Newcastle Intermediaries’ has completed its integration with Legal & General’s SmartrFit affordability research tool.

This follows the addition of Newcastle Intermediaries’ products and criteria to SmartrFit earlier this year.

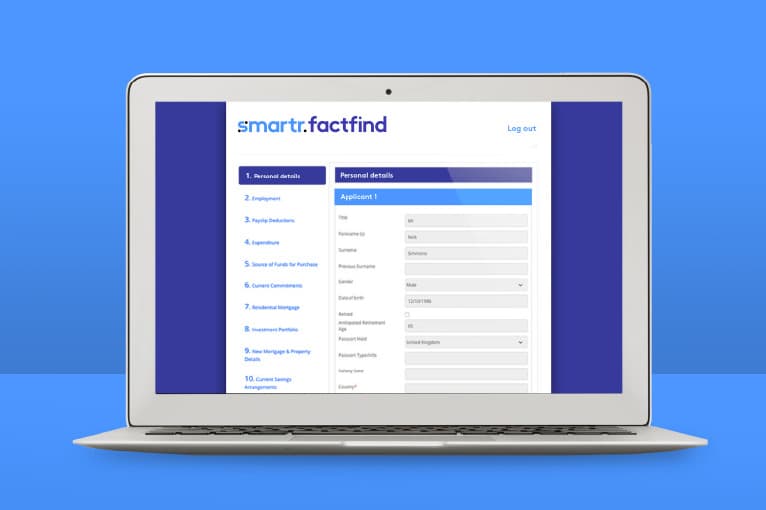

Legal & General’s SmartrFit tool is free-to-use and can be accessed whether an adviser is a member of the Mortgage Club or not, although users will need an agency number to log in.

SmartrFit users benefit from the tool’s built-in affordability calculator. The website tool will now give intermediaries affordability calculations for Newcastle Intermediaries’ residential and buy-to-let mortgages.

Through this, advisers will now be able to get an indication of how much customers can borrow against Newcastle Intermediaries’ lending criteria.

This integration is intended to save time for advisers, who can now focus on providing a more personalised and bespoke service for their client base.

Danny Belton, head of lender relationships, Legal & General Mortgage Club, said: “Newcastle Intermediaries has provided the mortgage market with products and services for over 150 years.

“We are delighted to support their integration with SmartrFit, which will continue to raise their profile and awareness of their proposition across Legal & General Mortgage Club’s broker network.

“We launched SmartrFit in November 2020 with the aim of improving the mortgage journey, for both brokers and lenders.

“Through our affordability calculator, brokers are able to complete a wider search of the market and save both money and time at the operational stage of their advice journey.

“With these results at their fingertips, we hope to drive value for both intermediaries and the customers they serve.”

Franco Di Pietro, head of intermediary mortgages, Newcastle Intermediaries, added: “Our most recent integration with Legal & General’s SmartrFit platform means we are able to offer accurate affordability results, alongside criteria and products, much earlier on in the process for a significant number of brokers in the intermediary space.

“This partnership not only strengthens our commitment to innovation, but will ultimately support brokers in establishing affordability for their clients in an efficient manner, and is another important step in our digital mortgage transformation programme.”