Annual house price growth in the UK stood at 9.5% in September, down from 10% in August, according to the latest house price data from Nationwide.

Overall 10 of the UK’s 13 regions saw a slowing in house price growth with London continuing to be the weakest area for price increases.

Overall the average price for a house in the UK stood at £272,259 in September, down from £273,751 in August.

Robert Gardner, Nationwide’s chief economist, said: “In September, annual house price growth slowed to single digits for the first time since October last year although, at 9.5%, the pace of increase remained robust.

“Prices were unchanged over the month from August, after taking account of seasonal effects. This is the first month not to record a sequential rise since July 2021.

“There have been further signs of a slowdown in the market over the past month, with the number of mortgages approved for house purchase remaining below pre-pandemic levels and surveyors reporting a decline in new buyer enquiries.

“Nevertheless, the slowdown to date has been modest and, combined with a shortage of stock on the market, this has meant that price growth has remained firm.

“By lowering transaction costs, the reduction in stamp duty may provide some support to activity and prices, as will the strength of the labour market, assuming it persists, with the unemployment rate at its lowest level since the early 1970s.

“However, headwinds are growing stronger suggesting the market will slow further in the months ahead. High inflation is exerting significant pressure on household budgets with consumer confidence declining to all-time lows.

“Housing affordability is becoming more stretched. Deposit requirements remain a major barrier, with a 10% deposit on a typical first-time buyer property equivalent to almost 60% of annual gross earnings – an all-time high.

“Moreover, the significant increase in prices in recent years. together with the significant increase in mortgage rates since the start of the year. have pushed the typical mortgage payment as a share of take-home pay well above the long-run average.

Most regions see further slowing in price growth

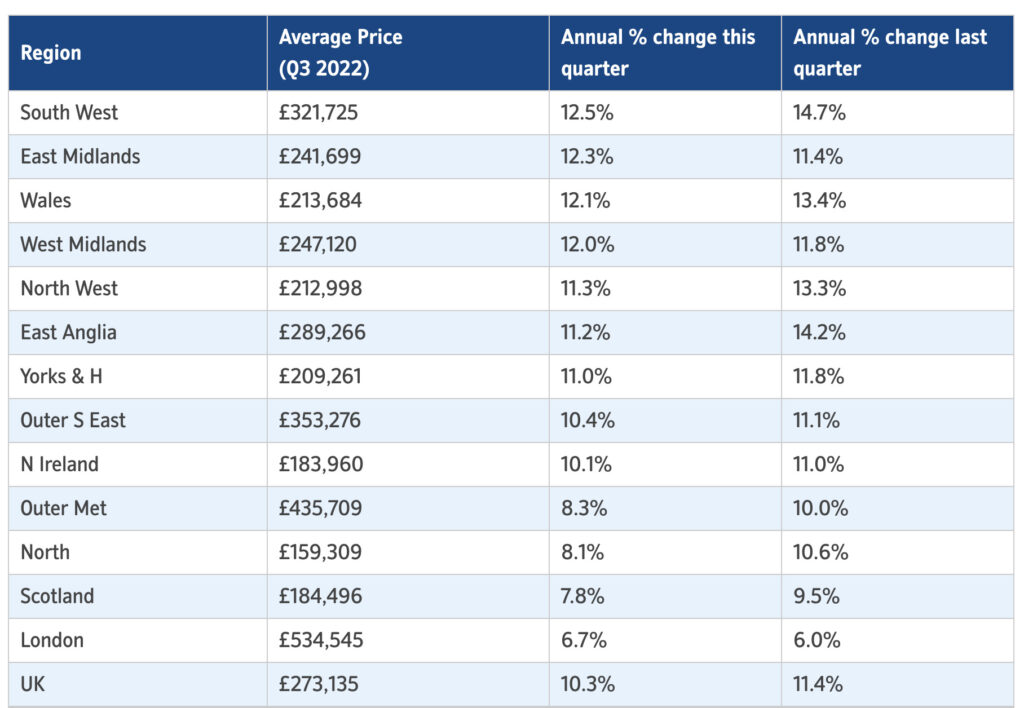

“Our regional house price indices are produced quarterly with data for Q3 (the three months to September) showing a softening in annual house price growth in 10 of the UK’s 13 regions (see table on page 4).

“The South West remained the strongest performing region, even though it saw a slowing in annual house price growth to 12.5%, from 14.7% in Q2. This was closely followed by the East Midlands, which saw annual price growth pick up to 12.3%, from 11.4% in the previous quarter.

“Wales saw annual price growth slow to 12.1% but remained the top performing nation. Price growth in Northern Ireland softened to 10.1%. Meanwhile, Scotland saw a further slowdown in annual growth to 7.8%, compared with 9.5% last quarter.

“England saw a further slowing in annual house price growth in Q3 to 9.9%, from 10.7% in Q2. While the South West remained the strongest performing region, southern England continued to see weaker growth overall than northern England.

“Within northern England (which comprises North, North West, Yorkshire & The Humber, East Midlands and West Midlands), the East Midlands was the strongest performing region with price growth picking up to 12.3% year-on-year, from 11.4% in the second quarter.

“London remained the weakest performing UK region, although did see a modest pickup in annual price growth to 6.7%, from 6.0% last quarter.”

Reaction

Guy Harrington, CEO of residential lender Glenhawk:

“The decade long house price growth party is over. If we do indeed see rates anywhere near the 6% that the markets are pricing in, the only outcome is a housing market crash.

“The BoE’s misguided obsession with crushing inflation has left an overpriced housing market at the mercy of the banks.

“Only a rapid unwinding of rates when the true scale of consumer headwinds becomes apparent this winter will prevent a prolonged period of turmoil for homeowners.”

Tomer Aboody, director of property lender MT Finance:

“Slower house price growth is inevitable, due to higher interest rates along with an increase in the cost of living. Buyers have been more thoughtful and patient with their purchases, either deciding to wait or offering well within their means, unlike the past couple of years where multiple offers on properties have pushed prices up, due to buyers being able to borrow at record low rates.

“With rates increasing at record levels, we will see a shift in sentiment and the move to a buyers’ market, rather than sellers calling the shots. Prime properties, especially within the London area, should sustain values, as foreign buyers look to take advantage of the weaker Pound.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“House prices continued to edge upwards in September, mainly due to lack of stock, although clearly some of the heat has come out of the market with the slowdown in annual price growth.

“So much has changed even since the beginning of September. Lenders have been pulling fixed-rate mortgages left, right and centre as Swap rate volatility makes them extremely difficult to price. Many of the smaller lenders in particular are waiting to see what the market does before relaunching.

“It is unlikely that much will change before the next interest rate decision on 3rd November or the Government plan supported by the Office of Budget Responsibility on 23rd November. Borrowers concerned about their mortgage should seek advice from a broker as to the options available and plan ahead as much as possible.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“The days of double-digit growth may not return for a long time. The level of uncertainty in markets, and being felt by consumers, is off the charts. The brief surge in sentiment caused by the stamp duty announcement on Friday has been wiped out by the tsunami of market volatility since.

“There’s no doubt now that a lot of prospective buyers will either have to look at smaller homes due to the sharply increased mortgage rates they are now looking at, or will shelve their plans altogether and wait until there is more clarity and things have calmed down.

“Prices will without doubt come under real pressure now, but the sizeable drops some have predicted are unrealistic given the lack of supply.

“Prices are far more likely to flatline than go through the floor. What we can all agree on is that the age of dirt cheap money is well and truly over.”

Gaurav Shukla, mortgage adviser at London-based broker, Home Me:

“Although rates increased at the beginning of September, they were still affordable for most customers so it was business as usual. It is no longer business as usual.

“In fact, in the property market, it is officially now business as unusual. Many first-time buyers will now put buying a property on hold, as the level of interest rates will push them out of affordability, especially with household bills due to increase in October.

“They are contemplating whether now really is the right time to buy. There is extraordinary uncertainty among the UK’s leading lenders and a lack of confidence across the board after the mini-Budget last week.

“With the Bank of England this week effectively bailing out the Government for their mini-Budget, it further demonstrates the lack of economic knowledge that Liz Truss and Kwasi Kwarteng have.

“Expect the Bank of England to continue to raise the base rate over the coming months and into 2023, with rates reaching their peak around the second or third quarters of next year. I expect house prices to drop over the coming year, with a much needed market correction.

“Demand will naturally decrease as only those who can afford mortgage payments at 6% interest rates will be able to proceed.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“We should get used to single digit price growth, potentially very low single digits and even negative.

“After the chaos of the past week, the level of uncertainty in the property market is off the scale. It’s like 2008 all over again.

“More rate rises, and potentially very sharp ones, are now almost certain, and that will further temper demand for property, putting prices under real pressure. For people who are currently locked into some of the lowest mortgage rates ever, the rate shock when they remortgage will be extreme.

“The pending remortgage crunch will significantly add to the cost of living crisis and put further pressure on household finances. We are heading into a brutal winter, with confidence among buyers and sellers alike at its lowest level since the Credit Crunch.”

Ian Hewett, founder of Ashford-based The Bearded Mortgage Broker:

“Despite all the madness of the past week, I don’t think we will see a property market crash. The reason is simple: the sheer lack of supply.

“Yes, mortgage rates have increased dramatically, and energy bills are set to soar, so affordability is going to be a challenge.

“However, the extreme lack of stock will likely prevent a crash even if demand drops off sharply. Many first-time buyers will still want to get out of the rental market, where rents are skyrocketing.”

Paul Neal of Derbyshire-based Missing Element Mortgage Services:

“It’s utter carnage out there right now. The wheels are coming off the mortgage market, and the property market as a result. Lenders are still withdrawing products, leaving brokers unsure when they will actually open again.

“Without mortgages, the property market could go pop. Many of our clients are in a Mexican stand-off between pulling the trigger on a property transaction and fleeing the market altogether.

“So many are unsure about whether to proceed. We have a mixture of clients who are rushing to get their applications in, and others standing off and waiting to see what the future holds. It’s impossible to know where prices will be in a year’s time. All we know is that there is a ridiculous amount of uncertainty thanks to last week’s mini-Budget.”

Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com:

“The events of the past week have fundamentally changed the mortgage market. I think we’re at the point where borrowers have started to realise house prices are likely to fall. The new norm over the coming weeks will be mortgage rates well over 5%, possibly 6%-8% by the new year.

“If no one can afford to buy at current prices, a lack of housing stock won’t make a jot of difference, despite what estate agents say to the contrary.

“Unless we are very lucky and inflation falls much more quickly than predicted, I don’t see any other outcome than a sizeable fall in house prices, possibly 20%+ over the next 2-3 years. The worm has turned. It’s a buyer’s market now.”

Samuel Mather-Holgate of Swindon-based advisory firm, Mather & Murray Financial:

“The stamp duty cut now pales into insignificance compared to the massive rise in borrowing rates. The naivety of some sellers to try and renegotiate prices upwards following that announcement will have left them with no buyers and nowhere to go.

“The housing market is soon set to dry up completely. It’s not interest rates doing this, but confidence in the economy and those running it.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“House prices stalled, even before chaos erupted in the mortgage market this week, and we saw the first month in over a year without growth. This could be a sign of stormier times ahead for house prices.

“There were already gathering clouds in the property market, with surveyors saying fewer people were househunting and buyers were losing confidence. In fact consumer confidence hit record lows. There was no real rush to buy, and mortgage approvals for purchases stuck below pre-pandemic levels.

“However, the storm broke this week, with around 40% of mortgages being pulled from shelves, because the pace and scale of the collapse in the bond market meant it was impossible to sensibly price them. When the dust settles, and lenders come back to the market, we can expect eye-watering rises in interest rates.

“This needs to be seen in the context of how dramatic house price rises have been in recent years, and the fact that our bills have raced away too. Even if people are still keen to buy, they may no longer qualify for a mortgage on affordability terms.

“It’s difficult to see this as anything other than a sign of things to come, as these pressures raise the risks not only that price rises stagnate, but that they begin to fall. There is the chance that we could see a significant correction in the coming months.

“There’s still the possibility that strength of the labour market could help hold the market together. Meanwhile, the fall in stamp duty could help to close the affordability gap, and keep the market ticking over. It’s unlikely to stimulate a boom, but it could make a difference, particularly at the more affordable end of the market.”

Scott Taylor-Barr, financial adviser at Shropshire-based Carl Summers Financial Services:

“The UK housing market is vastly undersupplied and so a fall in prices can really only be triggered by a couple of things: someone building and then releasing a million homes onto the market all in one go, or lenders withdrawing mortgages meaning that only cash buyers, or those with really big deposits, can purchase.

“I’m not aware of anyone secretly building a million houses, but the second one is scarily looking like becoming a reality. Our hope is that markets settle quickly and lenders return with their full, albeit higher priced, product ranges soon. If not, the housing market is looking extremely vulnerable.”

Joe Garner, managing director at London-based property developer, NewPlace:

“In some areas there will very possibly be a crash, in others prices will stabilise, and in other areas still prices could increase. The type of property will also play a role in how it fares in the weeks and months ahead.

“While owner-occupied property prices are likely to fall due to the reduced availability of mortgages and liquidity, we will likely see a big shift upwards in the value of rental accommodation. People still need somewhere to live, and if they can’t buy, they have to rent. If the demand for rental properties increases then so do the rental payments, which in turn increases the yield, resulting in an uplift in the value of the rented property.

“As mortgage products come to an end, it appears to me that homeowners have two choices. They move onto a new product with the same lender and suffer the inevitable increase in payments or they sell out at below market value and move into rented accommodation.”

Michael Webb, managing director at Brandon-based Mortgage Republic:

“Most people were expecting the next interest rate increase to happen at the scheduled November meeting, but it may come sooner than that, potentially this week or next.

“If an emergency rate rise does occur, it will be an enormous shock for many borrowers and could hit property market sentiment hard. The property market is facing a phenomenal level of uncertainty.”

Michael O’Brien, managing director at Romford-based Home of Mortgages:

“The market is not in the grave position it was back in 2008 yet. For now at least, first-time buyers can still purchase with a 5% deposit.

“There’s no doubt that the cost of borrowing is increasing, however, faced with the alternative, namely the ever-increasing cost of renting, a mortgage is still a more comfortable alternative. That will likely support prices as people will still want to exit the rental market wherever possible.”

James Miles, director of Exeter-based broker, The Mortgage Quarter:

“The pressure cooker is about to pop. We’re seeing borrowers strongly re-evaluate their lending options and demand will almost certainly start to weaken. If demand drops then prices, or at least the rate of price growth, will too.”

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions:

“September 2022 could turn out to be a significant turning point in the housing market cycle and it’s hard to now envisage anything other than a significant downturn in prices.

“Early indications are that, with confidence severely dented by the chaotic events of the past week, many people will now choose to sit on their hands for the next six months or so and wait for things to settle down. There is no question that for some would-be buyers, in particular first-time buyers, the rise in the cost of the mortgages that remain, along with the associated affordability challenges, will prove too much of a hurdle.

“For those, however, with reasonable deposits and strong incomes, a likely drop in house prices and fall in competition from other buyers could in fact be the opportunity they have been waiting for. Those opting to view from the sidelines will also feel the pain, as the cost of renting is also likely to surge as demand in this sector will continue to far outstrip supply.”

Mark Robinson, managing director of Southampton-based Albion Forest Mortgages:

“Lenders are pulling their products left, right and centre because they have no idea what is going to happen with interest rates. In the Bank of England versus Truss war, borrowers and homeowners are caught in the crossfire. I am hopeful that in a week or two we will have a clearer idea of what is going on.

“Hopefully the Bank of England will make a proper statement and then we will all know where we stand, lenders included. But the property market will be tested like never before in the weeks and months ahead.”

Jamie Lennox, director at Norwich-based mortgage broker, Dimora Mortgages:

“People who were considering moving just a fortnight or so ago are now battening down the hatches while storm Truss unfolds.

“A growing number of our clients have come back to us after months of searching for a home and are putting their move on hold, in shock at how quickly rates have gone up.

“Their ideal home has now passed beyond a budget they feel comfortable with. What we are seeing is more and more clients approaching us about the best way to protect their finances by potentially securing a new mortgage now before rates rise further. The shift in confidence has been dramatic over the past week. I’ve never seen anything like it.

Manooch Suree, director at Uxbridge-based mortgage broker, Zinga Financial Servces:

“Mortgage rates have never flashed so loudly on people’s radars. If rates were to rise again after an emergency meeting, it has the potential to bring the the purchase market to a grinding halt due to fears of what could happen next, which will invariably impact prices.

“We are in a highly fluid mortgage market now, with conditions changing by the day. People like certainty and there’s not much of that right now.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“We must remember we have a chronic housing shortage, and mortgage lenders want to lend. Those two things together are the opposite of what would predict a crash.

“Lenders are withdrawing rates because they don’t know how to price them accurately, not because they don’t want to lend. Will prices fall? Possibly. Will we see a crash? For all our sakes, let’s hope not.”

Rob Peters, director of Altrincham-based Simple Fast Mortgage:

“Although rates rose in early September, the moderate increase in the cost of borrowing was overshadowed by buyer demand driven via a lack of housing stock. However, the mood soon changed when the Bank of England raised rates again and many first-time buyers found themselves falling off the affordability podium, shelving any aspirations they had of property ownership.

“Then when Truss and Kwarteng announced a package of growth stimulus via tax cuts, pandemonium ensued, in the mortgage, stock, currency and bond markets. Both the pound and gilt rates dropped through the floor.

“The result has been a mass exodus by mortgage lenders with almost all fixed rates mortgages withdrawn or significantly repriced. The market is now in limbo, with no clear sign of whether things will stabilise or head further south. Regardless of stock availability, there is a significant lack of confidence in the market. All bets are off.”

Marcus Wright, MD of independent mortgage broker, Bolton Business Finance:

“There could come a point at which increasing mortgage payments due to interest rate rises massively reduces demand for houses, which will clearly be bad news for property prices. We might not be there yet but what if rates go up another 1%, 2% or 3%?

“Higher interest rates on mortgages have the potential to significantly reduce demand among people up-sizing or moving, as well as property investors.

“Then, of course, a lot of people may not pass banks’ affordability checks, which means they can’t buy the homes they want. Higher rates could also increase supply, as more people sell up if they cannot afford their mortgage and we may possibly see an increase in repossessions. All of these factors mean we may well see a property crash.”

Iain Crawford, CEO of Alliance Fund:

“Despite growing economic uncertainty the housing market continues to stand firm, posting a very robust level of growth over the last year.

“That said, with interest rates increasing in an attempt to curb inflation, homebuyers are now seeing the monthly cost of their mortgage start to climb. This increased cost, coupled with the usual seasonal slowdown seen during this time of year, will inevitably curb the high rates of house price growth seen over the last year or so.

“However, those anticipating a crash are likely to be disappointed and we’ve seen the property market survive far worse in recent times, including a prolonged period of political uncertainty and a global pandemic.

“Real estate remains one of the safest and most sensible investments you can make and this will remain the case despite what challenges lie ahead for the wider economy.”

Marc von Grundherr, director of Benham and Reeves:

“The first single digit rate of house price growth since last October will no doubt be pounced upon as signs that the market is starting to crumble. However, this would be inaccurate, to say the least, much like the mass panic that was spurred earlier this week by the creative take on a marginal reduction in mortgage product availability.

“The reality is that we remain in a very strong position and not only will this increased cost of borrowing fail to dent the insatiable appetite of the nation’s homebuyers, but a severe shortage of appropriate housing stock will also ensure house price growth remains stable.

“Despite London trailing the rest when it comes to the rate of house price growth being seen, the region remains the pinnacle of the UK property market. Home to the highest house prices in the nation, the capital’s homebuyers are actually enjoying a higher pound and pence increase in the value of their bricks and mortar assets despite a far lower rate of growth.”

James Forrester, managing director of Barrows and Forrester:

“In any other market, such high rates of annual house prices growth would be lorded as proof of a property market boom. But, we’ve become so accustomed to seeing regular double-digit rates of growth that any marginal slowdown is now sparking fears that a crash is imminent.

“This simply isn’t the case and we’re yet to see any definitive proof that the tide is starting to turn from boom to bust. Of course, the increasing cost of securing a mortgage will impact the price buyers are willing to pay, but the issue of homebuyer affordability is certainly nothing new and so a reduction in mortgage product choice is unlikely to topple the might of the UK property market.

Chris Hodgkinson, managing director of HBB Solutions:

“The market seems to have hit the wall where the monthly rate of house price growth is concerned and this will come as little surprise given the fact dark clouds have been building for quite some time.

“Mortgage approvals are starting to slide, driven by the increasing monthly cost of a mortgage pricing many buyers out of the market. Buyers can no longer match the inflated pandemic price expectations of many sellers and it’s only a matter of time before this adjustment causes house prices to decline.

“Those currently looking to sell are advised to do so quickly because it won’t be long before their home is commanding considerably less, or failing to sell altogether due to an unrealistic asking price expectation.”

Almas Uddin, founding director of Revolution Brokers:

“A property market price correction may be impending, but this will do little to comfort the nation’s current buyers who are still facing a huge task in climbing the ladder. Not only are house prices considerably higher than they were just a year ago, but the cost of securing and repaying a mortgage is also continuing to climb.

“The good news is that, while some lenders have pulled a range of product offerings, there remains a wealth of options to choose from. While it’s always advisable to consult a whole of market broker, doing so in the current climate will ensure you get the best view of the mortgage products on offer and which can best suit your individual financial situation.”

Jonathan Samuels, CEO of Octane Capital:

“Both homebuyers and sellers are best advised to buckle up as the remainder of the year looks to be a turbulent one for the UK property market.

“There’s no doubt that aspirational buyers will continue to pursue their dream of home ownership despite the increasingly unstable economic landscape. The question is to just what extent this economic uncertainty will impact the price they are willing, or able, to pay when purchasing.

“While we don’t expect the market to combust completely, something has to give and we can expect the current rate of house price growth to cool as we head into what is also a traditionally quieter period.”

Nicky Stevenson, managing director at national estate agent group Fine & Country:

“We know that a week is a long time in politics and perhaps the same could be said for the housing market. This data relates mainly to the period in September which came before last week’s mini-budget, and shows only a very modest slowdown in annual house price growth.

“In the coming weeks and months it is likely we will see a different picture emerging as interest rates accelerate faster than anyone anticipated against a backdrop of a sinking Pound.

“Increased borrowing costs may well have the effect of wiping-out any cash savings that buyers hoped to make as a result of the stamp duty cut, while volatility in the mortgage market could delay transactions already in the pipeline.

“The other side of the coin is that sterling’s weakness is already making Prime London more attractive to overseas buyers. We know that the capital’s housing market does not always move in sync with the rest of the country, and we anticipate a spike in interest from foreign investors in the months ahead.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“At a time when there is so much doom and gloom in the news, we might expect a much greater cooling effect on house prices than what these figures are showing.

“The modest slowdown in growth over September reflects higher borrowing costs and increased affordability challenges, as well as a slowdown in market activity as Britain entered a period of mourning over the death of The Queen.

“Last Friday’s ‘mini-budget’ has caused shockwaves throughout the economy and intervention by the Bank of England to counter these effects has resulted in lenders pulling many fixed-rate mortgage deals.

“While the current economic crisis is likely to impact mortgage rates, a sudden crash in the market is not as likely as some economists are forecasting.

“Estate agents are still seeing stock shortages in many areas of the country, something which has supported elevated house prices throughout the boom.

“The government’s stamp duty cut may well have the effect of mitigating spiking finance costs, but question marks remain over how high interest rates will climb.”

Nathan Emerson, chief executive of Propertymark:

“Sellers coming to market are still hoping to achieve the boost in prices we saw coming out of bidding wars last year. However, buyers are in a more sensible frame of mind and are taking their time over moving and budget decisions and we will see this effect prices being achieved.

“Our own data from our estate agent members across the UK shows the number of new homes and buyers coming to the market is up year-on-year which will underpin stability.

“With interest rate rises, we could start to see some re-negotiations if mortgage offers expire during the conveyancing process which is currently taking over 17 weeks on average.

“A trend of re-negotiation would start to soften house prices as those final sale prices are used by agents to create comparable evidence for the valuing of new properties entering the market.”