The UK property market forged ahead in June seemingly undeterred by economic woes and foreign conflicts, according to Home.co.uk’s Asking Price Index.

Demand remains high, even increasing in London and the North East. Stock levels remain very low by historic standards and consequently prices continue to rise rapidly across all regions.

The supply of new instructions entering the market nudged up slightly this month as more potential vendors are tempted by record prices.

Home prices rose significantly in every English region, Wales and Scotland during the last month and marketing times remain very low by any historic precedent.

Higher prices appear to pose no significant obstacle, as one should expect during a period of rapid monetary inflation.

Such is the vim and vigour of the market that even the North East, formerly overwhelmed with stock and stagnating prices, has now entered a boom phase. Demand has decimated the stock for sale over the last year and prices are rising rapidly.

Relative scarcity persists across all regions with the average stock total dropping around 11% year-on-year.

The largest falls in unsold sales stock are found in the North East (19.0%) and London (18.7%), and these trends strongly suggest further strong price growth going forward.

However, the first real indications of rising supply are evident in the East of England and East Midlands where the rate of new instructions rose by 10% and 12% respectively compared to May 2021. Overall, supply across the UK is up 5% year-on-year.

Rents are up year-on-year across all regions. The mix-adjusted average rise for the UK is 18.8%. Supply is worsening in this sector too, with newly available rental properties down by 24% compared to May 2021.

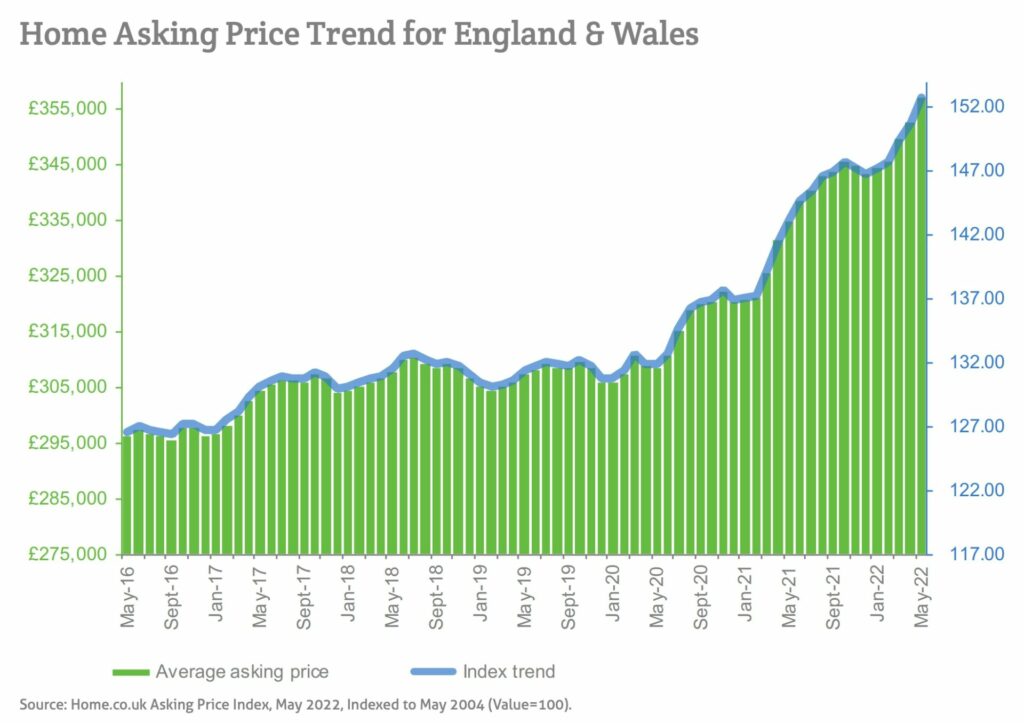

The annualised mix-adjusted average asking price growth across England and Wales is now at +6.5%; in June 2021, the annualised rate of increase of home prices was 9.0%.