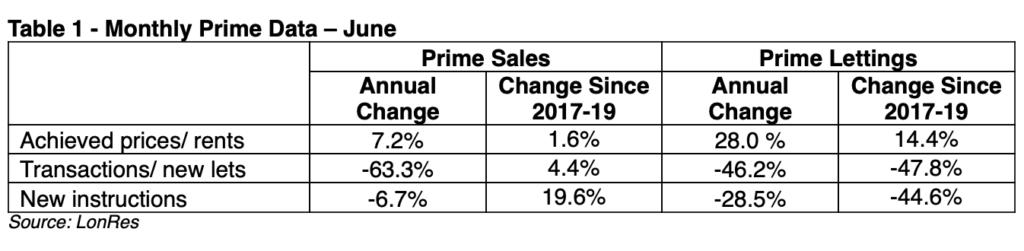

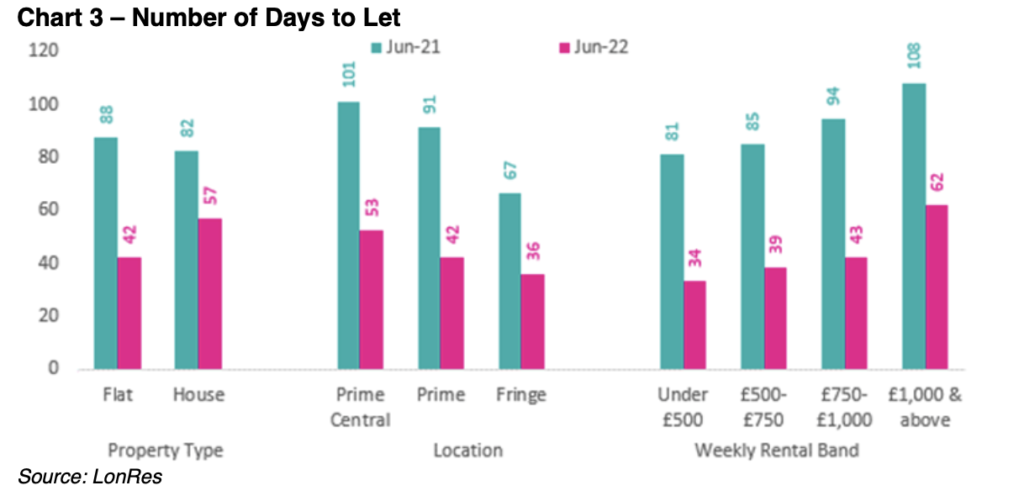

Prime London property prices have risen 7.2% over the past 12 months (June 2021 – June 2022) as a shortage of homes for sale and high demand has created strong competition amongst buyers, according to analysis from LonRes.

However, the current economic and political uncertainty means it is likely that annual price growth – which has risen just 0.9% in the first six months of 2022 – will slow further over the course of the second half of the year.

Activity levels in the first half of 2022 may have fallen 29% compared to the same period last year – when the end of the stamp duty holiday boosted sales – they were still 19% higher than the levels seen during the first halves of the three years leading up to the pandemic.

Although sales have fallen from last year’s highs, some parts of the market have continued to show robust signs of activity.

The top end of the market – homes priced above £5m – is still recording activity in line with 2014 levels and sales in the year to June were 11% higher than during the same period last year.

This compares to the £2-5m slice of the market where activity is currently just 1% higher than at the same point last year.

Anthony Payne, managing director, LonRes, said: “Prices across Prime London are still rising although this partly reflects the rapid growth last year and we expect annual price growth to slow during the second half of 2022.

“Meanwhile activity levels have fallen from last year’s stamp duty-fuelled boom (the full tax relief ended 30 June 2021) but are still above the levels recorded in the years prior to the pandemic.”

Meanwhile, sales of houses remain stronger than for flats as the post-pandemic world where space – inside and out – has been notched up buyers’ wish lists. House sales are just 12% below their 2013-14 peak levels while flats are 37% lower.

Rental supply squeeze…

Payne added: “As we enter the half-way mark in the year, demand for rental homes in Prime London has well and truly bounced back and it’s now a lack of stock that is the big challenge facing would-be tenants.

“This situation has led to a complete reversal in the state of the Prime London rental market from last year. In 2021 landlords’ struggled to let their properties which led to rents falling, the average time to let rising, and growing discounts to asking rents.

“This year, the opposite is true.”

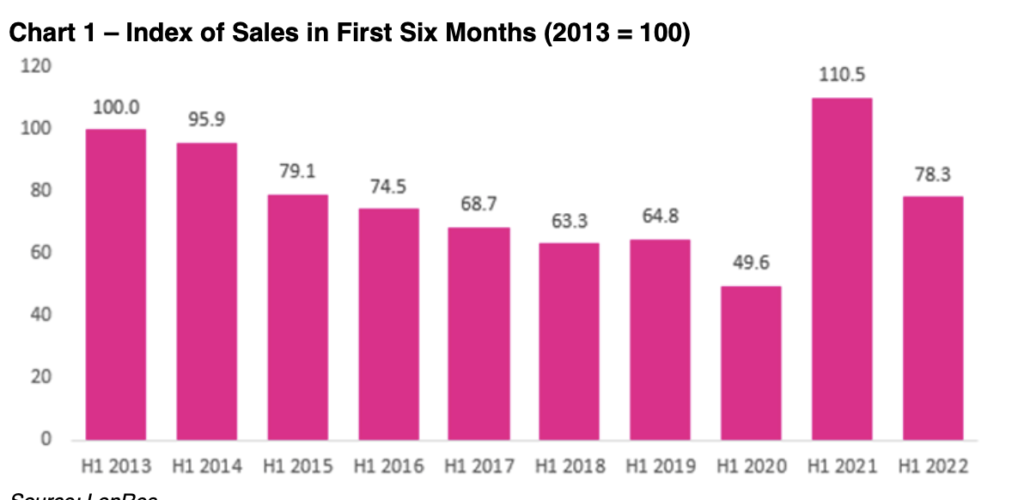

The lack of homes available to rent is now so severe that it is limiting activity in the rental market.

The number of homes put under offer and new lets agreed are nearly 50% below their average in the years leading up to the pandemic.

However, this partly reflects the large number of properties simply not being listed for rent.

Given the lack of homes available, tenants are now looking to renew existing agreements albeit at higher rents while many of those properties that do become available are being snapped up before they hit the listing websites.

For those tenants that do manage to get a new tenancy, some are being forced to agree to much longer-term tenancies.

Chart 2 – Index of Rental Market Activity in First Six Months (2017-19 average = 100)

Rapid rental re-lets…

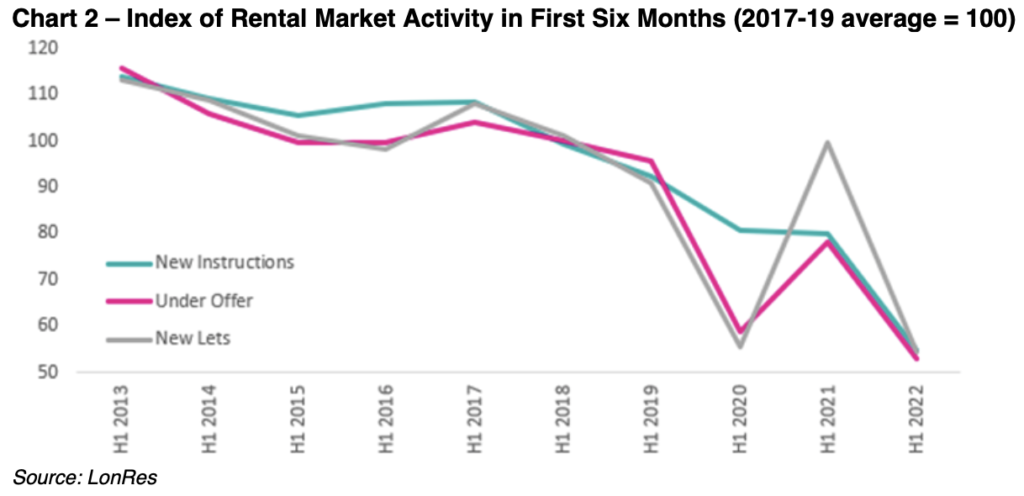

For those rental properties that do reach the market, the average time it takes them to let has fallen sharply – from 87 days in June 2021 to just 44 days in June 2022.

While the time to let has fallen across all properties, there are some clear trends in how long it takes to let depending on the rental price, location, and type of property.

More expensive rental properties have always taken longer to let than those lower down the rental price distribution.

And while the time it takes more expensive properties (£1,000 plus per week) to let has fallen, it has not fallen as quickly as it has for less expensive properties.

The average time to let a property with a weekly rent of £1,000 or above has fallen from 108 days in June 2021 to just 62 days in June 2022.

However, the time to let a property with a weekly rent under £500 has fallen from 81 days last year to just 34 days this year.

This pattern is also reflected in location and property types. LonRes data for June 2022 shows properties in Prime Fringe let more quickly than those in Prime Central London (36 days and 53 days respectively) while flats (42 days) let more quickly than houses (57 days) – although this last trend was reversed during the middle of last year when houses (82 days) were letting more quickly than flats (88 days).

Looking ahead Autumn is a traditionally busy time for the rental market. With increasing numbers of international students and other residents returning to the capital we could see rents rise further through the rest of the year as a lack of rental homes available puts more pressure on prospective tenants to adjust their price expectations upwards.

Payne concluded: “As we end the first half of the year, all the sales indicators show that the prime London housing market is moving from what has been a frantic period to a more normal one.

“Last June buyers were rushing to complete on deals to beat the stamp duty deadline and June’s figures for this year, reflect this.

“For prime lettings, the dearth of properties is making life difficult for prospective tenants.

“A severe shortage of homes to rent, is supporting prices and with LonRes data showing no change in sight for stock levels, this is a situation that looks unlikely to change anytime soon.”