For those of us that work in a regulated environment day in day out, it can be frustrating that there are still large sections of financial services that remain unregulated.

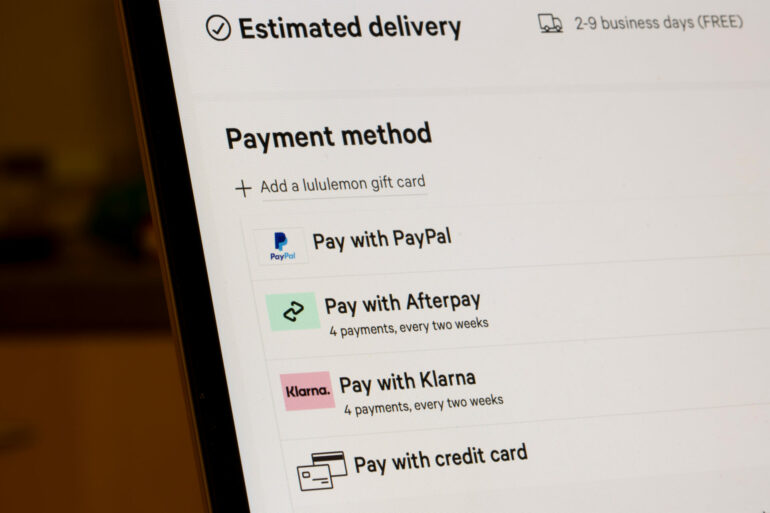

One such market is the Buy Now Pay Later (BNPL) sector. The Government has confirmed its intention to regulate the market, yet while it finalises its plans, more borrowers take on this type of credit, with little or no consideration given to the affordability of such finance.

Recent research from StepChange Debt Charity and Barclays shows that over a third of shoppers say BNPL lending has become more appealing due to the current cost-of-living crisis. As of June, BNPL users were paying off 4.8 BNPL purchases on average – up from 2.6 in February this year, with one in three consumers who have used BNPL saying the lending has got them into unmanageable debt.

With UK inflation currently sitting just below 10% at 9.4% and the cost-of-living crisis intensifying, we are likely to see the trend of turning to unregulated finance continue. The latest Bank of England (BoE) Money & Credit report shows unsecured credit continues to rise on an annual basis.

An additional £0.8bn in consumer credit was borrowed in May, following £1.4bn in April. This was split between £0.4bn on credit cards and £0.4bn through other forms of consumer credit – such as car dealership finance and personal loans.

The annual growth rate of credit card borrowing now stands at 11.2%, and 3.5% for other forms of consumer credit.

Although the £0.8bn figure is slightly below the 12-month pre-pandemic average of £1bn, overall, consumer credit borrowing is up 5.7% on May last year – the highest annual growth rate since February 2020.

Meanwhile, the BoE’s Credit Conditions Survey shows lenders saw demand for, and the availability of, unsecured credit increase in Q2. Within the overall figure, demand for credit card lending increased in Q2, and was expected to increase again in Q3. Demand for other unsecured lending was also reported to have increased but was expected to decrease slightly in Q3.

Such borrowers may be unknowingly taking on unmanageable debt, which could not only cause short-term problems but also longer-term issues for their credit score and any potential mortgage or remortgage application.

For homeowners in such a scenario, a regulated second-charge mortgage could help make their financial situation more manageable by consolidating their debt and reducing their number of monthly payments.

There can be a perception that unsecured credit offers a cheaper alternative to a second charge, yet without proper financial advice, it could work out more costly and increase a borrower’s reliance on such credit.

Figures from Moneyfacts show the average rate on a £7,500 loan in June stood at 5.2% – the highest rate in six years.

While in the credit card market, it notes that lenders are currently extending the average length of introductory 0% balance transfer offers. It reports several providers improved their terms during the second quarter of 2022; seeing the average interest-free introductory balance transfer term rise to 613 days, the highest point since May 2018.

The APR that borrowers will pay once such a deal ends however is rising. Between March and the start of June, the average purchase APR – which includes card fees – rose to an all-time high of 26.7%.

Such forms of finance can be beneficial for certain individuals but without professional advice, borrowers can run the real risk of making their financial situation worse.

As unsecured debt continues to climb, it is imperative that advisers know how to help such clients and are able to advise them of all options that might be beneficial – including a second-charge.

Kerri Pender is operations director at Evolution Money