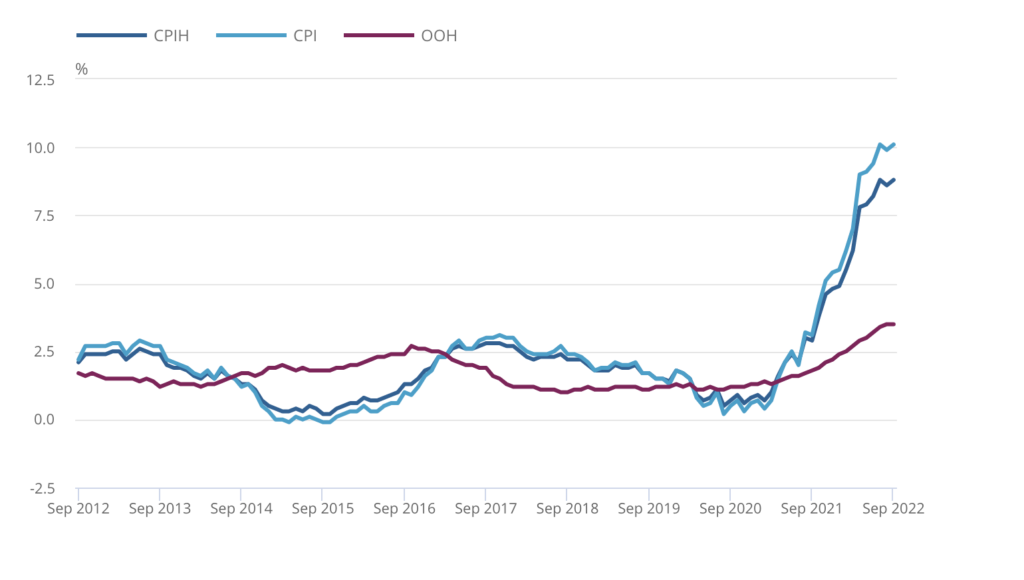

After slowing down last month inflation once more moved into double digits hitting 10.1% in September, according to the Office for National Statistics (ONS).

This marks the highest level of inflation in 40 years. The figures from September are usually used by Government to work out the increase in state pensions.

However, yesterday the Government refused to confirm that it would maintain the pension triple lock.

The triple lock commits to the state pension increase each year in line with whichever of the following, inflation, the average wage increase or 2.5%, is higher.

The Resolution Foundation said increasing pensions by the rate of the average wage increase (5.4%), as opposed to inflation, could save the Government £6bn.

Rising food prices made the largest upward contribution to the change in inflation rates between August and September 2022.

There were also increases from hotel overnight stays, and from furniture and household goods.

While the continued fall in the price of motor fuels made the largest, partially offsetting, downward contribution to the change in the rates.

Paul McGerrigan, CEO at fintech broker Loan.co.uk, said: “As the soap opera in numbers 10 and 11 Downing Street unfolds, the publication of September’s inflation figures is a sobering reminder of the breadth of challenge the UK faces.

“High energy bills driven by the war in Ukraine continue to be the main contributor to remarkable inflation conditions. While the government’s initiatives to control the cost of energy until April 2023 will restrict further large increases, the retreat to more normal levels (remember the Bank of England’s 2% target) still looks a distant dream.

“The mortgage mayhem of the last fortnight, driven by the mini-Budget debacle, coupled with a potentially record-breaking interest rate rise from the MPC on the third of November, will put significant pressure on the CPIH (Inflation including Housing Costs), with increases inevitable in the coming months.

“This will impact millions of households. Borrowers need to assess their position continually and act where needed. The role of mortgage brokers and financial advisers is more important than ever.”

Simon Webb, managing director of capital markets and finance at LiveMore, added: “The slight drop in inflation last month has been reversed with September’s double digit print and inflation remaining at a 40-year high.

“One of the main reasons for high inflation is the surge in energy prices since the Russian invasion of Ukraine in February this year.

“Government efforts to help curb energy bills with an Energy Price Cap of £2,500 for the next two years no longer stands as the new Chancellor Jeremy Hunt is only guaranteeing the cap until next April.

“If Government support for energy bills disappears, it is likely to result in higher inflation as well as negatively impacting on many people’s finances and living standards through 2023.”

Richard Pike, chief sales and marketing officer at Phoebus Software, added: “The rise in inflation announced this morning, albeit small, reflects the continuing rise in energy prices and basics in the supermarket. Given that the war in Ukraine continues to rumble on, we are to an extent being held to ransom and rising prices are as such inevitable.

“The next meeting of the MPC on the 3rd will no doubt end in another increase in interest rates. The question is how high can the Bank of England go? Mortgage rates are at the highest many have ever seen, which has to affect the first-time buyer market more than any other.

“Historically, benefit levels have been driven using the figures in September, it will be interesting to see if this policy is used when benefits are set for next April. Given the recent fiscal U-turns, the current level of borrowing and the ‘return to austerity’ it is questionable that benefits will be tied rigidly to the current rate of inflation. It is most definitely a fine line that the new Chancellor will be walking in the coming months.”