Swiss Re Institute (SRI) has released a new study that explores the availability, affordability, and accessibility of life and health insurance in 16 markets.

The report, titled “Life & Health Insurance Inclusion Radar,” reveals that none of the markets analysed are fully inclusive, leaving underserved groups vulnerable to financial hardship.

The study identifies inclusion deficits and provides guidance to life and health re/insurers on how to narrow protection gaps.

Melissa Leitner, head sustainable L&H delivery, said: “The L&H Insurance Inclusion Radar is a new resource calibrated to help steer our industry toward new sources of growth by better serving the needs of people who are particularly vulnerable to financial hardship.”

Julien Descombes, heead life & health products reinsurance, added: “By making life and health insurance more available, accessible, and affordable (the Inclusion Radar’s 3As), families and households will be better equipped to withstand financial challenges that occur when a breadwinner passes away or when they incur healthcare treatment costs. Making insurance more inclusive helps create a stronger, more resilient society.”

Jérôme Jean Haegeli, group chief economist, concluded: “The research comes as the global economy is slowing and social inequalities have increased enormously on the back of the uneven recovery and highest inflation surge in 40 years.

“Life and health insurance is a powerful remedy, providing families with financial relief after tragedies and by covering healthcare costs. Insurance covers are key to fostering economic and social progress with more focus needed now on inclusion to narrowing protection gaps in life and health.”

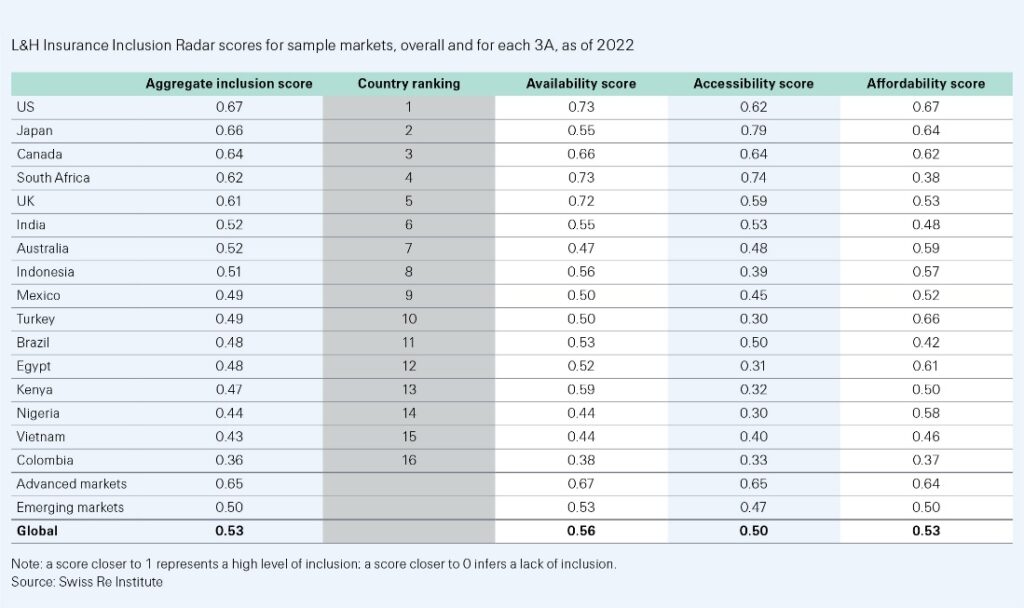

According to the report, accessibility is the biggest factor behind the lack of inclusion in emerging markets. This is due to lower financial literacy, lower usage and trust in the financial services sector.

Consumers in advanced markets face fewer barriers to obtaining insurance, but higher incomes in advanced economies do not necessarily translate into higher levels of insurance affordability.

The report also found that the US has the highest life insurance inclusion levels among the markets assessed, while South Africa has the highest inclusion levels in emerging markets. The report suggests that insurers must explore novel strategic partnerships to foster distribution diversity and use digital technology to achieve scale. Continued innovation in product design must accompany more efficient, inclusive underwriting practices.

The report also examines selected market trends, including UK insurance buying norms that leave women more vulnerable, India’s “Missing Middle,” South Africa’s innovation success, digital insurance opportunities in Brazil, and US diversity recruitment efforts to reach underserved customers.

The UK came in at fifth in terms of inclusion score lagging behind the likes of the US, Canada, Japan and South Africa.