Mortgage borrowing increased to £7.4bn in May, up from £4.2bn in April, the latest Bank of England statistics show.

This puts borrowing well above the pre-pandemic average of £4.3bn in the 12 months up to February 2020.

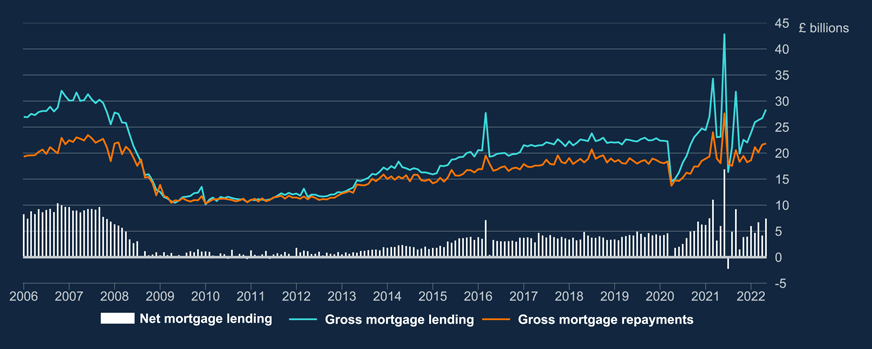

Gross lending increased to £28.4bn in May from £26.7bn in April, while gross repayments rose slightly to £21.8bn in May from £21.6bn in April.

Approvals for house purchases, an indicator of future borrowing, also ticked up to 66,200 in May, from 66,100 in April.

This stands slightly below the 12-month pre-pandemic average up to February 2020 of 66,700.

Approvals for remortgaging (which only capture remortgaging with a different lender) were unchanged at 78,800. This remains below the 12-month pre-pandemic average up to February 2020 of 49,500.

The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 0.13% to 1.95% in May. The rate on the outstanding stock of mortgages ticked up 0.02% to 2.07% in May.

Reaction

Paul McGerrigan, CEO at fintech broker Loan.co.uk:

“Mortgage borrowing leapt to £7.4bn in May from £4.2bn the previous month and up £1bn on March’s peak of £6.4bn. What had seemed a dampening of homebuyers’ appetites in April is clearly only temporary and demand for property market is still high, despite tough economic times.

“Consumer borrowing, however, dipped to £0.8bn from £1.4bn in April with a £0.3bn reduction in borrowing on credit cards – the peak possibly being a reaction to March’s increase in the base rate.

“As financial pressures increase, but demand remains high, it is not an easy time for people to make financial decisions and they are having to make tough calls, the credit industry plays a vital role in providing flexibility and some stability to financial outgoings.

“The role of the broker is more important than ever to help clients negotiate these turbulent financial waters. We need to be proactive and knowledgeable to help people’s changing needs. There are always solutions which can help and it’s important to provide regular, up to date, expert advice to continually reach best outcomes for clients.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Mortgage approvals are generally a good indictor of market direction and these, like the Nationwide figures yesterday, show that you write the property market off at your peril.

“What’s happening on the ground is that buyers and sellers are inevitably more cautious bearing in mind steep rises in the cost of living and interest rates with probably worse to come.

“Nevertheless, we are seeing few attempts at renegotiation or withdrawal as buyers know in particular the continuing shortage of stock means there will be little alternative. Therefore, we don’t expect to see a sharp correction in prices but they are already rising more slowly than they have been and certainly transactions are taking longer as there is less competition.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“Although some of the heat has come out of the market, these figures demonstrate that there are still signs of strong activity. Mortgage brokers remain exceptionally busy as borrowers worry about rising rates.

“What has changed for all borrowers is the rate environment – gone are the sub-1 per cent deals available nine months ago. Now, mortgage products are in the 3 to 4 per cent range depending on their length and loan-to-value.

“These rates available today reflect not only the increase in cost of funds but also lenders’ desire to moderate volumes, with many of the high street banks still sitting on large balances or even cheap Bank of England funds. Specialist lenders are repricing upwards and/or streamlining their product ranges, meaning borrowers need to move quickly to secure rates.”

Lisa Martin, development director, TMA Club:

“Today’s figures reflect a resilient mortgage market. Recent interest rate hikes and the cost-of-living crisis are likely to be influencing a more cautious approach by lenders, but approvals for house purchases rose slightly to 66,200 in May, from 66,100 in April.

“Conversely, with the recent spike in mortgage maturities and, again, rising rates, it’s no surprise to see remortgage approvals rise to 78,800, from 47,800 in April.

“As prices are likely to continue to rise throughout the year, customers will be looking to brokers to act swiftly to secure the best deals and lock into fixed rates before mortgages are replaced or pulled from the market.”

Simon Webb, managing director of capital markets and finance at LiveMore:

“May saw a healthy rise in mortgage lending from the dip in April’s figures increasing by 76% while gross lending was up by 6% month-on-month. Lenders remain busy as house buyers try to secure mortgages before more increases in base rate occurs while swap rates are also continuing to rise.

“Although approvals for house purchase rose by 100 in May, this was down by 3,200 on the March figure of 69,500. This indicates that we may see mortgage lending falling back especially as we move into the slower summer months for house purchase.”

Richard Pike, sales and marketing director at Phoebus:

“Mortgage activity appears to be bucking expectations following the recent interest rate rises. It would be easy to think that all the news of inflation and soaring prices would make many think twice about moving or buying, but for the time being that does not appear to be the case.

“There is still plenty of demand to buy and sell but there will come a time, if the MPC continues on its path of raising interest rates to curb inflation, when worries over finances may affect confidence.

“For now though, with plenty of lender appetite and competitive rates, we are looking at a pretty healthy picture.”

John Phillips, national operations director at Just Mortgages:

“Borrowing and lending levels continue to increase above what anyone predicted they would, almost doubling again in May.

Doom merchants who predicted the housing market would fall off a cliff when the pandemic hit were badly wrong.

“Levels of borrowing and house buying have defied expectations and are now higher than pre-pandemic, although it must raise the question just how much longer can these increases continue.

“We may well see a tail off in house purchases as the cost of living continues to rise, but instead it will drive remortgages as people look to lock into longer term fixed rates to protect them from interest rates that look set to increase several more times yet.”

Tomer Aboody, director of property lender MT Finance:

“Given that house prices continue to rise, albeit at a slower pace than in recent months, it is surprising that mortgage approvals for new purchases are on the up. Generally speaking, less supply and more demand leads to higher pricing.

“With the prospect of higher mortgage rates on the cards, buyers are taking advantage of the last remaining lower rates before the inevitable spike, with those remortgaging desperate to lock into a fixed-term mortgage for as long as possible.

“Consumer credit borrowing declined in May, a return to the previous trend towards saving. Going forward, one would expect higher inflation and living costs to mean many will have to dip into savings in order to manage, with those who don’t have that buffer finding life increasingly difficult.”

Simon Jones CEO of InvestingReviews.co.uk:

“The Bank of England clearly has a long way to go in its fight against inflation. The recent hikes in interest rates have done nothing to curb people’s spending on credit cards.

“And there’s no evidence of a cooling effect on the housing market either despite a chorus of doomsayers claiming a crash is now imminent.

“Mortgage debt has actually surged despite increased borrowing costs — and mortgage approvals are on the rise too.

“This data suggests that a more aggressive approach to monetary tightening may now be on the cards.”