Annual UK house price growth slowed modestly in May to 11.2%, down from 12.1% in April, according to the latest figures from Nationwide.

However, prices were still up 0.9% month-on-month after taking into account seasonal effects.

The average cost of a home now stands at £269,914.

| Headlines | May-22 | Apr-22 |

|---|---|---|

| Monthly Index | 536.3 | 531.8 |

| Monthly Change | 0.9% | 0.4% |

| Annual Change | 11.2% | 12.1% |

| Average Price(not seasonally adjusted) | £269,914 | £267,620 |

Robert Gardner, Nationwide’s chief economist, said: “May saw a slight slowing in the rate of annual house price growth to 11.2%, from 12.1% in April. Prices rose by 0.9% month-on-month, after taking account of seasonal effects – the tenth successive monthly increase, which kept annual price growth in double digits.

“Despite growing headwinds from the squeeze on household budgets due to high inflation and a steady increase in borrowing costs, the housing market has retained a surprising amount of momentum.

“Demand is being supported by strong labour market conditions, where the unemployment rate has fallen towards 50-year lows, and with the number of job vacancies at a record high.

“At the same time, the stock of homes on the market has remained low, keeping upward pressure on house prices.

“We continue to expect the housing market to slow as the year progresses. Household finances are likely to remain under pressure with inflation set to reach double digits in the coming quarters if global energy prices remain high.

“Measures of consumer confidence have already fallen towards record lows. Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.

Home improvement

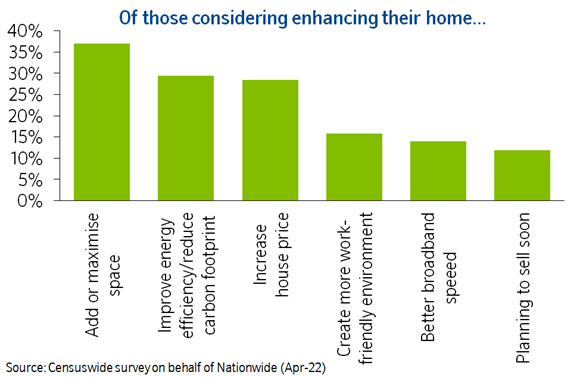

“Our recent housing market survey revealed that, as well as more people looking to move, over half of those surveyed (54%) are considering enhancing their home.

“The most popular option for those looking to make improvements was to add or maximise space, with more than a third (37%) citing this as a motivating factor. Interestingly, 29% of those surveyed wanted to improve energy efficiency or reduce the carbon footprint of their home. This consideration has become increasingly relevant in light of surging energy costs, though decarbonising and adapting the housing stock is also important if the UK is to meet its 2050 emissions target.

House prices since 1952

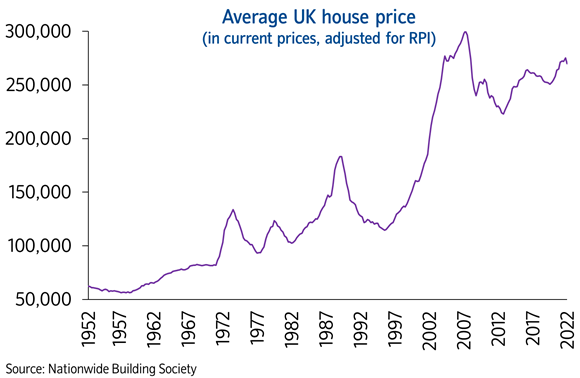

“2022 marks the Queen’s Platinum Jubilee and it is also 70 years since we produced our first house price data. The housing market was very different back in 1952, with just 32% of households owning their own home, compared to 65% today.

“The UK average house price in 1952 was £1,891 – which is around £62,000 in today’s money. This means that current average house prices are 4.3 times higher than 1952 levels in real terms (adjusting for retail price inflation).

“In 1952 the typical house cost four times average annual earnings, but today the average home costs 6.9 times earnings – a record high. However, borrowing costs were higher back then, with Bank Rate at 4.0%, compared to 1.0% currently.

“In the early 1950s, almost all mortgages were advanced by building societies, where the overwhelming majority were small, locally-based lenders. In 1952, there were 800 societies operating in the UK, compared to 43 today.”

Reaction

Alex Lyle, director of Richmond estate agency Antony Roberts:

“It is getting more difficult to call the market – on the ground, it feels as though activity has slowed a little over the past few weeks, due most likely to a lack of stock, combined with various bank holidays and half term rather than rising interest rates and inflation.

“The imbalance between supply and demand continues to fuel house price growth. Such little stock is coming onto the market, while buyer enthusiasm for a competitive-bidding bun fight appears to be waning. Some down-valuations are also beginning to creep in, which we haven’t seen for quite a while.”

Sundeep Patel, director of sales at specialist lender Together:

“We saw house prices increase by just 0.9% month-on- month in May, a previously red hot housing market now beginning to cool as rising inflation and the cost of living crisis hit disposable incomes.

“There are increasing signs that the market is becoming more sluggish as people grapple with this significant squeeze on their spending, making it increasingly difficult for first-time buyers and home movers to get onto – or move up – the property ladder.

“Renters are also feeling increased pressure with average UK rental growth the highest since the global financial crisis making it hard for those who want to buy their own home to save for a deposit.

“In this testing financial climate, stretched consumers may be shifting their priorities and only spending on the essentials, which may mean a slowdown in market activity in the coming weeks and months.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“There are still signs of strong activity in the market even though some of the heat has come out of it, and mortgage brokers remain exceptionally busy as borrowers worry about rising rates.

“Lenders continue to pull products and reprice at short notice in order to protect service levels. Mortgage pricing by smaller lenders and building societies is not as volatile as the bigger lenders as the ‘big six’ try to avoid being top of the ‘best buy’ tables due to the volume of business this attracts as borrowers scramble for the lowest deals.

“With rising inflation and living costs set to be a feature for a while, borrowers continue to favour longer-term fixes in order to protect themselves as much as possible.

“Five-year products in particular are flying off the shelves, partly because they are so favourably priced compared with their two-year equivalents.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Market activity is now being determined more by shortage of stock than softening demand, which in turn has been prompted by the rising cost of living and interest rates.

“As a result, sellers are seeing prices rising more slowly or asking levels reduced in some cases as supply and demand move more into line.

“Previously, buyers wanted to be first in the queue for new homes coming on the market but some are holding back and taking their time to consider their options.’

Amey Hellen of Derby-based estate agents, Boxall Brown & Jones:

“The fast-paced, aggressive market conditions we have become used to may be over as people re-evaluate whether this is indeed the right time to buy. May 2022 was exceptional for exchanges and completions, probably our busiest month since the end of the first pandemic lockdown, but felt quieter in terms of prospective buyers looking to purchase homes.

“If buyers do drop out of the market, reducing demand, we may finally start to see some parity with supply, which in turn will slow price growth. We do not see a crash materialising or prices falling but instead a much steadier market until living costs are reduced, especially gas and electricity bills.

“They really are weighing on people’s minds. Mortgage rates will need to rise a lot more to start impacting borrowing and house prices, as they are still very low by historical standards.

“If affordability checks and budgeting are done correctly and if someone is finally in a position to buy, especially if they are a first-time buyer seeking to get out of rented property, many are still going for it.

“Home improvements may have to be put on hold, though, as people focus on outgoings.”

Nicky Stevenson, managing director at national estate agent group Fine & Country:

“Annual price gains are finally beginning to decelerate as challenges in the broader economy start to filter through to the housing market.

“Many households are struggling amid the deepening cost of living crisis and it was only a matter of time before we saw a knock-on effect in price growth.

“While an imbalance still exists between supply and demand, things are slowly beginning to shift and at last we are seeing a steady rise in new listings.

“Though momentum remains stronger than many had anticipated, there may be room for further moderation in the months ahead if pay packets continue to be eroded and the Bank of England increases interest rates.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“The continued momentum in the property market is less surprising than absurd. Annual price growth may still be in double digits but few can deny that the property market has some significant challenges ahead.

“The rising cost of living is eroding confidence by the day and interest rates are rising. The low rate paradise we have been in for so long is now lost. The one positive is the jobs market, which is holding up for now.

“But if we enter a recession, as many are predicting, job numbers will deteriorate and that will hit sentiment, reduce demand and potentially increase supply as people are forced to sell. The result will be prices coming under pressure.

“The property market has had a surreal two years of growth since the stamp duty holiday was introduced but a cooldown now looks a nailed-on certainty, despite the strength of the market in May. The property market is driven by confidence and that is disappearing by the day. This is the calm before the storm.”

Jamie Lennox, director at Norwich-based mortgage broker, Dimora Mortgages:

“The tide could be turning as a number of clients who have been house hunting for the past six months are now finally getting offers accepted where, before, they were consistently being outbid by other buyers.

“A lot of buyers currently are committed to the idea of moving but once they finally complete we believe the housing market could start to dramatically change with a lack of new people considering moving.

“Prices in Norfolk, like much of the country, have so far remained extremely resilient in the face of rising interest rates and inflation.

“This is largely due to the extreme lack of stock in our area. On top of that, there is a lot of London money flooding in from people looking to relocate as the shift to remote working continues.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“With house price growth in double digits, and demand well above average, the market looked like it was flourishing in May, but there are signs that the vigorous growth of the past year is starting to wither.

“House price growth was still at an impressive 11.2%, but it was down again in May for the second consecutive month, and Nationwide has added its voice to those predicting price rises will continue to drop away as we go through the year.

“When you add in the Bank of England figures yesterday showing mortgage approvals have fallen below the pre-pandemic average, and the Zoopla figures from earlier in the week revealing more sellers are cutting prices and properties are taking longer to sell, the market looks like it’s starting to shift.

“The impact of rising prices is gradually taking a toll, and while the jobs market continues to support buyers, wages are falling behind inflation, which will feed into just how much people can afford to spend on a property.

“The mortgage market itself could eventually dent demand, as rates continue to rise. Moneyfacts figures show that the average two-year fix has risen above 3% for the first time in seven years. And while this is still low by historic standards, it’s up 0.69 percentage points since December.

“We also know that mortgage companies are factoring in higher costs to affordability calculations, which will make it harder to borrow, and that more of their valuers are down-valuing properties, because they don’t think they’re worth what buyers are prepared to pay.

“We’re not expecting a blight to strike the market, because right now, demand is still outstripping supply, which is likely to keep prices from falling. However, over the coming months, we’re likely to see buyers take their time, exercise a bit more caution, and house price rises to slow significantly.”

Joe Garner, managing director at London-based property developer, New Place Associates:

“While the jobs market appears to be robust for now, rising living costs are likely to negatively impact affordability calculations of mortgage applicants in the months ahead. The lack of a replacement of the Help to Buy scheme is exacerbating uncertainty in the market and may well drive transactions during 2022.

“Despite the cost of living crisis, our analysis of the market points to a ‘panic buy’ situation later in the year as the deadline for Help to Buy looms, followed by a stagnation in sales prices coupled with a significant cost increase in private rental rates. The Kafkaesque bureaucracy of the mortgage application approval process, coupled with overloaded solicitors and nervous valuation surveyors, could result in a quick, sharp knockout blow to property transactions in the UK.”

Tomer Aboody, director of property lender MT Finance:

“Although there’s a definite squeeze on people’s purses due to the higher cost of living and inflation across the board, we are still seeing a strong housing market with higher prices supported by low interest rates, even though these are rising, and strong employment.

“With homeowners looking to improve their homes, disposal income is being used intelligently to add value and improve quality of life.

“This will be something to watch closely in coming months with higher costs of such works and inflation hitting homeowner budgets. This surely will have a knock-on effect on the out-of-control costs being charged by contractors.”

Rob Peters, director of Altrincham-based Simple Fast Mortgage:

“During May 2022, the property market continued on almost undeterred by rising rates, inflation and costs of living. This is partly due to the fact we are still sitting in a time lag zone, where the full impact of these economic stressors has not filtered through to the data.

“I would expect a property slowdown in the coming months, but do not feel we have a potent enough mix of disastrous ingredients at this point for a full blown property recession.

“Property buying activity will continue to be driven by lack of houses and the British public’s will to own bricks and mortar of their own. While the dream of purchasing a home may move further into the distance for first-time buyers, and those in a weaker financial position, there are presently sufficient buyers in a strong financial position to take their place.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“The property and mortgage market in May was busier than Sue Gray so there’s still life in property, even if it’s not as robust as it was six months ago.

“Even though rates are rising, inflation’s biting, and wages are stagnating, there is no let-up in demand. And while house prices show signs of slowing, that doesn’t automatically translate into a property market crash.

“They couldn’t continue at the same pace, so a brief pause to catch our breath is a good thing. Of course, the question on many people’s minds is: are we heading for a recession? Unfortunately, we have all the necessary and sufficient conditions for a recession: decaying consumer confidence, raging inflation and stagnant wages. Sadly, all rivers lead to the sea at the moment.”

Lucy Pendleton, property expert at independent estate agents James Pendleton:

“House prices are continuing to sprint away from the rest of the economy and, while the pace has eased slightly, there’s no signs of cramp yet.

“Last month’s sharp drop in lending and the fall in mortgage approvals have so far failed to bring this market to heel.

“Average yearly growth is still above 10% and May’s monthly rise in prices outstripped that in April.

“Low supply is keeping healthy competition among buyers, while the strong jobs labour market and healthy number of job vacancies are allowing them to stay at the table while the chips are down elsewhere.

“However, sellers are finding it is taking longer on average to offload their properties, while more are reducing their asking price as high energy costs and inflation are biting. Sellers could be seeing the last of double-digit price growth. Change is in the air and that’s going to come as welcome news to first-time buyers.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“There’s yet another month of growth for the high-flying housing market, but we’re increasingly seeing signs that it is starting to feel the inexorable pull of gravity.

“It’s been surprising how little the cost-of-living crisis has affected house prices, and now it looks like the rate of price rises will gently slow over the coming months, rather than anything more severe.

“House prices will remain robust while the demand for property remains pent-up. Despite soaring inflation squeezing many households’ budgets, there are still plenty of first-time buyers looking to escape paying high rents and have a deposit ready to go.

“There is more turmoil on the horizon with further interest rate rises likely, and the energy crisis unlikely to see inflation return to normal any time soon, but the housing market has shown its resilience time and time again.”

Anna Clare Harper, director of real estate technology platform IMMO:

“May saw the tenth successive monthly increase, keeping house price growth in double digits.

“Many will be wondering why house prices remain so buoyant, in the context of post-Covid, post-Brexit and mid-Ukraine turmoil.

“Much like for the wider economy, house price inflation is being driven by shortages of supply. This shortage relates to housing in general, and to quality housing that people can afford, in the places they want and need to live, in particular.

“Suitable, affordable housing shortages are being made worse by planning backlogs from lockdown alongside labour and material shortages and inflationary pressures, alongside the fact that many new build schemes are unaffordable to locals.”