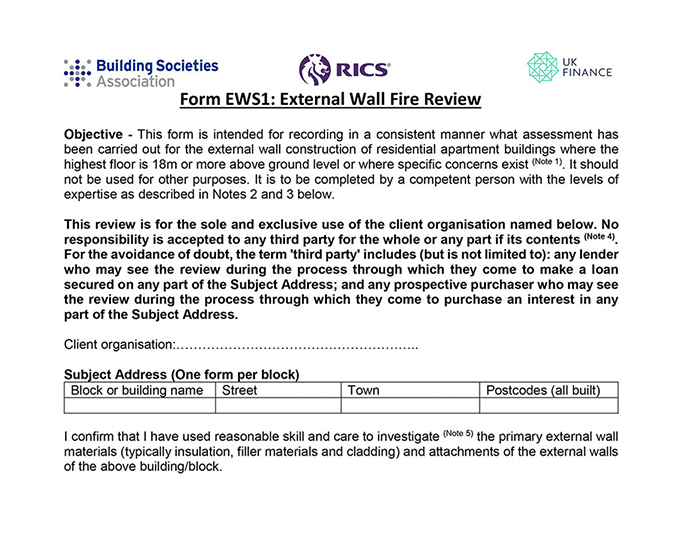

The deal involves a flat purchase and, as part of the process, an EWS1 form was supplied by the estate agents selling the property.

As readers are perhaps aware, Virgin require this form and a report to be uploaded to https://buildingsafetyportal.co.uk/search_forms.

This website is funded by some mortgage lenders, and it requires the inspection company to show they are qualified to inspect.

They must input their details to the site, which are verified as correct before they have full access to upload certificates.

However, not all lenders have made it compulsory to have the EWS documentation uploaded to this portal.

In order to proceed, we contacted both the agent and the company noted on the certificate to request that it was uploaded, which was refused.

We then managed to track down the individual named on the certificate via LinkedIn and asked if there was a possibility he could assist, even though he does not work for the company anymore.

We noticed his employment dates on LinkedIn, particularly that his start date was three months after the certificate was dated. He subsequently confirmed that the certificate was a forgery.

The estate agent sent an email trail to show it was sent the form by the property management company. The management company is no longer responding.

The estate agent confirmed that they had sold several other properties in the same block, which had the same certificate in use and sales were completed.

Please be aware that fake EWS 1 Forms are now common.

Buyers could be completely oblivious to such a fraud and this could mean they might not be able to sell at a later date.

More importantly, the building may not be safe and, when a genuine inspection is carried out, significant works could be required with the cost to be passed to the buyers, e.g. your client.

This could, of course, run to many thousands of pounds.

Martin Swann is managing director of Try Financial Ltd