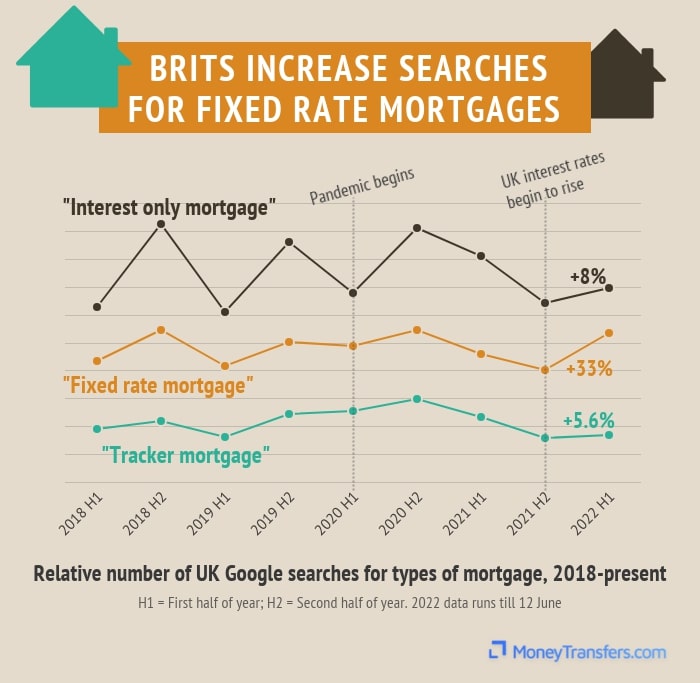

The Google search term of ‘fixed rate mortgage’ has risen by 33% in the year to date, versus a 5.6% increase for the term ‘tracker mortgage’, research from MoneyTransfers.com has found.

The term ‘interest only mortgage’, which has consistently ranked more highly than the other search terms over the last five years, has risen in popularity by 8% in 2022.

Joe DeMarkey, strategic business development leader at Reverse Mortgage Funding, said: “Homebuyers’ budgets are being impacted by today’s higher rates, and many will likely choose to buy a less expensive home or wait to see what happens with home values.

“Typically, a rise in rates will impact first-time home buyers the most, which will also have an impact on lower-priced homes.

“Those looking to buy a home in this current interest rate environment may consider looking at ARM [adjustable-rate mortgage] products, where the rate is fixed for 5 to 10-years and then adjusts.

“Most new homebuyers do not live in their home for 30 years, so for some homebuyers, there is no reason to take out a 30-year fixed.

“We also know we see refinance booms every three to seven years, so it likely makes more sense to consider a hybrid product.”