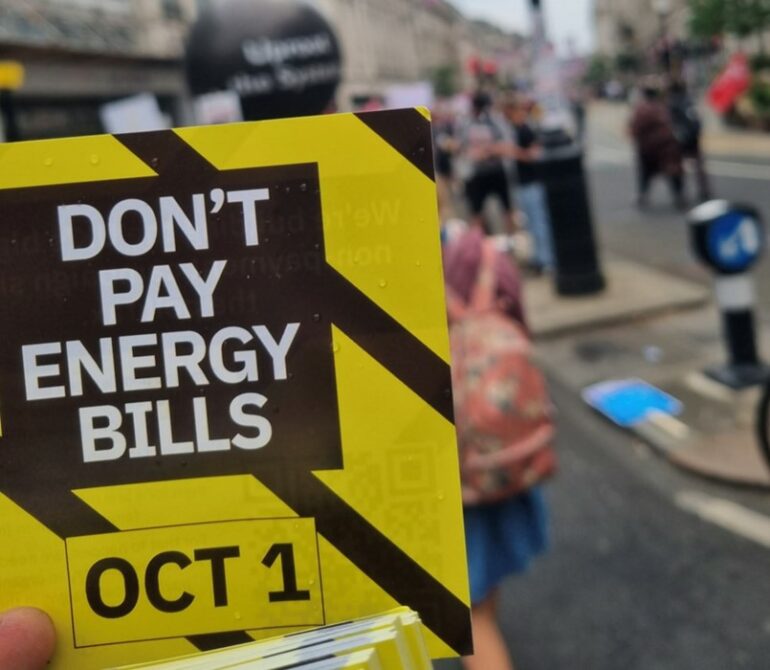

With rising energy bills becoming an increasing concern for millions campaign group Don’t Pay UK is urging people across the country to join its non-payment movement.

The group, which is demanding the return of gas and electric costs to an ‘affordable level, is trying to get the support of one million people who will pledge to cancel their direct debit from October 1st.

So far the group claims to have over 90,000 pledges to halt payments to energy firms.

But as Don’t Pay UK gains momentum, brokers, IFAs and personal finance experts have warned about the consequences for people who don’t pay their energy bills and cancel their DDs in the Autumn.

Reaction

Adam Hosker, director of Bradford-based mortgage broker, Cyborg Finance:

“Anyone taking part in this particular internet challenge will be swinging a wrecking ball at their credit score and potentially pay for it for years to come.

“There are plenty of other ways to cut household expenditure that don’t trash your future when it comes to securing a mortgage or taking out other forms of credit and debt.”

Jonathan Burridge, founding adviser at hybrid mortgage adviser, We Are Money:

“Just don’t do it. It is the most ill-thought-out consumer protest I can remember hearing of. The only outcome will be a detrimental one to those that sign up. It is the credit profile equivalent of gluing yourself to a motorway.”

Imran Hussain, director at Nottingham-based Harmony Financial Services:

“Anyone considering not paying their utility bills and who thinks they’ll be able to purchase a home within the next few years may as well forget about it, especially if they have a small deposit.

“Not paying your energy bills will be curtains for your credit score. As the economic climate deteriorates, any blips on credit files will impact who will actually lend to you and it’s also a slippery slope as all it takes is a few missed payments to end up with a default or CCJ.

“Then getting a mortgage will be a real struggle. I have spoken to many clients who, like myself, are concerned about rising energy prices and other utilities and I say have a proper review of your outgoings.

“Personally, me having coffee at home each morning saves me over £100 a month and I will also be cancelling subscription services I no longer use, e.g. Netflix, but ensuring I keep my mortgage, utility and protection policies in place.”

Mark Robinson, managing director of Southampton-based Albion Forest Mortgages:

“From a mortgage perspective, not paying any debt or bills can have a serious downside when trying to move house or remortgage.

“Lenders take a dim view of people who have gone into arrears, however noble their cause.

“Unfortunately, I don’t think enough attention is being drawn to the potential impact this could have on people’s credit reports.”

Dominik Lipnicki, director of Your Mortgage Decisions:

“Whilst I can understand why so many people are struggling to pay the bills and that the government must do more to help, stopping your direct debit simply isn’t advisable.

“Not only can your credit rating suffer, meaning higher borrowing costs, but the energy company can try and force you to have a pay-as-you-go meter.

“If in real trouble, it is always best to talk to the company involved to see if a payment plan can be arranged.”

James Miles, director of Exeter-based broker, The Mortgage Quarter:

“Don’t do it. Full stop. You’ve entered a contract and agreed to pay a bill every month. It’s what you signed up for.

“If you have a late payment, this will affect your credit score and will affect your ability to borrow money at the most competitive rates.

“Lenders will penalise you on the rate for future borrowing, which will ultimately increase your outgoings, which goes against the whole point of the campaign. If you’re struggling to pay your energy bills, contact the energy company in question to make a payment plan or review your tariffs.”

Rhys Schofield, managing director at Belper-based Peak Money:

“To anyone considering not paying their energy bills, my honest advice is, please, please don’t. We’re all feeling the pinch with the runaway cost of living crisis being ignored by the government but getting a default or a CCJ and knackering your credit score isn’t the way to solve it.

“You may find it harder to get a mortgage in future and even if you can it may be with an adverse lender where you have to pay hundreds of pounds over the odds every month, leaving you significantly worse off in the long run. If you opt for Don’t Pay, you will eventually pay – through the roof.”

Doug Miller, director at Bath-based independent mortgage broker, Lansdown Financial Services:

“Whilst I understand, and fully support, the need to take a stance against soaring energy prices, Don’t Pay UK should be stopped in its tracks immediately.

“Destroying your credit profile should be the last resort. Even one missed payment impacts your ability to obtain a mortgage.

“The trade-off here is potentially saving up to £100 per month on the average household energy bill, but seeing your mortgage payments soar by hundreds of pounds per month because your credit rating has plummeted. How can this be considered a good thing? Banks don’t care if you are ‘making a stand’.

“If you miss one payment or more you will potentially end up paying higher interest rates not only on new credit cards, loans and car finance, but also life’s biggest debt, your mortgage. Education is vital, and Don’t Pay UK have absolutely no warnings about the ramifications of what they asking millions of UK households to do. It’s shambolic.”

Scott Taylor-Barr of Shropshire-based broker, Carl Summers Financial Services:

“If you choose not to pay your energy bill from October onwards, you will be destroying your credit profile, plain and simple. Each missed payment makes it harder and harder to obtain any form of credit and those lenders happy to consider you will charge higher rates than you can get elsewhere.

“Once you have six consecutive missed payments your account will be placed in default, you will then find credit even harder and more expensive to obtain. Once defaulted, the next step would be for the energy company to obtain a County Court Judgment against you, again hitting your ability to get credit and the cost of it.

“Given that your credit profile looks at the past six years you are potentially going to be paying more for any mortgage, loan, car finance, or credit card long after the energy crisis is old news. Please be very careful not to end up creating an even bigger and more costly problem for yourself in the long run.”

Paul Neal of Derbyshire-based Missing Element Mortgage Services:

“This, for me, is up there with taking out an IVA: the impact on your credit score will be very detrimental.

“Any mortgage lender wants to see you are reliable and able to keep up your payments when applying for a mortgage, so a single missed payment can take you straight out of a good interest rate and potentially cost you thousands in additional interest, that’s if you’re lucky enough to be offered a loan. My advice is simple: don’t do it.”

Jamie Lennox, director at Norwich-based mortgage broker, Dimora Mortgages:

“We all get the sentiment of the Don’t Pay UK movement, but people are not being informed of the risks it poses to them in the long run.

“Utility providers feed data into the credit reference agencies so we are going to see a growing number of missed payments and maybe even Defaults and CCJs being added to people’s credit reports.

“Once these are on your credit report they stay there for six years, which will almost certainly impact any credit application.

“The end result of this is either the rates will be more expensive or the application is rejected altogether. Therefore, people should think really hard about this before making their decision about being part of this movement.”

Scott Gallacher, a Chartered Financial Planner at Leicestershire-based independent financial advisers, Rowley Turton:

“I fully understand people’s concerns about the cost of living crisis and I share their frustration that those in power seem to be doing little to help the man or woman in the street with this.

“However, I would urge people to ignore the Don’t Pay UK campaign. Failure to pay your bills risks serious damage to your credit rating and will only make your financial situation much worse in the long term.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“Understandably, consumers want to take a stand against energy suppliers when they appear to be boasting of record profits and bumper payouts to shareholders. In contrast, hard-working Brits will have to choose between eating and heating within the next few months, so it’s unsurprising that groups such as Don’t pay UK are springing up advocating mass non-payment of energy bills.

“Whilst many would love to be able to wield mass action against businesses that are bleeding people dry, the reality is the consequences of that type of action will be dire.

“Non-payment of utilities will show on a credit file, initially as missed payments, then arrears, then defaults after seven months and ultimately a CCJ. This means paying higher interest not just for a mortgage, if you’re even eligible, but on credit cards, loans and any other type of borrowing for the following six years.

“We need government intervention now. Otherwise, many households will sink in the economic storm we’re about to face.

“It’s notable that Gordon Brown, who hasn’t been prime minister for 12 years, seems more concerned and present than Boris, who is missing in action when he’s meant to be caretaker PM.”