Four in five landlords improve each rental property they purchase, driving an enhancement in standards in the privately rented sector, according to a survey by Paragon Bank, the FTSE 250-listed buy-to-let mortgage specialist.

The study, which surveyed over 500 landlords, found that 81% make improvements to every property they add to their portfolio.

Of these, 22% spend over £25,000 on upgrading a new portfolio property, while 18% spend between £10,000 and £20,000.

Landlords expect an average increase of 19.8% in property value and a 16.5% rise in expected rental income after completing the upgrades.

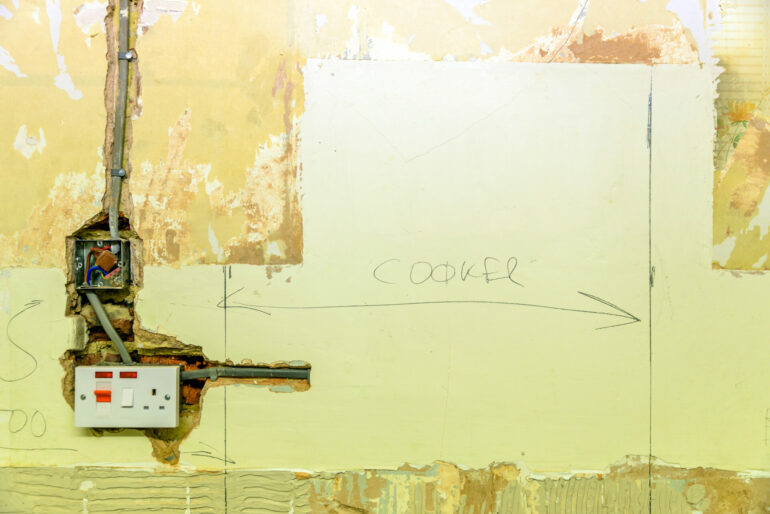

The research discovered that 40% of landlords prefer to purchase properties in need of refurbishment.

The private rented sector has seen a significant improvement in the standard of homes over the past 15 years, with the proportion of non-decent homes falling from 44% in 2008 to 23% today, according to the Government’s English Housing Survey.

Richard Rowntree, Paragon Bank managing director of mortgages, said: “Landlords have helped improve standards across the private rented sector over the past 15 years, and the upgrading of stock they purchase is central to that.

“The vast majority of landlords will look to upgrade each new property to boost the capital value and the potential rental income. However, they also do this out of a genuine desire to provide a good quality home to their tenants.”

The most common improvements made by landlords include painting and decorating (95%), installing new bathrooms or kitchens (78%), boiler replacements (78%), new windows (60%), and garden improvements (36%).