The UK saw annual house price growth slow to 10.0% in August, down from 11.0% in July, according to the latest Nationwide House Price Index.

Prices are up 0.8% month-on-month after taking into account of seasonal effects with the average house costing £273,751.

The increase puts the average house price up by almost £50,000 in two years.

Robert Gardner, Nationwide’s chief economist, said: “While annual house price growth softened in August, it remained in double digits for the tenth month in a row – at 10.0%.

“Prices rose by 0.8% month-on-month, after taking account of seasonal effects – the thirteenth successive monthly increase. Indeed, in the past two years, the average house price has increased by almost £50,000.

“There are signs that the housing market is losing some momentum, with surveyors reporting fewer new buyer enquiries in recent months and the number of mortgage approvals for house purchases falling below pre-pandemic levels.

“However, the slowdown to date has been modest, and combined with a shortage of stock on the market, has meant that price growth has remained firm.

“We expect the market to slow further as pressure on household budgets intensifies in the coming quarters, with inflation set remain in double digits into next year. Moreover, the Bank of England is widely expected to continue raising interest rates, which will also exert a cooling impact on the market if this feeds through to mortgage rates, which have already increased noticeably in recent months.

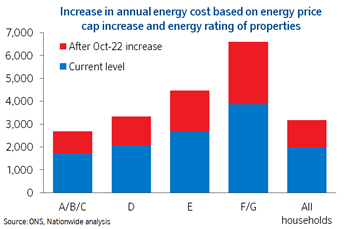

Energy price cap increase will have greatest impact for least energy efficient properties

“Ofgem recently announced an 80% increase in the energy price cap, effective from 1 October, which reflects the soaring cost of energy in wholesale markets.

“It is important to note that the cap is on the unit price charged to consumers, rather than a maximum bill a household can be charged. So, while a typical household is set to pay £3,545 a year, for some costs will be even higher.

“We’ve looked at the impact of rising energy costs on average bills for properties with different energy efficiency ratings (as reported on energy performance certificates). Currently (based on the April 2022 price cap), the most energy efficient properties (those rated A-C) pay £1,700 per year, whilst the least efficient (those rated F-G) typically see bills over twice as high at c.£3,900 p.a.

“As things stand, from October, average bills for D-rated properties (the most common type) are set to rise by just over £1,250 a year, even after taking account of the government’s £400 discount. Those in properties rated A-C will see average bills increase by nearly £1,000 a year (or over £80 per month).

“E-rated properties will see an increase of over £1,700 per year (c. £150 per month), whilst those in the least energy efficient properties (F/G) face a staggering £2,700 rise (£225 per month). While only a small proportion of the stock is rated F/G (approximately 2% of those with mortgages), the challenges for these households appear particularly acute.

“To provide some further context of the scale of these increases, we’ve calculated the equivalent interest rate rise based on a typical outstanding mortgage. For ease of comparison, we’ve used the same mortgage balance and term for each EPC rating. Overall, the average increase is equivalent to a 1.36% rise in interest rates, but around 1% for A to C-rated properties, 2% for an E-rated property and nearly 3% for an F/G-rated property.

“Moreover, these increases in energy costs come at a time when mortgage interest rates are also rising. While most mortgages (c85%) are now on fixed rates, protecting borrowers in the short term, those who are looking to refinance face a significant rise in borrowing costs if mortgage rates stay at current levels.

“For example, the average rate on new two-year fixed rate mortgages is currently over two percentage points higher than those prevailing two years ago, while the average rate on five-year fixed rate mortgages is around 1.5 percentage points higher than five years ago.

“With household budgets coming under substantial pressure, the government is likely to increase support. But, as well as addressing the rising cost of energy bills, improving the energy efficiency of the housing stock could play a crucial role.

“Incentivising improvement measures, such as loft and cavity wall insulation and solar PV installations, could help limit bill increases and assist the UK towards its carbon emissions targets.”

Reaction

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“Housing prices continue to edge upwards, due to lack of stock, although some of the heat has come out of the market with this slowdown in annual price growth.

“Borrowers remain keen to secure a fixed-rate mortgage before rates rise higher. With another potential rate rise on the cards this month, minds are focused on getting deals done before the cost of borrowing rises further still. With lenders pulling products with little or short notice in order to maintain service levels, there are further pressures on borrowers.”

Rose Lyle, director of private clients at property consultants INHOUS:

“As prices continue to rise, there remains strong demand for good family houses with decent gardens in school catchment areas in prime and outer prime London in particular.

“Escalating inflationary pressures will inevitably have a negative impact on affordability particularly for the middle and lower end of the housing market.

“However, the prime and super prime market are likely to be more resilient as cash-rich buyers look to invest their money into property when other asset classes show weaker performance.

“90% of our transactions so far this quarter have been cash buyers who appreciate that, with inflation where it is, leaving their money in a bank account does not make sense.”

Alex Lyle, director of Richmond estate agency Antony Roberts:

“If we see an increase in supply over the coming weeks then we expect a strong autumn market. There is, however, little doubt that the continuing economic challenges are having an impact, with buyers only seeing interest rates heading one way.

“The family house market in particular remained resilient throughout August. While there was precious little new stock, the high volume of deals agreed and new buyer registrations was reassuring.

“We expect buyers to attempt to secure a property as quickly as possible over the coming months, with sellers benefitting from some very committed demand.”

Avinav Nigam, co-founder and chief operating officer of real estate technology platform IMMO:

“This slowdown in price growth will be welcomed by those struggling with affordability challenges, as the average house price remains over 10 times average annual individual earnings.

“August’s data makes sense. House prices are the result of supply and demand gap between buyers and sellers, as well as investors and consumers. In August we see one upward force and one downward force on house pricing that explains the numbers better.

“August tends to be the best month in terms of seasonality peak and does 7% better on average than the rest of year due to more purchases and family moves happening which drive prices upwards.

“At the same time, interest rate rises and talk of recession are pulling prices downwards. In recessionary times and times with higher interest rates, demand for buying properties tends to fall.

“On the ground, we suspect that actual selling prices are softening a little even if asking prices may not change by much. Vendors are having to accept a slight adjustment in pricing with deeper discounts than may have been the case just some months ago.

“However, we all still need a roof over our heads. Demand for housing does not fall in absolute terms. Demand shifts from buying to renting properties, which offers more flexibility.

“Unfortunately, the shortage of supply of both properties for ownership and for rent continues. For this reason, the slowdown in growth should not be taken as an indicator of a major crash to follow.

“It just means that there’s a supply demand gap that will shift from buying towards renting. As a result, rental prices have grown by almost 10% in the last quarter vs year ago, creating the need for quality rental housing at affordable prices.

“Professional investors are needed to plug this gap in quality, energy efficient, affordable homes for people and communities across the UK.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“Economic conditions continue to deteriorate and more rate rises are almost certainly on the cards so the days of double digit price growth will soon draw to a close. The obscene rise in energy bills is something that needs to be proactively addressed by lenders as the current batch of green mortgages are little more than a gimmick.

“Using personalised data to target individual properties, we’re currently working with a variety of high street and specialist lenders with a view to embedding energy-efficiency measures into people’s mortgages where applicable.

“It’s in the interest of both the homeowner who will pay cheaper bills and the lender, as energy-efficient homes will retain value and also mean borrowers are less likely to default due to astronomical energy prices.

“Now is the time for the mortgage industry to go green in earnest rather than continue along the current path of lightly packaged and largely token green products.”

Mike Staton, director of Mansfield-based Staton Mortgages:

“August is usually a relatively quiet month in the mortgage and property market, but this time round there were no signs of a dip in activity, with first-time buyers especially active. It may be that people are keen to buy, lock into a low rate and batten down the hatches before we enter a time of potentially extreme economic turbulence.

“Although we are starting to see a reduction in the level of competition to buy houses, it remains a sellers’ market for now as there are still more than enough buyers out there despite the cost of living crisis.”

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions:

“Though the property market remains in a relatively healthy state for now, there’s nowhere near the frenzied activity that has defined the market during the past couple of years. We’re typically now seeing just two or three buyers competing for a property rather than two dozen, as was the case this time last year. In some instances, some old-fashioned negotiation between a single buyer and seller is now making a comeback.

“While there is still a general lack of supply, sellers’ expectations are also becoming more reasonable and generally more in line with valuations.

“The current flattening in the market and greater equilibrium between buyers and sellers is a good thing and in the past month I have had several clients make successful offers after some had been looking and offering unsuccessfully for over two years.

“Unlike the Global Financial Crisis of 2007/08, arguably the most important element of the housing market is that it remains fluid and functional so while prices may stagnate or fall slightly due to the cost of living crisis, I am confident that demand will remain and transactions will continue, albeit at lower levels than the past two years.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“It’s frankly mind-blowing that annual house price growth is still in double digits. However, with inflation and energy bills set to rise into the stratosphere, and rates also set to increase further, the property market will soon come back down to earth. Increased borrowing costs and the immense pressure on household finances due to skyrocketing energy bills will almost certainly start to temper demand in the months ahead.

“The one constant in these times of extreme flux, of course, is the lack of supply and homes being built. The abject lack of good quality, affordable housing will support prices even as we go through an unprecedented cost of living crisis.”

Samuel Mather-Holgate of Swindon-based advisory firm, Mather & Murray Financial:

“The UK still suffers from a massive housing shortage and until this fundamental and difficult issue is addressed, then house prices will always be high in comparison to wages. That said, a slowing economy and forthcoming recession will dampen the market significantly with many prospective buyers put off by higher interest rates and utility costs.

“However, I don’t expect to see prices decline like they did after the Global Financial Crisis. Under normal circumstances, this should now be turning into a buyers’ market, but after the amount homeowners have spent on their properties and the costs associated with that, I expect they will hold out for near asking prices and sit and wait if they don’t attain this. This is why I expect prices to hold up, but transaction levels to sink like a brick.”

Edward Checkley, managing director of London-based property finance specialists, Advias:

“August has been consistent with most of 2022, with people transacting against a backdrop of rate hikes, slow conveyancing and drawn-out lender processing.

“Buyers looking for the right property are still looking and taking the view that a mid-3% mortgage rate is still good in terms of longer-term averages.

“Investors are certainly reappraising their strategies as limited company rates are typically north of 4%, with some tipping into the 5% space. We have certainly noticed a slowdown from overseas buyers who face a double surcharge cost in stamp duty and less attractive interest rates to offset this cost.

“We believe that house price growth will level out from here, with the lack of housing supply keeping a decline at bay from the inevitable economic jitters and the cost of living crisis.”

Michael Aldridge, director of Bath and Chippenham-based Lucra Mortgages:

“Despite the growing number of doom and gloom prophecies, the housing market continues to defy logic and house prices continue to boom.

“Some analysts predicted the property market would be on its knees by now but despite an apparent perfect storm it still remains very buoyant.

“Without doubt, the squeeze on household spending will start to have an impact on demand and, in turn, prices, but several factors are counterbalancing this.

“Housing stock remains very low, employment levels very high and though interest rates are rising, they are still at historically low levels. Though the rate of price growth will almost certainly start to cool, I just can’t see a crash.”

Charles Yuille, managing director of Bath-based Willow Brook Mortgages:

“With inflation going through the roof and energy bills set to hit terrifying heights, a moderation in the rate of house price growth is now inevitable, but the egregious lack of stock will prevent any material drop in house prices.

“The cost of living crisis is definitely hitting wallets and confidence hard but for now the employment market remains strong. As long as people have jobs, there will be demand for property. If jobs start to go at scale, that’s when we could see prices fall.”

Rhys Schofield, Managing Director at Peak Mortgages and Protection:

“I have never known a busier August. We saw the usual summer slowdown in purchase work as there wasn’t much new stock coming to market but this is an annual event and estate agents are very busy with new properties hitting in September.

“It’s still very much a sellers’ market, though, with demand outstripping supply. What kept us really busy though was remortgage work with customers wanting a new fixed rate to protect against rate rises. Remortgage enquiries through our website were up 227% in August on the previous month alone.”

Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com:

“August was busy, with lots of enquiries from clients looking to remortgage. There’s a real sense of urgency now after the recent 0.5% hike in the Bank of England base rate.

“The market is definitely turning in favour of buyers, who are wary of paying over the odds now mortgages, energy and the price of everything else is going through the roof. Unless Truss or Sunak can pull several rabbits out the hat, I don’t see anywhere else for house prices to go but down.”

Jamie Lennox, director at Norwich-based mortgage broker, Dimora Mortgages:

“August is naturally the holiday season, with children off school so it’s unusual to see a downturn in activity levels as families are on holiday or entertaining their children, with paperwork and property at the back of their minds.

“In our eyes, it’s too early to tell if the market is changing until further data for September and October become available. However, we will say while stock levels remain as low as they are, it’s hard to back the idea that house prices will drop across the UK.”

Jamie Thompson of Manchester-based Jamie Thompson Mortgages:

“August was the busiest month on record for my business, by some 30% more than the second best ever month. First-time buyers remain out in force and some customers are returning earlier than anticipated for remortgage reviews, willing to pay penalties now to secure today’s rates in case of further interest rate raises.

“I think this is common across the industry at the moment if lenders service levels are anything to go by. I’ve seen more borrowers revising down the purchase price they are looking at in some cases.

“This means that those who were looking to purchase for around £300,000 a few months ago are now considering smaller, more energy-efficient homes around £200k.

“Paradoxically this could mean more people competing for properties at lower price points, increasing the prices at the lower end of the ladder more than the higher, making it yet harder still for first-time buyers without access to the Bank of Mum and Dad.

“There’s no one market for housing in the UK. It varies by location and property type and size so different buyers and sellers can go through completely different experiences depending on their circumstances.”

Dominik Lipnicki, director of Your Mortgage Decisions:

“August proved to be a busy month, especially on the remortgage front with borrowers keen to fix their mortgage rate. So far, the housing market has remained strong but house price increases are likely to dampen as the cost of living crisis bites.

“Without a doubt, we face an uncertain future with some predicting mortgage rates unseen for well over a decade.”

Scott Taylor-Barr of Shropshire-based broker, Carl Summers Financial Services:

“We’re entering uncharted waters in terms of the economy, so how things play out ultimately is as much luck as judgment. I’ve personally seen a noticeable reduction in the number of enquiries coming in for people looking at buying property, but many people are keener than ever to review their existing mortgage, so activity is still at the same level in the mortgage market overall.

“The shift away from property purchase will no doubt have an impact on house price growth, maybe even stalling it completely for a period, but I can’t see any widespread falls in house prices as long as mortgages are still available to the majority of potential buyers.

“If mortgage lenders for some reason constrict mortgage availability, then that may have a negative effect on house prices, as only those with excellent credit scores and larger deposits will be in a position to buy.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“August has been off the charts for new applications, whether it’s people moving home, first-time buyers or people wanting to remortgage; it’s been the best month so far this year, which is odd as August is typically one of the quieter months.

“However, we’re noticing a significant change with landlords looking to sell up, giving tenants first refusal. This is off the back of rates rising, EPC changes coming down the tracks on top of the landlords no longer getting an interest rate tax relief.

“Essentially it’s squeezing landlords’ margins, and we’ve seen a massive increase in those types of enquires from renters hoping to buy from their landlords. The tide is certainly turning from what’s been a seller’s dictatorship into a buyer’s paradise.

“As long as the Bank of England doesn’t do anything too drastic, the wheels should stay on the property market and hopefully, the government can do something about the energy crisis. In short, don’t bet against the housing market too soon.”

Rob Peters, director of Altrincham-based Simple Fast Mortgage:

“Usually August disappoints, but not this year as new mortgage business levels have been through the roof. A solid mix of first-time buyers, remortgages, and buy-to-let applications has seen us through one of our best months ever.

“If anything, it’s the seasoned investors who are sitting on the sidelines waiting to see if the economic environment will provide a key opportunity. Our view is it remains a sellers market and that it’s going to take some some serious economic pressures to slow down the property market machine.”

Imogen Sporle, head of term finance at London-based broker, Finanze:

“Although we have a cost of living crisis which would usually bring the market down, this has been counteracted by so many people rushing to buy now to avoid the higher rates which are being predicted for the end of the year and 2023.

“I do think price growth will slow however but in comparison to the massive boom we have had in the past two years I do not think this is anything to worry about. I do think the lack of stock will help support prices.”

James Briggs, head of personal finance intermediary sales at specialist lender Together:

“House prices defied expectations to increase by 0.8% month-on-month in August 2022 and 10% compared to August 2021, despite financial belt-tightening across the UK.

“But this trend can’t continue for much longer, and a drop is to be expected soon as the country braces itself for a tough winter ahead, with double digit inflation sending fuel bills spiralling.

“The threat of a recession is also likely to dampen consumer confidence. Pressure to secure a quick sale before the housing market cools may also be a factor, as sellers decrease prices to secure a buyer.

“While this may benefit first-time buyers who can take advantage of a price drop and secure a mortgage now, many homeowners who were looking to move and upgrade their homes may now want to stay put, as they focus on remortgaging or consolidating unsecured debts to avoid going into payment shock as interest rates and inflation continue to rise”.

Tomer Aboody, director of property lender MT Finance:

“With less stock on the market and therefore lower transaction volumes, these price rises are not surprising as buyers have little choice and are therefore outbidding to secure a home.

“However, while a few months ago these bids were above asking price, buyers now are more cautious due to rising rates and costs so are bidding around or below asking price, taking into consideration any work required and therefore delays in material and higher building costs.

“With energy prices rocketing, an energy-efficient home will be higher up the pecking order on buyer’s wish lists, especially as lenders will be looking to reward borrowers on being more efficient by offering lower rates.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Although of course a little historic and reflecting only activity of Nationwide’s customers, these figures have proven to be a long-standing, reliable indicator of market health.

“At the sharp end, demand is still there, albeit softer than in previous months but continuing lack of stock means prices are likely to be sustained for some time yet. Rises in the cost of living and interest rates are certainly making a difference but the latter has not filtered through to the figures yet, bearing in mind so many borrowers are on fixed-rate terms.

“Looking forward, we don’t expect much change, particularly while new listings and appraisals are at a relatively low level, although the picture may alter as many return from holidays.”

Nicky Stevenson, managing director at national estate agent group Fine & Country:

“Price gains continue to soften amid a squeeze on living standards and a decline in buyer affordability. Underlying demand remains robust though spiking energy bills and increased borrowing costs are having a gradual cooling effect which is expected to become more pronounced later in the year.

“While the pace of growth is no longer accelerating, demand continues to outstrip supply throughout most of the country and the desire to trade-up among existing homeowners remains strong.

“Ten successive months of double digit growth is remarkable, but we expect momentum to soften as recession looms larger.”

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“You might think a posh period property is your dream home, but in reality, owning one is becoming a financial nightmare.

“The age of a property is the single biggest factor in determining how energy efficient it’s likely to be. Almost all homes built since 2012 in England and Wales have a high energy efficiency rating – compared with 12% of those built before 1900 in England and 8% of those of the same age in Wales. The next most important factor is size. Flats and maisonettes are most likely to be in the most efficient bands and detached homes are the least likely to be. It means that big, detached Victorian homes are costing people dear.

“Before the horrendous hikes in the energy price cap, this might have been manageable, but the impact of rising prices is taking a terrible toll. The average energy bill for the least efficient homes is twice the level of the most efficient homes – at £3,900, and the price cap rise will add an incredible £2,700. That’s an impossible bill £550 a month.

“And it’s not just the energy bills that make these properties a financial liability. Because so many people want to buy a period property, you’ll pay a premium for them compared to something less desirable that’s 20-40 years old. The price of houses is still growing faster than the price of flats too, so a big, older property is going to mean enormous monthly payments.

“Anyone who has been in their home for a while, meanwhile, and is coming to the end of a fixed rate mortgage deal is in for a mortgage shock, because the rates are now significantly higher than when these two-year and five-year deals were locked in. It means trying to wrestle with hefty monthly mortgage payments while trapped under the weight of bloated energy bills.

“For older people, who are still in the family home, the pressure of energy bills may make it impossible to stay. Anyone on a fixed retirement income faces a challenge when prices rise, and for many people these higher energy bills will be insurmountable. This spike in energy prices may force them to leave behind a home they love because they can’t afford to stay.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“With all the doom and gloom on the front pages recently, you would have thought that house prices would be going the opposite way, but it seems that the housing market doesn’t read the news.

“This is the thirteenth monthly rise in a row, with prices kept sky-high by limited housing supply on the market.

“The signs of a slowdown are growing, however, activity is starting to fall, at the same time as new mortgage approvals drop. Expected interest rate rises combined with soaring household costs will start to bite in the coming months.

“It’s almost difficult to believe that just two years ago the average house was worth £50,000 less than today.

“This house price growth is unlikely to continue but it still leaves many first-time buyers priced out of the market. Many people hoping to get on the ladder will have their fingers crossed that prices soften soon and allow them to take that first step.”

Emma Cox, MD of real estate at Shawbrook:

“House price growth has remained remarkably robust given the worsening economic headwinds. However, we are now seeing inflationary pressures and higher borrowing costs having a bigger impact.

“Prices are continuing to be buoyed by a lack of properties on the market. The sector remains in desperate need of an influx of affordable, energy-efficient stock. The candidate who emerges as prime minister on Monday will need to put solutions in place to help alleviate challenges.

“In the rental sector, the lack of supply, high demand, and pressures on household finances mean that costs are likely to be passed on to tenants, and rental prices are set to rise further.

“Lenders remain keen to support buyers and are competing to offer favourable rates and LTVs. Shopping around now and locking in a fixed rate now will be a key to protecting prospective buyers against any further interest rate rises.”