Consistent price increases since early 2022 saw the UK achieve a record average house price of £296,000 in August 2022, according to the Office for National Statistics (ONS).

Average annual growth stood at 13.6%, compared with 16.0% in the year to July 2022 and 8.1% in the year to June 2022.

This decline is driven by the volatility seen in house prices throughout 2021 because of Stamp Duty holiday changes.

For example, tax holiday changes at the end of June 2021 caused average house prices to fall £13,000 in the month to July 2021, followed by an increase of £7,000 into August 2021.

There was a smaller increase of £3,000 between July and August 2022. This base effect, where prices are increasing by a smaller amount than the same period last year, has led to the slowing of annual growth this month. Trends in 2022 have been more stable.

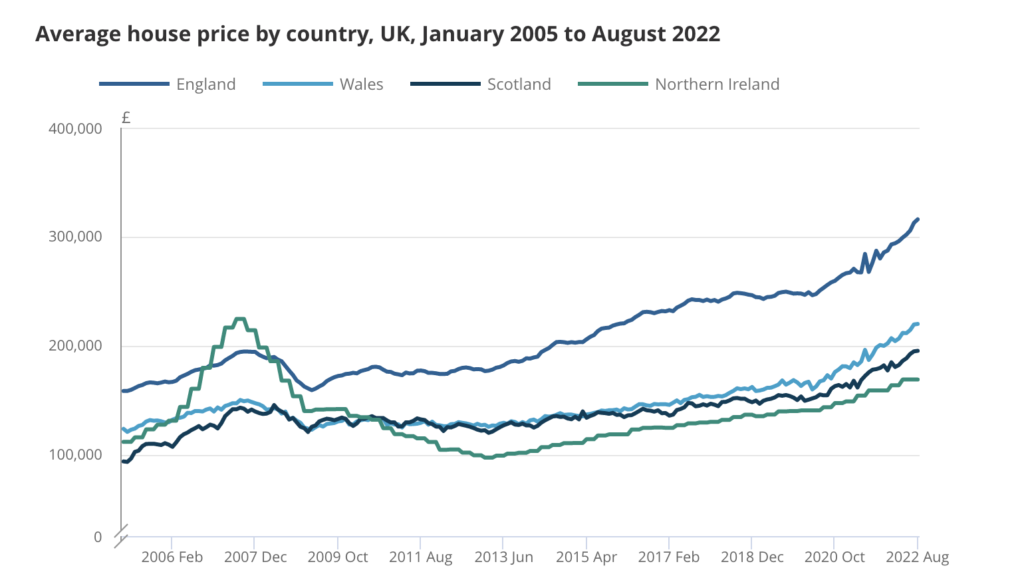

Wales continued to see the strongest annual house price growth at 14.6% followed by England (14.3%), Scotland (9.7%) then Northern Ireland (9.6%)

Reaction

Malcolm Webb, technical director at Legal & General Surveying Services:

“Today’s data confirms that house price growth remained resilient over the summer. However, it may be some time until we have the data to analyse the volatility felt by the UK housing market in the last few weeks.

“The fast-moving nature of today’s market also makes it extremely challenging to forecast which way house prices will go next.

“Many prospective homeowners will be feeling anxious about their finances, which makes a thorough survey more important than ever to avoid unexpected repair costs further down the line.”

Vikki Jefferies, proposition director at PRIMIS:

“Despite a cooling in the rate of house price growth reflected in today’s statistics, prices remain strong and the housing market continues to prove itself resilient. It’s also positive to see the new Chancellor has re-confirmed the Stamp Duty cut first announced in September.

“This is particularly the case for first-time buyers who will see their threshold on stamp duty exemption rise to £425,000 as a result.

“Overall demand for properties remains healthy and the mortgage market remains a flurry of activity, with many buyers continuing to rush to lock in rates. In this ever-evolving mortgage landscape, brokers have a vital role to play in ensuring their customers understand new developments, as well as what the best products available to them are, in light of these.”

Emma Hollingworth, MPowered Mortgages:

“The slowdown in the rate of house price growth is to be expected, as the effects of subsequent interest rate rises begin to impact consumer sentiment. That said unemployment numbers remain strong and we are still seeing demand albeit more subdued demand from buyers who are looking to lock in rates before they rise further.

“Our latest research shows that the speed of offering on a home has dramatically increased over the past five years and in 2022 one out of three homes now receive an offer within an hour of viewing. This shows that people will continue to need to act fast to secure the house of their dreams.

“We strongly urge any homebuyer or owner to speak to a broker about the options available to them during these uncertain times and whilst the cost of living and mortgage rates continue to rise.

“There are many products out there to choose from including longer term fixed rates which provide security over your mortgage payments over the long run. Tracker products are also increasing in popularity as fixed rate products continue to rise.”

Emma Cox, managing director of Real Estate at Shawbrook:

“The current economic outlook has created an air of uncertainty in the housing sector. However, the ongoing supply pressures and newly announced stamp duty changes are likely to stabilise prices in the short-term.

“Rising interest rates and the ongoing cost of living crisis are making the housing market difficult to navigate. For many prospective buyers it is important to look to secure a competitive mortgage with a fixed rate – however this may remain a challenge in the current landscape.

“The market remains in desperate need of a steady stream of high quality, affordable, housing to restore some balance and help those struggling to purchase or rent a property. Looking ahead to 2023, it is widely expected that current economic conditions could lead to a cooling of house prices due to a lack of demand, which could create a window of opportunity for some buyers.”

Kate Davies, executive director, IMLA:

“Today’s data should reassure homeowners of the resilience of the housing market, with prices remaining high. Having said this, there are numerous predictions that point to a decrease in prices in the coming months.

“The current cost of living crisis, along with record petrol and energy prices, rising inflation and tax rises mean most households are wary of moving up the ladder, putting a dampener on the extreme house price growth seen in recent years.

“While there have been recent talks of a ‘crash’ in the media, there is certainly no need to panic – property is a long-term investment and prices have always risen after short-term falls.

“However, housing supply still remains a pertinent issue, and something that the new Government needs to set out a clear plan to address. Housebuilding is still well below the set figure of 300,000 a year that is needed to meet demand.

“The Government made it very clear that it had no intention of prolonging the Help to Buy scheme, which closes to new applicants at the end of this month, but the alternative schemes which have been developing to replace it cannot match the volume of demand.

“The added burdens and challenges on first-time buyers which have become evident over the past few months and weeks are going to require fresh Government thinking on how to help FTBs and how to kick-start new-build.”

Kay Westgarth, head of sales at Standard Life Home Finance:

“Today’s figures from the ONS suggest that the strong house price growth we have seen over the last few years has slowed down due to market uncertainty and interest rate increases.

“While this will no doubt worry some homeowners, housing equity could provide options that will prove a real support, particularly when over-55s on fixed incomes are more vulnerable to cost-of-living increases than some other age groups.

“Rather than struggling to make ends meet, people need to speak to advisers to explore their options and find out if equity release, downsizing or other later life lending options may be appropriate.”

Paresh Raja, CEO of Market Financial Solutions:

“Every house price index has taken on added intrigue of late. Everyone – from buyers and sellers to brokers and lenders – is watching to see how the market reacts to rising interest rates, high inflation and the prevailing economic and political uncertainty that has defined the start to Liz Truss’ Premiership.

“Throw in the Stamp Duty cuts, one of the few policies to survive from Kwasi Kwarteng’s ill-fated 38-day reign as Chancellor, and it makes predicting the direction of property prices very challenging.

“For now, as the ONS data shows, the sense is that demand will likely dip – the result of rising rates more than anything – but limited supply will ensure enough competition in the market to keep prices stable, if not growing.

“The Stamp Duty reductions, particularly for first-time buyers, should help keep the market buoyant; but unlike the Stamp Duty holiday of 2020/21, there is no deadline to this tax cut, so do not expect the same frenzied response of buyers rushing to benefit.

“Certainty is a rare but highly sought-after commodity right now. After several weeks of mortgages being pulled and some lenders no longer accepting new applications, borrowers and brokers are desperate to know what products they can access and at what price. Lenders that can act quickly, transparently and commit to deals from the outset will emerge from this challenging period with their reputations enhanced.

“And only with certainty and clarity from lenders can buyers act with confidence; so, the performance of lenders will be key to how the market performs in the months to come.”

CEO of Alliance Fund, Iain Crawford:

“Despite the government’s best efforts, we are yet to see house prices take a hit and the property market remains predictably resilient despite the turbulence of the wider economic landscape.

However, although Jeremy Hunt has pulled an almost complete three sixty manoeuvre where tax cuts are concerned, the irresponsible management of the UK economy in recent weeks will understandably unsettle the nation’s homebuyers.

Many are already facing a notable hike to the monthly cost of their mortgage and while the increasing cost of borrowing is now likely to plateau, we can expect to see some form of house price correction. That said, this will most probably come in the form of a reduction in the rate of growth rather than a downward spiral in values themselves.”

Marc von Grundherr, director of Benham and Reeves:

“If history has taught us anything, it’s that it will take far more than a bumbling bunch of buffoons mismanaging the economy from Westminster to topple the UK property market.

“House prices continue to climb and this will remain the case as long as the buyer demand balance remains tipped firmly in favour of home sellers.

“Mortgage rates also remain fairly favourable at present and so we simply won’t see a house price dip while this remains the case. However, the increasing cost of borrowing may curb the enthusiasm of homebuyers when it comes to their ferocity during the negotiations stage and so sellers may no longer see their property achieve above and beyond their asking price expectations, as has largely been the case during the pandemic.”

James Forrester, managing director of Barrows and Forrester:

“While the UK Government may be a laughing stock, the UK property market is far from it and continues to move forward at pace despite the chaos that has unfolded across the wider economy.

“A commitment to cutting stamp duty will certainly act as the cherry on the cake for many homebuyers, but it’s their continued ability to borrow in order to buy that will keep the cogs of the property market turning.

“As it stands, they remain more than able, with the majority of lenders still offering a great level of products at what remain favourable rates. With stability now returning to the gilt markets, we can expect the mortgage sector to level out after what has been a rough few weeks and this will ensure the market remains in good health over the coming months.”

Chris Hodgkinson, managing director of HBB Solutions:

“It’s not just the nation that is facing a tough few months ahead with potential energy blackouts, we expect to see the property market follow suit as a shambolic government performance leaves its mark where house price growth is concerned.

“While the market remains unfazed at present, it’s important to note that these figures are reported on a lag of a few months and there’s no doubt that the increasing cost of borrowing will have dampened buyer activity, which in turn will see house prices dip before the year is out.”

Jack Roberts, CEO of home moving platform SlothMove:

“Like an ageing rock group on their 10th farewell tour, the UK housing market’s best days are clearly behind it – yet its merchandise prices continue to shock.

“Annual property price growth of 13.6%, despite falling from last month, still looks completely at odds with the harsh realities Brits are facing, with their belts being tightened to new notches.

“There is a clear and large affordability gap confronting many first-time buyers in particular. They will be pleased that the cut to Stamp Duty was one of the few policies to survive the new chancellor’s butchering of the mini-Budget.

“Yet while early signs are that Jeremy Hunt’s actions may have helped to buttress the property market, ongoing cost-of-living pressures and the strong likelihood of more interest rate rises next month mean property prices may soon begin their descent.

“For the moment a shortage of supply is keeping prices high and the average UK property may still reach £300,000. Looking ahead to winter however, a homebuyer hibernation beckons.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“The slightly historic nature of these comprehensive figures demonstrates the strength in the housing market before it hit the buffers at the end of September.

“Since then, activity has slowed and prices have softened a little but there is still plenty of pent-up demand, not least to take advantage of favourable existing mortgage rates before they rise even higher.

“Fortunately most sellers are recognising the importance of negotiating bearing in mind rising inflation, which is making it particularly difficult for first-time buyers or those seeking larger loans.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“The uptick in inflation to 10.1% will do nothing to calm borrower concerns about rising interest rates.

“The reversal of many of the mini-Budget measures has stabilised base rate expectations although a 1% increase is still expected at next month’s Monetary Policy Committee meeting. However, the peak base forecasts of 6% have now been lowered to around 5.25%.

“While mortgage rates are expected to settle at lower levels, particularly short-term fixes, the ‘big six’ lenders will be wary about reducing pricing too far too soon in order to manage volumes.

“Even if these rates do edge downwards, there are still concerns about households coming off recent low fixes as borrowers will see a significant jump in monthly payments, just as the cost of living is soaring.”

Tomer Aboody, director of property lender MT Finance:

“As demand continues to exceed supply, we have seen another month of rising property values with annual growth in excess of 10%.

“As the market now slowly takes a turn with constantly fluctuating mortgage rates, slower growth or possible downwards movement is expected. However, this should be seen in perspective as even a 10% fall in prices, which some are predicting, would take us back to where we were a year ago.

“The new reality will be interesting once rates settle but further Government intervention with regards to Stamp Duty and whether downsizers should pay would help maintain market momentum.”

Anna Clare Harper of real estate investment platform, IMMO:

“House prices grew by 13.6% in the year to August, fuelled by shortage of supply and long-term growth in demand.

“This data is the most reliable of all house price indices since it reflects the whole of the market from official government figures. However, it’s also the slowest of the house price indices, and as we have seen, a lot can happen in a few short weeks.

“As a result of what has happened since in terms of interest rates and confidence, going forward, the pace of house price growth is likely to slow. This will be driven in particular by interest rate rises, affecting the circa two million property owners on, or soon to be on, variable or standard rates on their mortgages.

“However, the largest tenure of housing in the UK is owner-occupied homes owned outright, meaning interest rate rises cause no pressure to sell. That said, the cost-of-living crisis affects us all, and constrains purchasing power for homeowners and private investors alike.

“There is much talk of a house price crash. If the past is anything to go by, a correction in the pace of growth in the short to medium term is likely. However, we still have a severe shortage of quality, energy-efficient housing – both for sale and for rent. The fundamentals have not changed: we all still need a roof over our heads.

“There is an opportunity for professional investors to step in and re-capitalise the market, upgrade the quality and energy performance of existing housing, and benefitting the people and their communities who still need a place to call home.”

Joe Garner, managing director at London-based property developer, NewPlace:

“A house price crash is now a fait accompli. The only unknown is how hard and how fast the crash is. Only a few weeks ago, I was fairly confident the crash would be minimal, but then Liz Truss and Kwasi Kwarteng blew the mortgage, property and bond markets apart.

“We will now be lucky if we manage to get away with a 10% drop in prices. With inflation back in double digits, confidence among buyers has been shattered.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“Compared to August, the property market in October is in an alternate reality. The mini-Budget and chaos in the markets have blown the whole market apart. Confidence is in tatters. House prices could fall by up to 10% in the next six months, potentially more. The problem is cheap money, specifically the fact it no longer exists.

“With mortgage rates having shot up, the buying power and confidence people had just a few months ago no longer exists and prices can only go one way as a result, and that’s down. Prices will rebound as they always do, but it could take a few years for them to do so. It all depends on the length and depth of the recession that almost certainly lies ahead.

“For now, the immediate problem people are facing is the remortgage crunch. Speaking to a good mortgage broker to ensure you get the very best rate possible has never been more important. Though fixed rates are high, there are deals out that that are significantly lower than a lender’s standard variable rate.”

Aaron Forster, director of Derby-based mortgage broker, Create Finance:

“With mortgage rates soaring, and inflation back into double digits, house prices will now come under real pressure. The market generally slows down in the closing stages of the year anyway as people’s attention switches to Christmas but this year that could happen earlier than usual due to the sheer economic and interest rate uncertainty.

“As mortgages become unaffordable, especially for landlords, there will be an increase in properties on the market, which will will apply downward pressure on prices. We may even see a raft of forced sales next year, adding to that pressure.

“With the cost of living also sky high, mortgage increases will be the final nail in the coffin for many people. Even with tax cuts and the new stamp duty regime, the savings these amount to will be minimal compared to the frightening jump in mortgage costs. If it’s not already, it will become a buyers’ market very soon.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“There is unprecedented uncertainty right now. House prices are set to come under real pressure but the sizeable drops of 10%-15% that some are predicting are frankly unrealistic given the lack of supply.

“Prices are far more likely to flatline than go through the floor. If there’s one thing everyone can agree on, it’s that the age of dirt cheap money has been relegated to the dustbin of history.”

Rob Gill, managing director at mortgage broker Altura Mortgage Finance:

“If mortgage rates remain at current levels, there’s every chance of a buyers’ strike as people calculate that their mortgage payments at 6% are higher than they’re willing and able to pay. The current imbalance between supply and demand could then flip completely and a substantial correction in house prices could be on the cards.

“Our base case assumption is a sustained period of mortgage rates of 6% or higher will lead to a fall in property prices of 15%. For this reason alone, there’s every chance the government will continue doing everything possible to settle down financial markets to bring down mortgage rates. If sacking the Chancellor and cancelling the mini-Budget doesn’t prove enough, then more is sure to follow.”

Lewis Shaw, founder of Mansfield-based Shaw Financial Services:

“Unless there is significant intervention from both the Bank of England and the government, it’s a certainty that house prices will start to fall. With mortgage rates reaching new highs not seen for over a generation and signs they could move higher, the impact on buying power is stark. That can only translate into falling house prices.

“Even with the stamp duty cut, most first-time buyers were already exempt from that tax and are facing the highest rates. If first-time buyers can’t afford the mortgage payments, they won’t buy. Given that first-time buyers are the oil that keeps the machine turning, the property market begins to seize if they dry up.

“This all points to a change of direction from a seller’s to a buyer’s market. Add in the glut of buy-to-let properties about to hit the property portals as landlords decide the game is up, and you’ve got all the ingredients for a property crash.”

Samuel Mather-Holgate of Swindon-based advisory firm, Mather & Murray Financial:

“With the typical 2-year fixed rate mortgage now over 6%, it’s obvious this is going to have an effect on the property market. Many are now predicting house price declines of 10% next year, but this is a serious drop and unlikely given the lack of supply. We still have a massive shortage of houses in the UK and that will support prices.”

Mike Staton, director of Mansfield-based Staton Mortgages:

“This week, I drove past seven For Sale signs and only three of them were sold. This is worrying and could be seen as the first sign of a housing market crash. Hopefully we will not end up with one but it’s now starting to appear a very realistic possibility.

“This is especially the case when this week we saw one lender change applicants’ interest rates mid-way through their application, meaning that even the submission of an application isn’t protecting people from interest rate increases, even after they have paid reservation and product fees. With both of these factors in mind, it’s hard to see prices going anywhere but south, or staying flat at best.”

Gaurav Shukla, mortgage adviser at London-based broker, Home Me:

“Expect the Bank of England to continue to raise the base rate, potentially sharply, over the coming months and into 2023, with rates reaching their peak around the second or third quarters of next year.

“I expect house prices to drop over the coming year, with a much needed market correction. Demand will naturally decrease as only those who can afford mortgage payments at 6% interest rates will be able to proceed.”

Ian Hewett, founder of Ashford-based The Bearded Mortgage Broker:

“Despite all the madness of recent weeks I don’t think we will see a property market crash. The reason is simple: the sheer lack of supply. Yes, mortgage rates have increased dramatically, and energy bills have gone through the roof, so affordability is going to be a challenge.

“However, the extreme lack of stock will likely prevent a crash even if demand drops off sharply. Many first-time buyers will still want to get out of the rental market, where rents are skyrocketing.”

Paul Neal of Derbyshire-based Missing Element Mortgage Services:

“It’s utter carnage out there right now. The wheels are coming off the mortgage market, and the property market as a result. Lenders are still withdrawing products, leaving brokers unsure when they will actually open again. Without mortgages, the property market could go pop. Many of our clients are in a Mexican stand-off between pulling the trigger on a property transaction and fleeing the market altogether.”

Scott Taylor-Barr, financial adviser at Shropshire-based Carl Summers Financial Services:

“The UK housing market is vastly undersupplied and so a fall in prices can really only be triggered by a couple of things: someone building and then releasing a million homes onto the market all in one go, or lenders withdrawing mortgages meaning that only cash buyers, or those with really big deposits, can purchase.

“I’m not aware of anyone secretly building a million houses, but the second one is scarily looking like becoming a reality. The housing market is looking extremely vulnerable.”

James Miles, director of Exeter-based broker, The Mortgage Quarter:

“The pressure cooker is about to pop. We’re seeing borrowers strongly re-evaluate their lending options and demand will almost certainly start to weaken. If demand drops then prices, or at least the rate of price growth, will too.”

Michael O’Brien, managing director at Romford-based Home of Mortgages:

“The property market is not in the grave position it was back in 2008 yet. For now at least, first-time buyers can still purchase with a 5% deposit. There’s no doubt that the cost of borrowing is increasing, however, faced with the alternative, namely the ever-increasing cost of renting, a mortgage is still a more comfortable alternative. That will likely support prices as people will still want to exit the rental market wherever possible.”

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions:

“It’s hard to now envisage anything other than a significant downturn in prices. Early indications are that, with confidence severely dented by the chaotic events of the past week, many people will now choose to sit on their hands for the next six months or so and wait for things to settle down.

“There is no question that for some would-be buyers, in particular first-time buyers, the rise in the cost of the mortgages that remain, along with the associated affordability challenges, will prove too much of a hurdle.

“For those, however, with reasonable deposits and strong incomes, a likely drop in house prices and fall in competition from other buyers could in fact be the opportunity they have been waiting for. Those opting to view from the sidelines will also feel the pain, as the cost of renting is also likely to surge as demand in this sector will continue to far outstrip supply.”

Karen Noye, mortgage expert at Quilter:

“Headline figures for the UK house price index show that house prices saw another rise of 0.9%, on a non-seasonally adjusted basis, in August but growth is certainly now slowing. While the cost-of-living crisis was no doubt biting at that point and is reflected in the slowing growth, the turmoil and furore of the mini-Budget and then huge projected mortgage increases has yet to be priced in.

“Despite new Chancellor Jeremy Hunt axing almost all of Truss’ mini budget policies, one that has remained is the Stamp Duty cut. This may serve to help soften any dip in house prices as we enter a turbulent time for the UK property market. However, any stamp duty savings made are likely to quickly be swallowed up by the huge increases in mortgage payments people are already suffering, which will only get worse as the Bank of England rachets up its base rate.

“As people are squeezed by their mortgage payments, the cost of living the pressure may get too much for some and the only option might be to sell their home in a bid to downsize to realise cheaper monthly payments. If this happens up and down the country, at much the same time, then the flood of properties will naturally push prices down as the market has remained so buoyant over the last two years because of the severe lack of stock.

“This might spell good news for some who are struggling to get a foot on the ladder due to high house prices, but again affording mortgage rates around the 6% mark is no easy feat so first time buyers won’t be celebrating any time soon.

“If house prices do drop considerably those who have bought in the past year or so with a high loan to value mortgage may be at risk of suffering negative equity. In fact, our analysis of new Freedom of Information (FOI) data from the FCA shows that at least 80,000 borrowers who took out mortgages with a loan to value (LTV) of more than 90% last year, could go into negative equity if house prices drop more than 20%.

“Negative equity drastically reduces your options and can leave people stuck in their homes with no other refinancing options. With the housing market and the economy as a whole looking precarious at the moment, taking out a high loan to value mortgage deal doesn’t leave the buyer much equity to play with and ultimately could leave them worse off in the long run.”