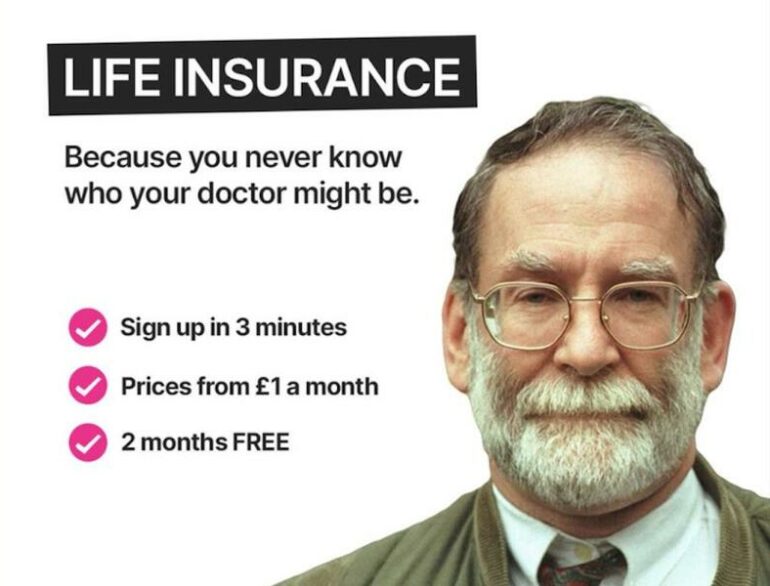

Financial professionals have been left reeling after life insurance firm DeadHappy featured serial killer GP Harold Shipman in an advert.

Shepherds Friendly, which underwrites DeadHappy, responded on LinkedIn with: “We have expressed our view to DeadHappy that it was distasteful and inappropriate and had them take it down immediately. We are currently investigating the matter further.”

Free PR platform NewsPage asked financial services experts for their views:

Gareth Davies, director at South Coast Mortgage Services:

“I mean, what sane marketing exec signs off on something like this? There’s controversy and there’s downright wrong, and this is the latter I’m afraid. I can take a joke with the best of them but for this to go live is crazy. However, I’m guessing they knew what the response would likely be, and it has us all talking about them as a firm. What’s that old saying again?”

Lewis Shaw, owner and mortgage broker at Riverside Mortgages:

“Who would ever countenance an advert like this? It’s not ‘bad taste’, it’s downright disgusting. For the families who had loved ones snatched from them by this murderer, it must be horrific. Had any of my family been killed by that monster and someone tried to make money off the back of it, I’d be stood outside the doors waiting for whichever marketer thought it was funny or edgy and give them a good insight into my own ‘edgy’ and ‘dark’ sense of humour. The inability to empathise with the families of murder victims shows what a psychopathic and parasitic company this lot are.”

Alex Shairp, director at Blackmount Private Wealth Limited:

“The ad’s clearly been designed to create a furore and nothing else. It’s a shame the marketeers couldn’t come up with something decent and give financial services a good name. It’s not big and it’s not clever. It’s just a bit s**t.”

Lee Thomas, protection advisor at Pangea Life:

“I thought twice before commenting as another article will possibly give Dead Happy more of the publicity they seem desperate to get. However, hopefully, not all publicity is good and this may deter them from future tasteless advertising. I used to find their adverts funny and a clever attempt to engage people in an important issue, however, they are now going too far and doing more harm than good.”

Jonathan Southgate, founder at Sterling Southgate:

“DeadHappy are disgraceful. That so-called industry disrupters feel they can use such cold and shortsighted “banter” to onboard clients in an age where the majority of the industry is approaching the market with kindness leaves a terrible taste in the mouth.

“But when companies are this devoid of humanity and compassion and put a marketing spin over the sensitivities of the families affected by this heinous individual, why would anyone use them?

“How on earth can you trust a company with something as personal as arranging funds for your loved ones in the event of your death if they have no thoughts for the victims, or their families, of Harold Shipman?”

Rhys Schofield, managing director at Peak Money:

“I may possess a dark sense of humor, the nicest people generally do, but there is a line when it comes to what’s in good taste as an ad and even I would say this steps pretty far over it. Is it ballsy? Sure. Is it wise? Probably not.”

Samuel Mather-Holgate, independent financial advisor at Mather and Murray Financial:

“Distasteful is an understatement. Putting a serial killer’s face on an advertisement gives attention to a man that most want forgotten. This will upset victims’ families and the Advertising Standards Agency have to debate whether this type of marketing should be allowed.”

Scott Taylor-Barr, financial adviser at Carl Summers Financial Services:

“This is really appalling and tasteless. Shipman’s crimes are not that long ago, his victims’ close families are still alive and could well see this advert, which would be horrendous for them. Seeing the murder of their loved ones trivialised to sell insurance. How someone signed this off and felt it was the right image for their business, not to mention the wider insurance industry, is beyond me.”

Jamie Lennox, director at Dimora Mortgages:

“The bleak reality in a world where we are bombarded with ads is that shock value is often the easiest way to be seen amongst the fog. Will it be distasteful and offensive to many? Yes, but at the same time it will bring huge attention to their brand, which is what they are trying to achieve. With a younger demographic who spend their life sharing memes on social media, this type of marketing is only going to increase.”

Craig Fish, founder & director at Lodestone Mortgages & Protection:

“This company needs to be shut down. I honestly don’t know how they get away with it. This type of advertising is all about the headline to get attention, and sadly they will probably succeed. I used to think their adverts were funny, but now they are just inappropriate, inconsiderate and downright distasteful. Did nobody give any thought to the families of those who were victims of this vile human being? The FCA and ASA need to carefully reconsider their approval of this advert.”

Kylie-Ann Gatecliffe, director at KAG Financial:

“I appreciate marketing has to be creative nowadays to get traction, in a world where we have thousands of companies shouting for our attention. However, I think there are ways and means of doing this without trying so hard to cause offence. The team that put this together will have known how close to the bone this is, and that it would cause a reaction.

“While some people will find this funny, I think they are setting themselves up as a jokey company within the industry, which will not appeal to everyone, and when it comes to protecting their families, clients usually want this to be taken seriously.

“I think they are going too far with their message and it seems controversy is being used to keep them in the limelight, rather than focusing on how they are actually helping clients.”

Scott Gallacher, director at Rowley Turton:

“I’d never dream of running such an advert for my own company. With this and the recent Northern Irish Spa “Bikinis and Balaclavas” advert, I do wonder who signs these adverts off. I’m guessing it’s a case of any publicity is good publicity.”

Debbie Porter, managing director at Destination Digital Marketing:

“There are a few creative agencies out there now making a name for themselves by producing edgy campaigns to create ‘talkability’. Talkability is what ads are all about. There is a line to be drawn between producing work that’s not for everyone but that will create chatter, and what’s beyond acceptable limits of taste though. These guys just overstepped that line.”

Benjamin Blyth, director at Houz Mortgages:

“I do wonder what the underwriter, Shepherds Friendly, thinks about this. Would they run the same ad campaign themselves? If not, why not? They’re a mutual organisation established almost 200 years ago. You’d think they’d champion the same values as other mutual organisations, which tend to have a sense of community. They say “We’re a society that cares, always putting our members first. We never compromise on our moral standards. We honour our commitments, always behave responsibly and act in good faith. We don’t just look after our community of members – we support great causes in the wider community.” Community, you know, that thing Shipman ripped apart with his monstrous actions. A strange thing to allow the marketing brand selling your product to use for some PR.”

Graham Cox, director at Self-employed mortgage specialist – SEMH:

“This is just plain wrong. Trivialising and profiteering off tragedy, good going Dead Happy. I hope, they get hauled over the coals for this. Better yet, customers leave them in droves.”

Natalie Hines, founder at Premier One Mortgages:

“The marketing team at DeadHappy could be dead sad tomorrow if they walk into a p45 for this inappropriate advert.”

Austyn Johnson, founder at Mortgages For Actors:

“What is wrong with people? I know any publicity is good publicity, but it just shows what utter heartless fraggles they are. Yes, it’s been a few years, but I’m sure it’s still quite sore for the families of those affected by Shipman. I am never the type of person to hope a business goes under, but their publicity team should be let go. Back to the playground where they were found.”

Amit Patel, adviser at Trinity Finance:

“The DeadHappy advert is vile, distasteful, abhorrent and vulgar. Did they take a leaf out of Jeremy Clarkson’s attack on Meghan Markle? There is no place in society for this type of advertisement. Yes, I agree the conversation about protection needs to be impactful to make the target audience think, but this has crossed all boundaries. Did no one at DeadHappy think for a second about the hurt and pain they would cause the victims’ families? The company need to be investigated by the FCA, Advertising Standards Agency and Ofcom. They should not be able to continue trading and have all authorisations removed, effective immediately.”

David Corbett, protection specialist at Protection 1st:

“This effort by the DeadHappy team is clumsy but I broadly agree with the sentiment. They are trying to attract their own breed of customers who will be drawn in by their dark marketing, and when boiled down to its bare bones, they are trying to close the huge protection gap we have in the UK. Yes, this one is a step too far as there are real victims and families here, but there are plenty of life insurance adverts over the years showing car crashes, heart attacks and cancer patients. We are in danger of being so vanilla that we’ll eat ourselves. We in the industry need to tread a fine line between disturbance, which the FCA will not countenance, and painting enough of a picture to allow the client to consider the consequences of inaction. I hope therefore there is a proportionate response here and minimal hysteria.”

Keith Hood, mortgage and protection advisor at Warners Financial Services:

“I am evangelical about life cover and protection in the event of ill health. I have personal experience of it, as I was widowed in 2010 when my youngest child was just five years old. So when I speak to my clients I don’t hold back. They need to know exactly what the challenges are for them and their family following a death or diagnosis of something horrible. So I don’t actually feel that too much is off limits if it shakes parents into cutting back on the Sky or Deliveroo in order to protect themselves, if that’s what it takes. However, this company really has crossed the line. Again.”