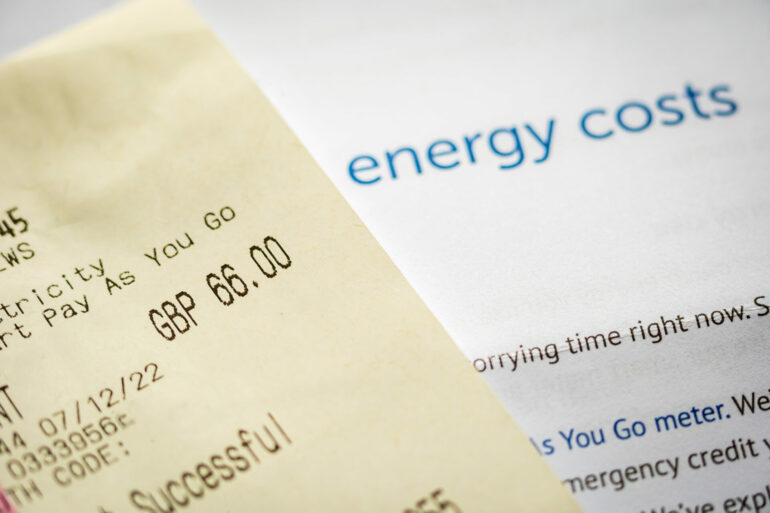

The financial strain from rising household bills has driven parents to borrow from their children’s savings, according to recent research conducted by Scottish Friendly, a prominent financial mutual.

The survey, which involved 1,000 UK parents, disclosed that over one in five (22%) have tapped into their children’s savings. A significant 64% of those parents have done so within the past year, grappling with escalating inflation and soaring interest rates.

Funds from children’s savings were mainly allocated towards household bills (33%), unexpected expenses (32%), and debt repayments (20%). Some parents also used the money for birthday or Christmas presents (19%) and even holidays (13%).

The persistent financial pressure on households is evidenced by Scottish Friendly’s data, showing a decline in the number of Junior ISAs opened by parents in the past year.

Most parents (87%) expressed concern about how much they should be saving for their children. Although 40% conceded they could save more regularly, over half (54%) reported they had more savings for their children than for themselves. Notably, two-thirds (66%) of parents indicated a stronger motivation to save for their children than for themselves.

Kevin Brown, a savings specialist at Scottish Friendly, reflected on the situation: “Borrowing money from their children’s savings is a last resort for parents desperately trying to make ends meet. While inflation might be slowing, living costs continue to rise, pushing more families into debt.”

“Budgeting can only do so much. If borrowing isn’t an option, dipping into family savings becomes a difficult choice that many are being forced to make,” Brown added.

He emphasised the importance of having an easily accessible emergency fund, free of penalties and charges. Brown also suggested parents consider how to maximize potential returns over the long term, given the current low-interest-rate environment. He encouraged parents to contemplate investing, starting with a ‘little and often’ approach to make the most of compounding.

“Times are challenging for many families at present, but it’s important to remain hopeful for better days and to strategise how to make the most of your money for your children,” Brown concluded.