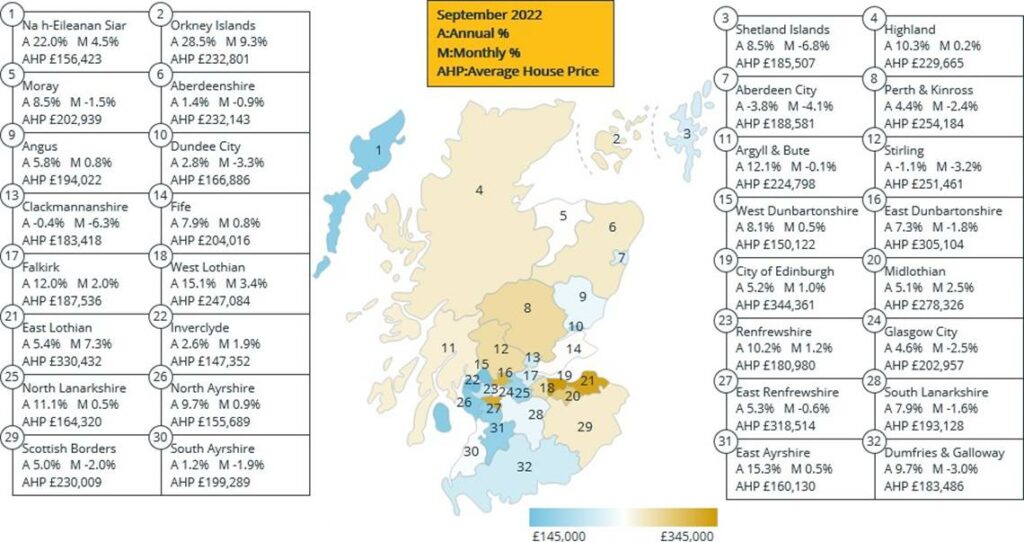

Scotland’s average house price fell for the second month in a row in September but prices are still up in 29 Local Authorities over the year, according to the latest data from Walker Fraser Steele.

East Ayrshire has the highest rate of annual growth on the mainland at 15.3% while 16 Local Authorities have seen rising prices in the month.

However, sales volumes are now down 6% on pre-Covid levels.

| Month | Year | House Price | Index | Monthly Change % | Annual Change % |

| September | 2021 | £210,265 | 275.4 | 0.8 | 12.8 |

| October | 2021 | £210,467 | 275.6 | 0.1 | 11.2 |

| November | 2021 | £210,552 | 275.8 | 0.0 | 8.7 |

| December | 2021 | £210,700 | 276.0 | 0.1 | 6.9 |

| January | 2022 | £212,970 | 278.9 | 1.1 | 7.4 |

| February | 2022 | £214,508 | 280.9 | 0.7 | 7.4 |

| March | 2022 | £217,585 | 285.0 | 1.4 | 6.4 |

| April | 2022 | £218,807 | 286.6 | 0.6 | 7.6 |

| May | 2022 | £221,327 | 289.9 | 1.2 | 8.4 |

| June | 2022 | £222,242 | 291.1 | 0.4 | 10.4 |

| July | 2022 | £224,247 | 293.7 | 0.9 | 9.1 |

| August | 2022 | £224,089 | 293.5 | -0.1 | 7.5 |

| September | 2022 | £223,604 | 292.9 | -0.2 | 6.3 |

Scott Jack, regional development director at Walker Fraser Steele, said: “As the principal drivers underpinning much of the house price growth in the Scottish house market over the last couple of years (the pandemic, record low interest rates and the fiscal stimulus of the Stamp Duty holiday) become a distant memory, it’s no surprise that the housing market reflects this.

“This is not only happening here in Scotland but is reflected across the broader UK housing market.

“The average price paid for a house in Scotland in September 2022 was £223,604 which represents a reduction of£485, or -0.2%, from the price seen in August. It is the second fall in a row for Scotland’s monthly average house price, but this follows 13 months of successive gains.

“If we take stock for a minute of the longer-term performance, we can see that while the average price has fallen in the month, it remains some £13,300, or 6.3%, higher on an annual basis than it was 12 months earlier.

“Clearly, we should not be surprised if this annual rate of price growth slows for the reasons I have outlined.

“But things to keep an eye on include the budget this week, the expectation that inflation is easing, and that mortgage rates and affordability will improve in the first quarter of next year, and the lack of supply that has always supported higher prices.

“These may all mean this reduction in house prices is less short-lived than many suspect.”