iPipeline – a leading provider of low code / no code content-enabled digital solutions and services to the life insurance and financial services industry – has partnered with Sherpa.

Sherpa is expanding its financial resilience tool into the UK market and the extensive market data from iPipeline’s PreQuo product will be used to power it.

This is important for providers and advisers across all areas of financial services because it means they will have a new high-quality, data-driven analytical tool to assess and serve their clients’ needs better.

Sherpa provides insurers, banks, providers and distributors with an interactive tool to engage their clients in the need for financial resilience, which helps to close the ’advice gap.’

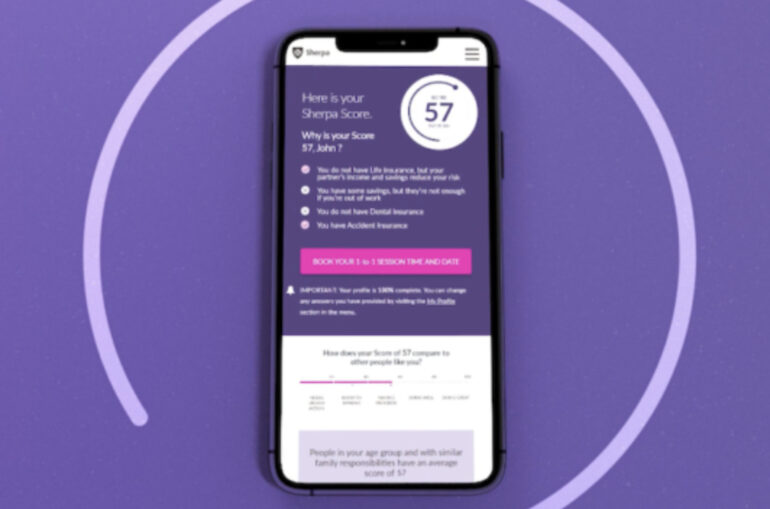

Their innovative Sherpa Score allows consumers to input key personal financial information and obtain a financial resilience Score, which in turn, can be used to position the need for solutions such as protection and savings.

A financial resilience Score helps people understand the impact of taking on debt and commitments without any form of safety net, should they face financial challenges. The Score can be embedded into existing consumer journeys, influencing and driving better financial habits.

This technology helps educate consumers about their personal risk profile and nudges them on the crucial importance of planning for the future. The solution uses data supplied by iPipeline’s PreQuo protection engagement product to produce personalised risk realities and prices to help engage consumers on the need and affordability of taking out protection cover.

“Financial resilience is a crucial subject and one which needs to be discussed in all households,” Paul Yates, product strategy director at iPipeline, said. “For protection to hit home and be really considered around kitchen tables, we need to find innovative ways to engage and provoke. Sherpa Score does just this.”

“The combination of Sherpa Score’s AI-driven technology with the reach of iPipeline’s insurance platform will enable us to provide personalised insights to more customers and point them towards making better planning decisions that build their financial resilience,” Chris Kaye, Chief Executive Officer at Sherpa, said.

The Sherpa Score platform is targeting further expansion into the UK, aiming to help all stakeholders within the protection market understand the crucial importance that financial resilience plays in happy, healthy households.