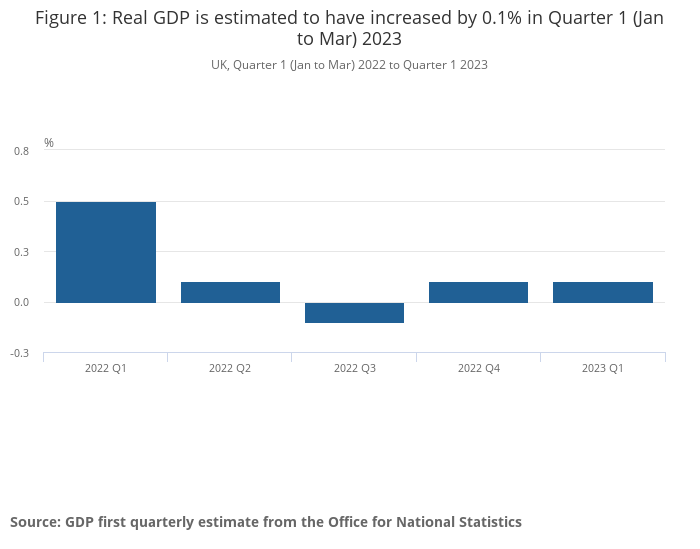

The UK’s real gross domestic product (GDP) rose by a marginal 0.1% in the first quarter of 2023, according to the first quarterly estimate released by the ONS today.

This comes despite a slight contraction in the economy in March, where GDP fell by 0.3%.

The new data, released on 12 May 2023, also revealed that GDP saw an increase of 0.5% in January 2023, up from the previous estimate of 0.4%, and experienced no growth in February 2023.

In terms of output, the services sector, which saw growth in information and communication, as well as administrative and support service activities, grew by 0.1% in the quarter.

Additionally, the construction sector reported a stronger growth of 0.7%, while the production sector saw a modest increase of 0.1%, bolstered by a 0.5% growth in manufacturing.

Despite these increases, household consumption remained flat over the quarter, though there was a positive contribution from gross fixed capital formation.

When compared with the same quarter last year, the implied GDP deflator, which measures the level of price inflation in the economy, rose by 6.3% in the first quarter of 2023, down from 7.3% in the final quarter of 2022.

The first quarter GDP growth of 0.1% followed a similar increase in the previous quarter.

However, the GDP level in Q1 2023 is still 0.5% lower than its pre-coronavirus level in Q4 2019.

Reaction

Riz Malik, director of Southend-on-Sea-based independent mortgage broker, R3 Mortgages:

“The unprecedented rise in interest rates has been exerting significant pressure on both households and businesses, posing a formidable challenge to the United Kingdom’s economic growth prospects.

“To overcome this, it is crucial that the government implements strategic fiscal and monetary policies, complemented by targeted deregulation measures, in order to reinvigorate the economy and foster sustainable expansion.

“As the UK embraces change with a newly crowned king, it may be time to consider a new Prime Minister if the current one falters in addressing economic challenges.”

Kundan Bhaduri, director of London-based property developer and portfolio landlord, The Kushman Group:

“The primary challenge facing the proper market is a shortage of skilled labour in construction, which has been exacerbated by Covid and Brexit. This shortage of skilled workforce has led to increased labour costs and longer lead times, resulting in project delays and increased expenses for developers. In addition, we are also grappling with rising material costs.

“The cost of construction materials such as timber, steel, cement and concrete has surged in recent months due to global supply chain disruptions and increased demand. Meanwhile, ongoing interest rate hikes are causing further inflationary pressures for the sector.

“Higher interest rates mean greater borrowing costs for developers and property investors, which eventually get passed down to consumers, whether they’re buyers or tenants. Despite the challenges, the sector remains resilient, with demand for rental homes remaining sky-high and new government initiatives such as Help to Buy being introduced.”