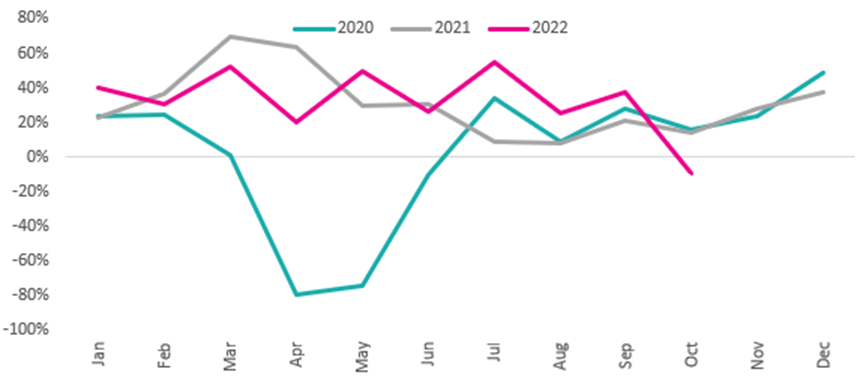

Prime London property sales held firm during October some 11.6% higher than last year and 12.1% higher than the pre-pandemic average, according to the latest data from LonRes, but it wasn’t all good news for the capital.

LonRes found that fall throughs are now 80% higher than their pre-pandemic average (2017-19).

While under offers, a leading indicator for sales activity, fell sharply in October (-20.3% compared to last year). This was the first time the under offer data had been below its 2017-19 average since June 2020.

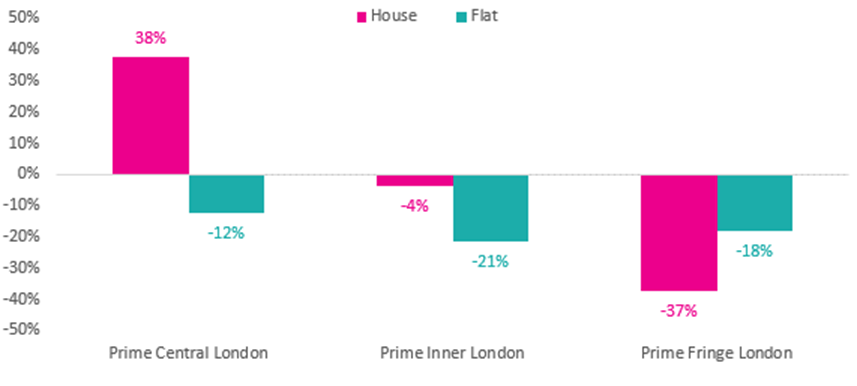

Under offers have fallen most in the more mortgage dependent Prime Fringe area: houses down 37% and flats down 18%.

Under offers for flats are down across all sub-markets, but houses in Prime Central London saw a 38% increase.

But despite cautious buyers, average achieved prices per square foot still rose, though just 0.8% compared to last year.

The rental squeeze continues with average rents across Prime London at a record high. In Prime Inner London rents are now 15% higher than their pre-pandemic level while those in Prime Fringe London are 9% higher.

Anthony Payne, managing director, LonRes, said: “The fall out from September’s mini-Budget continued to impact the Prime London housing markets as we headed into October.

“Although prices rose slightly (very slightly!), price reductions were up and more properties came to the market.

“However it is the fall in the number of properties going under offer that is the stand-out metric of the month.

“Buyers and sellers are clearly cautious about what happens next and putting their moves on hold – at least for a while.

“Meanwhile October saw prime London rents reach a new high. It’s a familiar story, with strong demand and a severe shortage of stock, driving rents upwards.

“However, anecdotally we are hearing that a number of letting agents are starting to see a slight uplift in stock coming to the market which may ease price growth in the months ahead.”