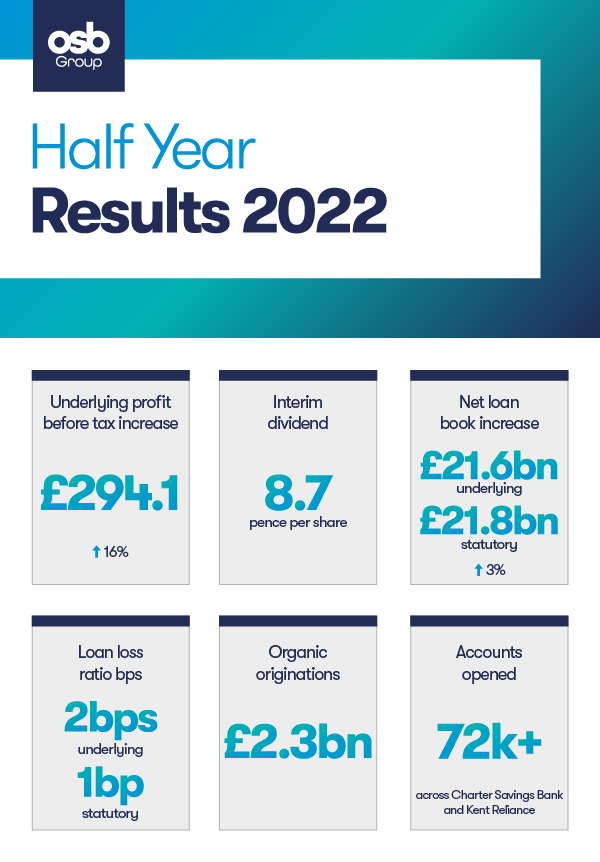

OSB Group saw pretax profits hit £268.1m for the six months ended 30 June 2022, up from £221.9m during the same period last year.

Net interest income also increased hitting £343.4m, up from £265.3m, OSB’s interim results show.

The Group attributed the profit surge to an increase in the size of its loan book and its higher net interest margin.

Andy Golding (pictured), group CEO, said: “I am delighted with the strong financial and operational performance of the Group in the first half of 2022. We delivered a record underlying profit with consistent and class-leading returns for our shareholders.

“Demand in our core lending segments remains robust and we have a record pipeline of applications. We have entered the final quarter of our three year integration programme having successfully delivered our pledged savings at lower cost than originally expected.

“The next phase of technology investment will focus on improving efficiency in our business operations, an enhanced user experience for our customers and further streamlining the interaction with our broker community.”

Golding continued: “The Group recognises the somewhat uncertain outlook for the UK economy and the impact of inflation and increasing cost of living on us all. We continue to monitor our lending book closely for any early signs of stress, however the credit performance of our portfolio to date remains strong.

“Our people are a key asset to the Group and have been central to its success. They too have been affected by the current macroeconomic conditions and we have recognised this by providing an additional cost of living support payment of £1,200 to more than 80% of our UK-based colleagues.

“We have improved our full year underlying net interest margin guidance and now expect it to be broadly flat to the first half. We remain confident in delivering underlying net loan book growth of c. 10% for 2022 based on current pipeline and applications. We continue to expect the underlying cost to income ratio for full year 2022 to increase marginally from 2021.

“The strong foundations of our business with its secured balance sheet, strong capital position and proven operational resilience position us well to respond to opportunities and challenges as they arise.”