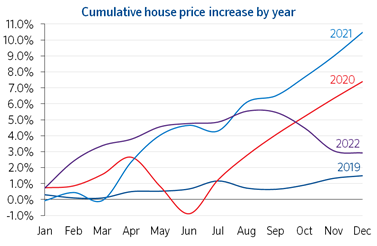

House prices declined for the fourth consecutive month in December with the rate of annual house price growth dropping to 2.8%, according to Nationwide’s latest house price index.

The UK’s largest building society’s data shows that all regions of the country have recorded a slowdown in annual price growth in the final quarter of the year.

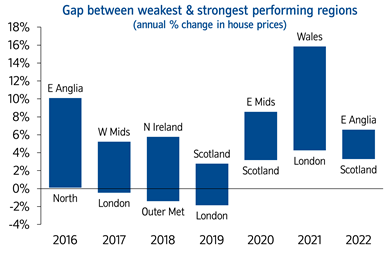

Overall the average price of a home in the UK stood at £265,195 with East Anglia topping the charts as the strongest performing region in 2022, and Scotland coming in as the weakest.

It comes as the gap between the weakest and strongest regions is the smallest since Society’s regional indices began in 1974.

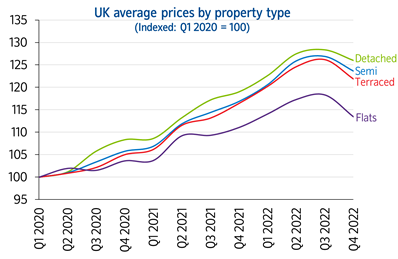

Elsewhere the data also revealed that since Q1 2020, price growth in detached properties was around double that of flats.

Robert Gardner, Nationwide’s chief economist, said: “December saw a further sharp slowdown in annual house price growth to 2.8%, from 4.4% in November. Prices fell by 0.1% month-on-month – a much smaller decline than in the previous couple of months.

“However, December also marked the fourth consecutive monthly price fall – the worst run since 2008, which left prices 2.5% lower than their August peak (after taking account of seasonal effects).

“While financial market conditions have settled, mortgage rates are taking longer to normalise and activity in the housing market has shown few signs of recovery.

“It will be hard for the market to regain much momentum in the near term as economic headwinds strengthen, with real earnings set to fall further and the labour market widely projected to weaken as the economy shrinks.

Can we achieve a soft landing in 2023?

“The recent weakness in mortgage applications may, in part, represent an early seasonal slowdown. With the chaotic backdrop and elevated mortgage rates in recent months, it wouldn’t be surprising if potential buyers have opted to wait until the New Year to see how mortgage rates evolve before deciding to step into the market.

“Longer-term interest rates, which underpin mortgage pricing, have returned towards the levels prevailing before the mini-Budget. If sustained, this should feed through to mortgage rates and help improve the affordability position for potential buyers, as will solid rates of income growth (with wage growth currently running at a c.7% pace in the private sector), especially if combined with weak or negative house price growth.

“But the main factor that would help achieve a relatively soft landing (especially for house prices) is if forced selling can be avoided, and there are good reasons to be optimistic on that front. Most forecasters expect the unemployment rate to rise towards 5% in the years ahead – a significant increase, but this would still be low by historic standards.

“Moreover, household balance sheets remain in good shape with significant protection from higher borrowing costs, at least for a period, with around 85% of mortgage balances on fixed interest rates. Affordability testing has been central to mortgage lending since the financial crisis and typically stress tested at an interest rate above those prevailing at the moment. This means that, while it will be difficult, the vast majority of those refinancing should be able to cope.

“The fact that the housing market remained buoyant in the first three quarters of 2022, despite weak consumer confidence on the back of a stagnant economy, falling real incomes and a near tripling of mortgage rates, provides some reassurance that there will be a pickup in activity in the New Year, although it is likely to remain tepid until the broader economic outlook improves.

“Similarly, while house prices are likely to see a modest decline in 2023 (perhaps of c.5%), a significant deterioration in the labour market or more elevated mortgage rates would probably be required to generate the double-digit declines suggested by some forecasters. While the risks are skewed in that direction, it doesn’t appear to be the most likely outcome.

House price growth slowed in all UK regions

“Our regional house price indices are produced quarterly with data for Q4 (the three months to December) showing a marked slowdown in annual house price growth in all regions (see full table further below).

“This was most pronounced in the South West, the strongest performing region last quarter, which saw annual house price growth slow from 12.5% to 4.3%. East Anglia was the strongest performing region over the year, with average prices increasing by 6.6%. Meanwhile, Scotland was the weakest performing region, with annual growth of 3.3%.

“Wales saw a significant slowdown in growth in the final quarter of 2022, with annual growth slowing from 12.1% in Q3 to 4.5% in Q4. Northern Ireland saw prices increase by 5.5% during 2022, much weaker than the 12.1% rise recorded in 2021.

“England saw a further slowing in annual house price growth to 4.8%, from 9.9% in Q3. While East Anglia was the strongest performing region, southern England continued to see weaker growth overall than northern England.

“Within northern England (which comprises North, North West, Yorkshire & The Humber, East Midlands and West Midlands), the West Midlands was the strongest performing region with prices increasing by 6.1% over the year.

“London remained the weakest performing English region, with annual price growth slowing to 4.1%, from 6.7% in Q3. The surrounding Outer Metropolitan and Outer South East regions saw very similar annual growth in 2022, with prices increasing by 4.2% and 4.3% respectively.

“Recent quarters have seen significant narrowing in the gap between the weakest and strongest performing regions in terms of annual growth, with Q4 2022 seeing the smallest difference – 3.3 percentage points (pp) – in the history of our regional indices, which stretch back to 1974. The largest gap recorded was back in Q1 1989 when annual house price growth in the strongest region (East Midlands at 54.4%) was 53.3pp higher than the weakest (Northern Ireland at 1.1%).

“As shown on the chart below, last year the gap between the best performing region (Wales) and worst performing region (London) was 11.6pp, whilst this year it was just 3.3pp (between East Anglia and Scotland).

“While recent years have seen relatively weak house price growth in London, looking back since the turn of the century it remains the top performing region, with average house prices having increased by 304% since 2000 (by comparison UK average earnings have increased by around 85% over the same period). It has also been the strongest performing region in six out of the last 23 years.

“Meanwhile, the weakest performing region over the same period has been Northern Ireland, which has finished bottom seven times. Nonetheless, average house prices there have still risen by 185% since 2000.

Flats continued to see slower price growth

“While the shifts in housing preferences as a result of the pandemic are now fading, we have continued to see differences in price trends between property types. Detached properties have performed most strongly since the onset of the pandemic, whilst flats have been the weakest.

“Between Q1 2020 and Q4 2022, the average price of a detached property increased by 26.0% (nearly £78,000 in cash terms). Meanwhile, over the same period, flats only increased by 13.4% (around £23,000). The chart below illustrates how the prices of different property types have evolved in recent years.

“Annual house price growth slowed markedly across all property types in the final quarter of 2022 but detached were the strongest performing over the year as a whole, with average prices up 5.9%. Meanwhile, the average price of flats increased by just 2.1%.”

Quarterly Regional House Price Statistics (Q4 2022)

Please note that these figures are for the three months to December, therefore will show a different UK average price and annual percentage change to our monthly house price statistics.

Regions over the past 12 months

| Region | Average Price(Q4 2022) | Annual % change this quarter | Annual % change last quarter |

| East Anglia | £285,776 | 6.6% | 11.2% |

| West Midlands | £240,975 | 6.1% | 12.0% |

| North West | £208,600 | 6.0% | 11.3% |

| North | £156,892 | 5.9% | 8.1% |

| N Ireland | £176,637 | 5.5% | 10.1% |

| East Midlands | £233,459 | 5.3% | 12.3% |

| Yorks & H | £199,615 | 4.6% | 11.0% |

| Wales | £205,666 | 4.5% | 12.1% |

| South West | £307,588 | 4.3% | 12.5% |

| Outer S East | £344,027 | 4.3% | 10.4% |

| Outer Met | £428,201 | 4.2% | 8.3% |

| London | £528,000 | 4.1% | 6.7% |

| Scotland | £178,269 | 3.3% | 7.8% |

| UK | £265,195 | 4.8% | 10.3% |

Reaction

Nathan Emerson, chief executive of Propertymark:

“As the average house price continues to fall, a gradual shift back to a more realistic and sustainable market is emerging which we would expect to continue into 2023.

“Our latest data provided to us by our member agents shows that 72% of sales agreed were secured below the asking price in November. This is because competition has dropped by over a third, from a high of 11 new buyers to every new property instructed.

“The sales market is firmly back in the hands of buyers who have been on the back foot for 18 months, so it remains a good time to buy. We would expect to continue to see people keeping a close eye on trends and being more sensible when purchasing compared to what was seen previously seen.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“As expected at this time of year, activity in the housing market has slowed with average prices falling month-on-month, although by a smaller amount than in November. Higher mortgage costs, along with the rising cost of living, are having an inevitable impact on affordability.

“The swap rate volatility sparked by the the mini-Budget has largely dissipated and mortgage rates have settled on the back of this. Lenders continue to chip away at the pricing of their fixed-rate mortgages but even so, there are still many people coming off fixes who are in for a payment shock. We expect lenders to come to market with more attractive pricing in January as they start from scratch in terms of building their business for the new year.

“Further interest rate rises are on the cards in the coming year as the Bank of England continues in its efforts to bring inflation under control. However, a lower peak in rates than previously thought may be sufficient, making life easier for borrowers.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“The drop in house prices is not surprising considering the sharp rise in the cost of living and especially interest rates. Prices may soften further as concerns about job security increase and uncertainty will remain until mortgage payments are seen to stabilise.

“However, the housing market continues to be supported by strong employment, lack of stock and lender forbearance, which are reducing the risk of mortgage defaults and preventing a larger fall in house prices.”

Gary Bush of the Potters Bar-based MortgageShop.com:

“The continued decline in annual price growth in December was always on the cards as the fall-out from the mini-Budget continued. Property prices in 2023 are almost certainly set to undergo a correction after the crazy highs of the past two years and the strength of the economic headwinds.

“However, if fixed-rate mortgages keep reducing, as they currently are, then with the shortage of decent available properties across the UK and a strong jobs market we may get away with a temporary rather than a long-term reduction in house prices. 2023 is set to be turbulent but may not see the dramatic falls many are predicting.”

Zaid Patel, director at London-based estate agents, Highcastle Estates:

“December was always going to be a write-off, with the World Cup adding to the usual seasonal drop-off in demand and the soaring cost of living crisis. January will see cash- and mortgage-ready buyers carefully analysing the market, pouncing on any good deals, which will prevent the housing market from crashing.”

Kylie-Ann Gatecliffe, director at Selby-based broker, KAG Financial:

“Call me an optimist, but I don’t think 2023 is going to be all the doom and gloom that many are predicting. Even if there is a 10% drop in house prices, official data shows that, over the year to August, we saw an increase of 13.6%. There will be less of a housing crash and more of a correction to pre-pandemic prices.

“As busy as the past two years have been with property sales, it has been tremendously difficult for first-time buyers to get onto the ladder, with many being outbid or simply being priced out of an area. 2023 could be their year.

“When it comes to selling and buying the reduction is usually seen on both sides, so any drop in prices often negates itself. Lenders are still reducing mortgage rates and I believe these will stabilise into next year.”

Lewis Shaw, founder of Teesside-based mortgage broker, Riverside Mortgages:

“Unsurprisingly, the Nationwide house price index showed what everybody already knows: December was as dead as the Conservative party come the next election.

“Consumer sentiment dropped off a cliff, positive economic news was harder to find than Lord Lucan, and to top it off, Harry Kane volleyed a penalty with a trajectory not seen since Liz and Kwasi put a bomb under mortgage rates.

“So let’s not beat about the bush: we are well and truly into a buyer’s market, and prices are already falling.

“With 1.8 million mortgage holders needing to remortgage in 2023 and inflation still in double figures, the problems and pain haven’t even started. So I expect to see forced sales, a massive increase in debt consolidation and adverse lending, along with a buy-to-let fire sale, all contributing to an annus horribilis.”

Joshua Ellard, head of specialist finance and research at London-based broker, Finanze:

“Demand for housing slowed throughout 2022, with much of the contraction due to increased mortgage costs, high inflationary pressures squeezing the purse strings of buyers and declining real wages. Unfortunately, the outlook didn’t change in December, with further downward pressure on prices. The shift towards a buyer’s market is well underway, with many estate agents reporting that a large proportion of recent sales have been below asking price.”

Samuel Mather-Holgate of Swindon-based advisory firm, Mather & Murray Financial:

“These are the snowflakes that started the avalanche. People will be in no rush to buy properties at the top of the mountain in the New Year. There is plenty of room for prices to fall and I expect little activity in the market until we know where prices decide to settle and that won’t be until late Spring.

“For buyers who are willing to wait until then, that will be the time to bag a bargain. There will be a lot of distressed sellers needing to offload their properties as they cannot cope with the cost of living. I expect interest rates may have peaked by then.”

Mike Staton, director of Mansfield-based mortgage broker, Staton Mortgages:

“This data was no surprise given that we had a World Cup, a growing cost of living crisis and then Christmas, with most people putting their homebuying dreams on hold and demand dropping off. January and February could be a good time to start looking as banks will be looking to get 2023 off to a great start and buyers will hold the bargaining power. However, due to the strong jobs market and weak supply, we are less likely to see a crash and more a housing market reset.”

Austyn Johnson, founder at Colchester-based Mortgages for Actors:

“With the costs of utilities going up dramatically, buyers will be looking at EPC-friendly homes to offset this. Lenders should therefore implement a new affordability process to accommodate this change.

“If a client can save £50 a month on their heating, this should be considered when it comes to their mortgage affordability. Why do they need to be penalised by being thrown in the same hat as a drafty old 1960s pre-fab? We need innovative thinking from mortgage lenders and the cost of living crisis demands it.”

Tomer Aboody, director of property lender MT Finance:

“As the year draws to a close, this slowdown in house price growth isn’t unexpected as financial markets are still to stabilise, leaving buyers uncertain as to where mortgage rates will settle.

“A combination of Covid, the Ukraine war and changes in government, have left the UK in a position where stability is key to growth and confidence. We have probably seen the peak in Swap rates which will help, and are now waiting for more continuous and steady market rates.

“As the cost of living increases at the same time as rates, buyers are more cautious of taking on bigger commitments, so although we might not see a huge fall in house prices in 2023, a slowdown in transactions will see a slight decrease in pricing.

“We have seen good growth in 2022, especially in the house market where space is still key and in areas which provide good commutes for consumers and green space, such as the South West. This trend is likely to continue, especially as many companies are still happy for staff to work from home.”

Jack Roberts, CEO of home moving platform SlothMove:

“As 2022 draws to an end, a gloomy December has failed to deliver any early winter cheer for this property market.

“A year that started brightly with buyers and sellers out in force has now turned estate agents and mortgage brokers into auld acquaintances, with many not likely to be remembered until well into 2023.

“Crumbs of comfort are thin on the ground as mortgage applications dry up across the country and a seasonal slump in transactions takes hold.

“With the prospect of a lengthy recession in the months to come, the level of unemployment will be a key factor in deciding how far and how fast the slide in prices will go.

“House moves cannot be put on hold forever and, if the labour market proves more resilient than previous downturns, you can expect buyers coming back to the table in search of a bargain.

“The rental sector could also deliver a shot in the arm for both supply and demand. With the impact of a costly remortgaging deal on the way, some landlords will be either planning to sell up or upping rents to the point where their tenants decide taking on a mortgage is a less painful option.”