House prices saw the first monthly decline since July 2021 in October falling 0.9% from September, according to the latest house price figures from Nationwide.

On an annual basis house prices are still up 7.2%, albeit down from 9.5% registered in September.

That leaves the average price of a home in the UK standing at £268,282, down from £272,259 a month earlier.

Robert Gardner, Nationwide’s chief economist, said: “October saw a sharp slowdown in annual house price growth, to 7.2% from 9.5% in September. Prices fell by 0.9% month-on-month, after taking account of seasonal effects, the first such fall since July 2021 and the largest since June 2020.

“The market has undoubtedly been impacted by the turmoil following the mini-Budget, which led to a sharp rise in market interest rates. Higher borrowing costs have added to stretched housing affordability at a time when household finances are already under pressure from high inflation.

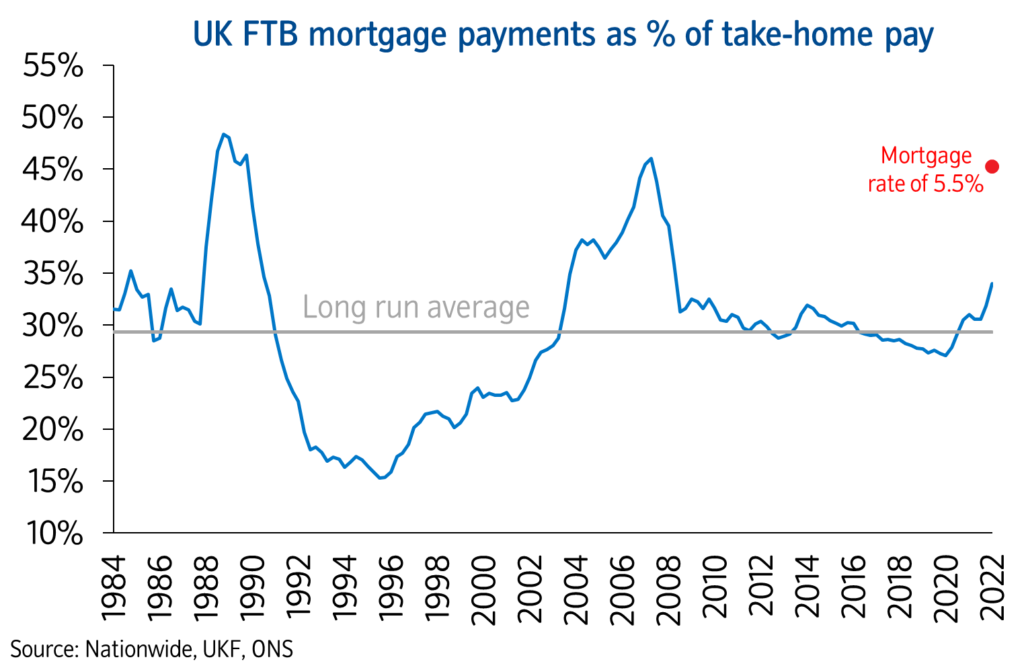

“For example, the increase in mortgage rates meant that a prospective first-time buyer (FTB) earning the average wage and looking to buy a typical FTB home with a 20% deposit would see their monthly mortgage payment rise from c.34% of take-home pay to c.45%, based on an average mortgage rate of 5.5%. This is similar to the ratio prevailing before the financial crisis.

“The market looks set to slow in the coming quarters. Inflation will remain high for some time yet and Bank Rate is likely to rise further as the Bank of England seeks to ensure demand in the economy slows to relieve domestic price pressures.

“The outlook is extremely uncertain, and much will depend on how the broader economy performs, but a relatively soft landing is still possible. Longer term borrowing costs have fallen back in recent weeks and may moderate further if investor sentiment continues to recover. Given the weak growth outlook, labour market conditions are likely to soften, but they are starting from a robust position, with unemployment at near 50-year lows.

“Moreover, household balance sheets appear in relatively good shape with significant protection from higher borrowing costs, at least for a period, with over 85% of mortgage balances on fixed interest rates. Stretched housing affordability is also a reflection of underlying supply constraints, which should provide some support for prices.

Energy costs update

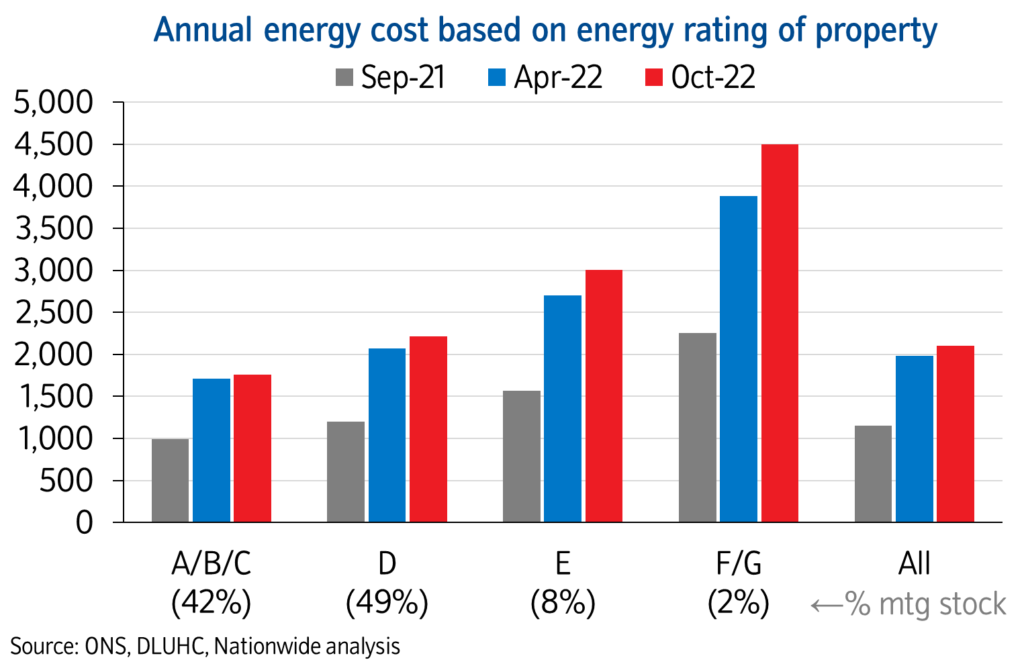

“The government’s ‘Energy Price Guarantee’ means a typical UK household will now pay an average of £2,500 a year on their energy costs until next April. This is c.£1,000 a year below Ofgem’s previously announced price cap, that was due to take effect from 1 October and will help shield households from the soaring cost of energy on wholesale markets.

“Despite this intervention, energy costs are still going to be around 80% higher than a year ago, even after taking account of the £400 energy support scheme discount. It is important to note that the cap is on the unit price charged to consumers, rather than a maximum bill a household can be charged. Running costs for less energy efficient properties tend to be considerably higher, leaving these households particularly vulnerable to price rises.

“Average energy costs for the most energy efficient properties (those rated A-C as reported on energy performance certificates) are expected to rise to c.£1,800 per year, compared with around £1,000 a year ago.

“Typical bills for D-rated properties (the most common type) are set to rise to £2,600 a year. Those in E-rated properties will be paying around £120 a month more than last winter. However, those living in the least efficient properties (rated F-G) will see average bills rise to c.£4,500, an extra £185 a month compared with a year ago, though these properties make up a small proportion (c.2%) of the stock of housing with a mortgage.

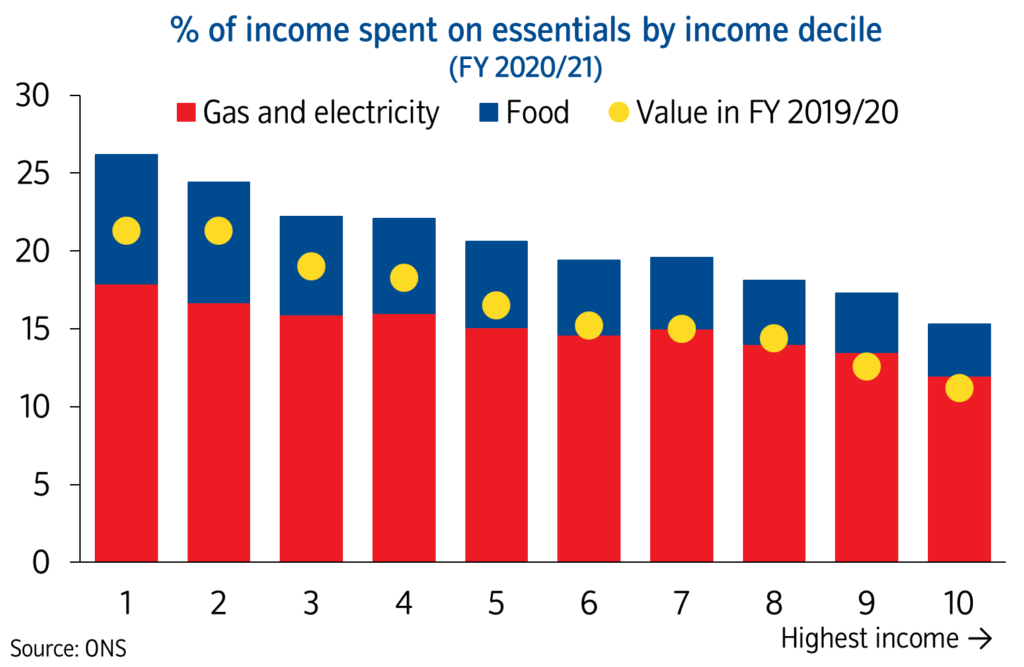

“The cost-of-living crisis is set to disproportionately affect lower income households as they spend a higher proportion of their income on essentials (food, gas and electricity). Lower income households are also much less likely to have accumulated savings, so they will find it more difficult to cover the increase in these costs.

“Further, following the recent announcement that the blanket guarantee has been scaled back to last for six months (compared with two years previously), there is additional uncertainty about what will happen thereafter if global energy prices remain high.”

Reaction

Sofia Jones, Managing Director at London-based independent mortgage broker, Penny House:

“Few will be surprised at the sharp slowdown in annual price growth in October. Over the past five to six weeks, since the now infamous mini-Budget, demand from buyers understandably dropped off a cliff as mortgage rates shot up and political turmoil rose to Alpine heights.

“Where we were active in October was with requests to remortgage as people sought to protect themselves as best they can.

“We’re predicting a busier November and December as buyers who held off in October amid the chaos decide to move forward with their purchases, as they see lenders reducing their fixed rate deals across the board.

“Let’s hope the Nationwide are right in that a soft landing is still possible. The lack of supply and strong jobs market may well serve to support that.”

Emma Cox, MD of Real Estate at Shawbrook:

“Although prices remain high and the current economic uncertainty continues to make the housing market tricky to navigate, rising mortgage rates are likely to contribute to a cooling of house price growth in the coming months.

“Factors such as supply pressures and the recent cut to Stamp Duty are also likely to contribute to some stability across the property landscape. Though the stamp duty changes will be welcome news to prospective buyers, further Government support would be welcomed; and the market is still in urgent need of an influx of more affordable, quality housing to meet demand and restore some form of balance to the market.

“Buyers will have to shop around and really consider their options in order to secure the right mortgage for them in the current climate. However, some potential buyers may hold off in the short-term to see if a cooling does come into effect.”

Iain Crawford, CEO of Alliance Fund:

“The property market is still standing firm, but we’re now seeing concrete signs that the marathon period of double-digit price hikes spurred by the pandemic are coming to an end.

“While this certainly doesn’t signal that a market collapse is on the horizon, the latest mortgage approval data From the Bank of England also shows that buyer appetites eased in September.

“However, it remains unclear as to whether we’re witnessing a notable reduction in buyer demand, or the temporary impact of an unsettled mortgage sector following the government’s shambolic mini-budget.

“While the latter is more likely, it will be a few months yet before we know if we’re in the midst of a property sector slump, or simply a seasonal market slowdown.”

Marc von Grundherr, director of Benham and Reeves:

“Any market slowdown is likely to strike fear into the hearts of the nation’s homeowners, but a reduction in the rate of house price growth should be largely welcomed.

“The monumental levels of house price appreciation seen throughout the pandemic market boom just simply aren’t sustainable and it’s far better the market steadily returns to normality, rather than crashing back down to earth with a bump.

James Forrester, managing director of Barrows and Forrester:

“Despite the panic of recent weeks, we’re simply seeing no let up from buyers on the ground and there remains a far greater appetite for homeownership than the available housing stock to satisfy it.

“While this remains the case, any fears of a property market crash can be firmly put to bed and we expect to see house prices continue to increase on an annual basis throughout the remainder of the year, albeit at a more measured pace, as has already been the case in recent months.”

Chris Hodgkinson, managing director of HBB Solutions:

“All current signs point to a housing market running dangerously low on steam, with buyer demand starting to fade, while dangerously over-inflated house prices can no longer maintain the trajectory of the last two years.

“With many buyers also being hit by increasing mortgage costs, we can expect a turbulent few months ahead, as sellers struggle to achieve their desired asking price, leading to a raft of sales falling through.”

Jonathan Samuels, CEO of Octane Capital:

“We’re now starting to see the level of buyers entering the market return to pre-pandemic levels and this drop in demand will inevitably impact the level of house price growth being seen across the UK market.

“At the same time, the average cost of repaying a mortgage is now at its highest in over a decade and this will also impact house prices, with prospective buyers no longer able to stretch to the same house price heights seen over the last two years.

“As a result, the housing market will start to cool as we approach the end of the year, but it’s unlikely we will see a property market crash, rather a softening of the curve.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“House prices continue to rise year-on-year but at a slower pace as higher mortgage costs, along with the rising cost of living, have an impact on affordability.

“Swap rates have calmed since the furore of the fallout of the mini Budget, with two-year money easing by more than 100 basis points over the past month. Some fixed-rate mortgage pricing has dropped accordingly over the past few days, with Barclays, HSBC and Santander, among others, reducing their rates.

“With a 75 basis points base rate rise forecast later this week, borrowers will be wondering whether prices of new mortgages will edge up again. However, while base rate may not peak at 3%, rates may not need to go much higher now that Rishi Sunak has brought some stability.

“Borrowers have been opting for tracker or variable mortgages over the past month, with medium and long-term fixes already falling and expected to fall further.”

James Briggs, head of personal finance intermediary sales at specialist lender Together:

“After 14 consecutive months of rises, house prices finally fell to 7.2% in October.

“This decrease, while welcome news for hopeful first-time buyers still doesn’t address the issue of affordability for new homes along with the bigger challenge of how homeowners keep on top of mortgage repayments.

“As we face yet more uncertainty with another new government taking office, all eyes will be firmly focused on the Chancellor’s Budget later this month. There will be expectations of further cost relief to help alleviate pressures in the face of a potential recession. Should this come to pass, we could see a final flurry of activity in the property market before the year is out.”

Nicky Stevenson, managing director at national estate agent group Fine & Country:

“Buyer demand cooled in October as the mini-Budget caused elevated volatility in the mortgage market and a threat to stability in the broader economy.

“Transaction levels are likely to continue easing in the near term as the housing market adjusts to this new era of higher interest rates.

“With household budgets squeezed like never before, buyers must balance their long-term ambitions against their immediate outgoings.

“Consequently, we now expect to see the housing market normalise back to more sustainable averages in the months ahead.”

Ross Boyd, founder of the always-on mortgage comparison platform, Dashly.com:

“To say the outlook is uncertain is an understatement. With inflation where it is, and mortgage rates on a different plane to where they were just six months ago, 2023 could be like 2008 all over again for the property market. Another rate rise to control inflation could further reduce demand for property, putting prices under real pressure.

“Those people who are currently locked into some of the lowest mortgage rates ever will be in for a profound shock when they come to remortgage, as they are already under pressure due to the cost of living crisis and soaring energy bills. The short-term outlook for the property market may be savage but, as ever with bricks and mortar, at some point things will bounce back.”

Riz Malik, director of Southend-on-Sea-based R3 Mortgages:

“There is more chance of King Charles writing the foreword to Prince Harry’s new book than there is the property market seeing significant house price growth over the next six months.

“For activity to pick up in the housing market, confidence and some form of stability need to return and both are sorely lacking. The past six weeks or so have blown confidence to smithereens.

“A lot of people will be sitting on their hands and waiting to see what happens when the Bank of England meets this week.”

Aaron Forster, director of Derby-based mortgage broker, Create Finance:

“This October house price index is a lesson in how political decision making can hit the property market. The market generally slows down in the closing stages of the year anyway as people’s attention switches to Christmas but this year that could happen earlier than usual due to the level of mortgage rates and the depth of economic and political uncertainty.

“As mortgages become unaffordable, especially for landlords, there will be an increase in properties on the market, which will apply downward pressure on prices. We may even see a raft of forced sales next year, adding to that pressure.

“With the cost of living also sky high, increased mortgage payments will put unprecedented pressure on people’s finances and that will ripple through to the property market.”

Rob Peters, director of Altrincham-based Simple Fast Mortgage:

“That was a bleak October for the property market. Expect values to continue to fall during the close stages of the year. The timing of market volatility and interest rate rises has culminated perfectly at what is traditionally the quietest part of the property calendar. Early 2023 will certainly see property values in some areas fall, but by how much or how long nobody knows.

“Adding fuel to the fire, the Bank of England is expected to increase interest rates further when it meets this week. However the impact on mortgages rates is expected to be minimal given most lenders have already priced in far more than their fair share.”

Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com:

“October 2022 will go down as the month the property market became a buyer’s market. However, due to the time lag between transactions being agreed and the Land Registry reporting completed sales, the true extent of house price falls, for several months yet, will be masked by declining year-on-year property price growth.

“Early next year is when it will become obvious the market has turned and house prices are actually falling sharply. A drop of 20% or more over the next 18 months is quite possible.”

Michael O’Brien, managing director at Romford-based Home of Mortgages:

“The property market, though under pressure as this data shows very clearly, is still not in the grave position it was back in 2008 yet. There’s no doubt that the cost of borrowing is increasing, however, faced with the alternative, namely the ever-increasing cost of renting, a mortgage is still a more comfortable alternative. That will likely support prices as people will still want to exit the rental market wherever possible.”

James Miles, director of Exeter-based broker, The Mortgage Quarter:

“The property market pressure cooker is about to pop. We’re seeing borrowers strongly re-evaluate their lending options and demand will almost certainly continue to weaken as people wait and see what happens next. If demand drops then prices, or at least the rate of price growth, will too.”

Imran Hussain, director at Nottingham-based Harmony Financial Services:

“Demand for mortgages slowed down in October due to the extreme market volatility caused by Trussonomics.

We could well see a drop in house prices across certain regions until stability returns and there is more clarity on mortgage rates, but the fall unlikely to be extreme due to the lack of stock on the market.”

Andrew Montlake, managing director of the UK-wide mortgage broker, Coreco:

“The impact of the mini-Budget on the property market is clear for all to see in this latest Nationwide house price index. The property market was hit for six as mortgage rates soared and many people put their buying plans on hold due to the extreme political uncertainty.

“House prices are set to come under further pressure during the winter months, but the sizeable drops of 10%-15% that some are predicting are frankly implausible given the sheer lack of supply and the fact that the jobs market is still strong.”

Tomer Aboody, director of property lender MT Finance:

“Given recent political uncertainty, combined with interest rate fluctuations, it is no surprise that there is a slowdown in the housing market, as buyers and sellers are unsure whether to proceed.

“Rising cost of living and higher interest rates translate into less money in people’s pockets and therefore a different approach, until these higher costs become the norm.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“These figures are interesting as they already show a sharp fall even before the shock of the mini-Budget hit the market. On the ground, new buyer enquiries almost dried up as uncertainty about the future direction of mortgage repayments added to cost-of-living concerns.

“Activity has slowly started to resume since as mortgage rates began to stabilise and are now starting to fall. Buyers are negotiating hard as they strive to take advantage of good mortgage offers while prices continue to be supported by lack of stock.”

Jack Roberts, CEO of home moving platform SlothMove:

“After months of sky-high annual growth the ripcord has been pulled on this housing market. The question remains whether it’s wearing a parachute or a rucksack

“The largest monthly fall in prices in over two years speaks to the turbulence brought by the mini-Budget. With mortgages seeing their biggest hike in decades, buyer interest is falling quickly and more property deals are falling through as those in chains increasingly get cold feet.

“Figures showing that housing affordability for first-time buyers is now around 2007 levels are only likely to add to the chilly mood.

“With interest rates set to rise higher on Thursday and a sobering tax and spending plan on the way, there are plenty of reasons to suggest a managed descent in housing prices may not be on the cards.

“Much hope will rest on the undoubted strength of the labour market and underlying supply constraints to cushion the blow.”