The average UK property price has remained broadly unchanged in June, up by just 0.1%, on May, according to the latest House Price Index from Zoopla.

The property platform recorded the lowest rate of monthly price growth since December 2019, while the quarterly growth of 1.4% is the slowest since March 2021.

Year-on-year, property prices are up 8.4%, down from +9.2% in April and the rapid house price growth seen across the UK since the start of the pandemic has finally peaked.

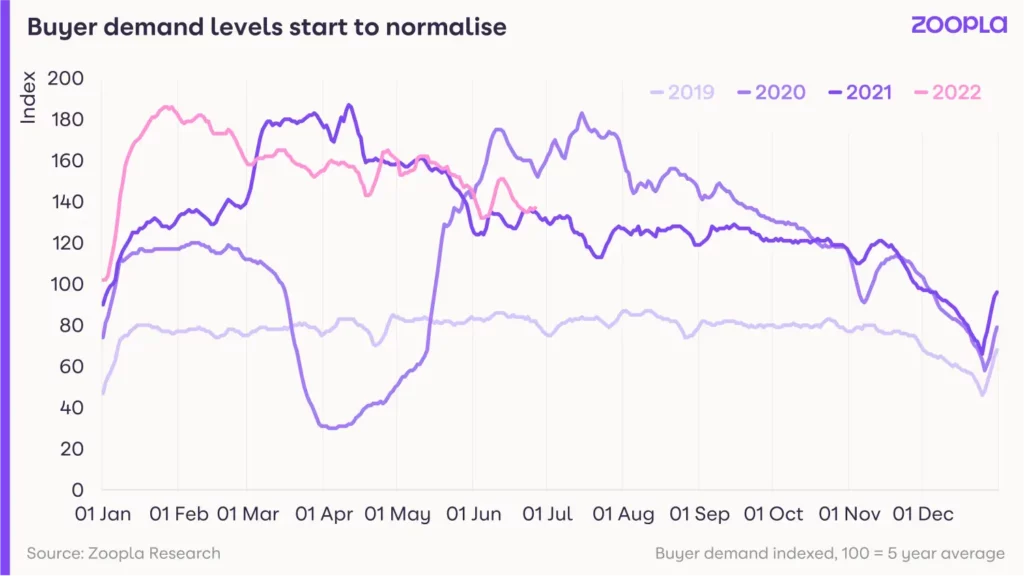

Demand for properties still remains strong at 40% above the five-year average, but that demand is beginning to decline week on week, as the market returns to more ‘normal’ conditions.

With that in mind Zoopla said sellers looking to capitalise on gains made during the pandemic-driven property boom should act sooner rather than later.

The Index also reported the proportion of listings where asking prices rising.

One in 20 properties (or 5.1%) showed a reduction of 5% or more in May. That’s up from 4.7% in April.

The average price reduction is 9%, which, when applied to the average property price, equates to a discount of around £22,500.

That said, the number of new sales agreed is 21% above the five-year average, showing there is still plenty of appetite among buyers, so now is still a good time to sell.

Gráinne Gilmore, head of research at Zoopla says: “Buyer demand is still strong in the housing market, but signals are emerging that the impetus may be easing, so those who want to make a move should investigate their options sooner rather than later.

“In addition, mortgage rates are likely to continue to climb, so locking into a rate shortly could save hundreds over the longer-term.

“There are many factors supporting the price growth seen since the start of the pandemic, not least the continued imbalance between demand and supply, but the increasing cost of living, increasing mortgage rates for buyers and cloudier economic outlook will act as a brake on house price growth through the rest of the year.”

Wales continues to be the hottest UK property destination, registering the highest price growth yet again at +11.4% year on year.

While this is down from a high of 13.4% in February, homes in Wales have risen by an average of £32,000 in the last 24 months, taking the typical house price to £192,500.

Homes are also selling quickly in the South West, where properties are taking just 19 days to sell, subject to contract, from first being listed.

The South West has been basking in high levels of demand since the pandemic began, as buyers swiftly prioritised rural and coastal settings as their places of preference.

A similar picture is emerging in Bournemouth, where price growth is up 10.2%, making it one of the cities with the highest levels of growth in the year leading up to May 2022.

That said Zoopla expects these speedy sales to slow this year, as buyer demand for homes in the South West is seeing one of the sharpest declines over the last month, down 16%, despite demand for houses remaining 37% above the five-year average.

Across the UK, the average time to sell (that’s the time between when a property’s first listed and when it becomes sold, subject to contract) is rising.

It’s now 22 days for May compared with 20 days in March, while the time it takes to get to the point of exchange is now averaging around 170 days – around five and a half months.

All of this suggests that buyers who want to move this year should consider putting their home on the market now.

Reaction

Emma Hollingworth, distribution director at MPowered Mortgages:

“The latest Zoopla house price index shows that house prices are up 8.4% on the year, taking the average value to £251,550. Rising house prices, coupled with rising interest rates, is making homeownership less and less affordable. For many of those looking to buy their next home, time is now squarely of the essence – securing a mortgage, and indeed a purchase, as quickly and efficiently as possible in order to ensure this remains financially viable, is key.

“Looking at rates alone, MPowered Mortgages has worked out that a homeowner could save over £2,000 over a two-year period if they lock into a deal now versus at the end of the year if mortgage rates rise alongside the base rate by a further 0.5%.

“It is becoming increasingly clear that further savings can be made by buying a property sooner rather than later – just because prices are now rising at a considerable speed.

“The current climate is exacerbated further by demand for properties remaining high, whilst supply remains relatively low. Those able to move through the homebuying process quickly are going to be at a critical advantage to others looking to purchase the same property.

“At MPowered Mortgages, we are focused on using AI to speed up and improve the mortgage process, giving consumers a smoother experience of getting a mortgage. As we move through this period of elevated volatility, making the homebuying process as smooth as possible, as well as supporting those looking to buy a home, has never been more important than it is now and remains our priority.”