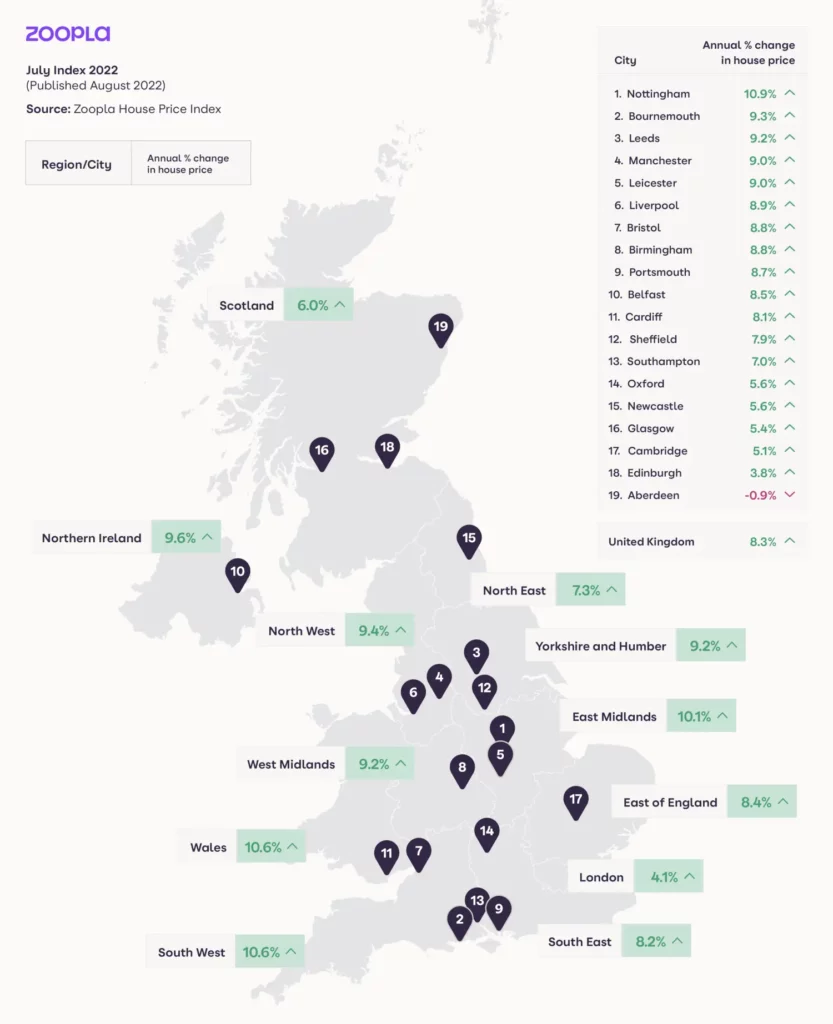

The past 12 months have seen UK house prices increase by 8.3%, or £19,800, but demand is starting to weaken, Zoopla’s house price data for July has shown.

However, the property platform warned that demand is beginning to wain as mortgage rates continue to increase and the cost of living crisis begins to bite.

But, despite the decrease in demand interest still remains well above the five year average, tracking at +17%.

Mortgage rates for new buyers are now at 4%, meaning the average first-time buyer will need an extra £12,250 to buy a home today compared to a year ago – and up to £35,000 more in London.

The average time to sell a home is also lengthening, taking 22 days right now, compared to 19 days back in April.

First-time buyers are currently the biggest driving force in the housing market right now, accounting for 177,000, or 35%, of all transactions.

The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%.

Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth in these areas.

In terms of cities, Nottingham, where homes remain more affordable, continues to lead the way with house price growth of 10.9%.

It’s hotly followed by Bournemouth (+9.3%), Leeds (+9,2%) and Manchester (+9%).

Reaction

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“The property market may not be as safe as houses, because while annual price rises are still impressive, there are signs of weakness creeping in. Demand is getting shakier, and the first-time buyers who have been propping the market up are feeling the strain.

“Demand is still above the five-year average, but it has started to drop back, and is now less than a third of what it was in the spring.

“It takes around three months for agreed sales to translate into completions, so house price figures being announced at the moment reflect demand back then. It means we can expect significant changes in the months to come.

“Part of the problem is that a combination of soaring house prices and hikes in interest rates are pricing first-time buyers out of the market.

“Those in housing hotspots are feeling particular pressure. Meanwhile, although rents have been rising, the pace of mortgage hikes means that in more expensive areas, the cost of repaying the mortgage could increasingly overtake the cost of renting. This is likely to dampen demand from first-time buyers even further.

“First-time buyers are the engines of the housing market, particularly at the moment when they make up just over a third of all sales.

“When they get cold feet, it seizes up the rest of the market, so those who want to move up their ladder find it impossible to shift their old property, and are stuck in limbo.”

Kay Westgarth, head of sales at Standard Life Home Finance:

“It is clear that although house price growth has slowed compared to previous months, house prices are still higher than they were a year ago. However, we may see a further cooling in growth in the coming months.

“As the Bank of England continues its campaign of rate rises to counter rising inflation, it is likely that prospective buyers will be reconsidering their plans to buy a home.

“Despite this, we have seen an increasing number of older clients help their younger relatives onto the housing ladder by releasing equity in their own homes.

“Anyone considering the use of equity release should consult with an adviser who can provide guidance on the broad range of products that are currently available. In doing so, consumers can understand their options and make informed decisions on which products are suitable for their individual circumstances.”

Richard Tugwell, director of mortgage distribution at Vida:

“Today’s energy price cap rise is expected to affect already rapidly rising inflation even further, with Citi Group’s prediction of inflation set to hit 18% in 2023 looking more realistic every day. Worryingly, if these forecasts hold true, by April next year, energy bills will swallow almost a fifth of the average household’s income.

“Soaring energy bills will put even more pressure on households’ finances, which for many are already hugely stretched. This will no doubt impact prospective homebuyers’ affordability.

“These price hikes are affecting those on lower incomes the hardest. Recent research commissioned by Vida showed that 74% of keyworkers who don’t own their own home worry that they will never be able to, and the rising household bills will no doubt add to their concerns.

“It is more important than ever that the Government steps in to provide support for these low-income families, as well as key workers who were the backbone of our country during the Covid-19 pandemic. As a responsible lender we will continue to work with our broker partners to focus on the most affordable solutions for their clients.”