UK house prices showed no signs of growth in September, marking a 5.3% decrease year-on-year, according to the latest data from Nationwide.

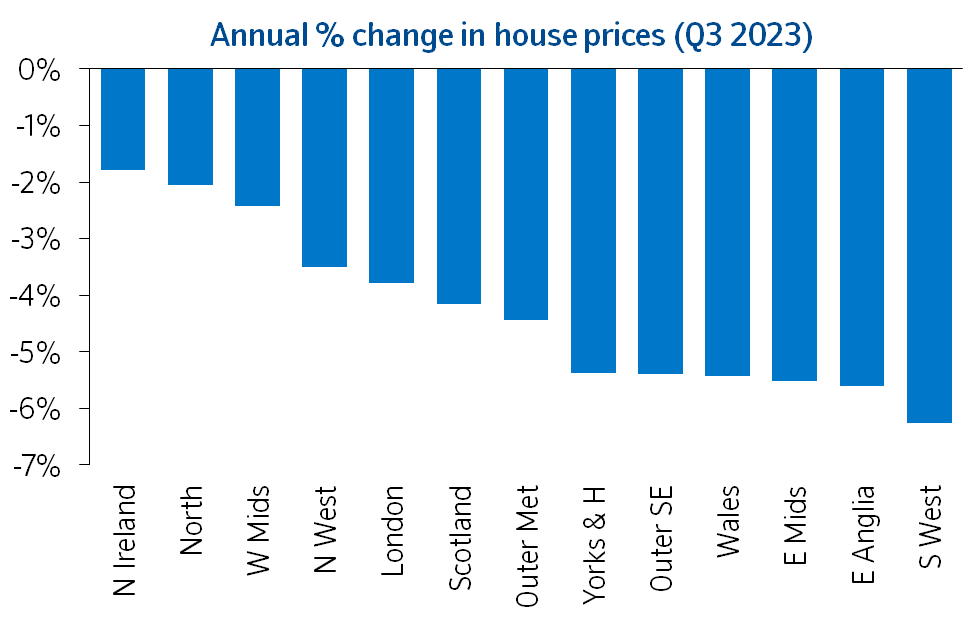

The figures revealed that all regions experienced a decline in annual house prices in the third quarter of 2023.

The South West was the weakest performing region, with a 6.3% drop year-on-year.

Nationwide’s chief economist, Robert Gardner, said: “Annual house price growth was unchanged at -5.3% in September.

“Prices were also flat over the month, after taking account of seasonal effects, following the 0.8% decline seen in August.”

Gardner also pointed out that the housing market continues to struggle, with only 45,400 mortgages approved for house purchases in August.

This is approximately 30% lower than the monthly average seen before the pandemic in 2019.

“This relatively subdued picture is not surprising given the more challenging picture for housing affordability,” Gardner added.

Discussing the future outlook, he said: “However, investors have marked down their expectations for the future path of Bank Rate in recent months amid signs that underlying inflation pressures in the UK economy are finally easing, and with labour market conditions softening.

“This in turn has put downward pressure on longer-term interest rates which underpin fixed-rate mortgage pricing.

“If sustained, this will ease some of the pressure on those remortgaging or looking to buy a home.”

The report also highlighted a shift in consumer behaviour, with transaction volumes for flats holding up better than other property types.

Gardner said: “Despite signs of demand for flats holding up a little better more recently, the price underperformance has continued in the most recent quarterly data, with flats seeing the largest year-on-year fall (-5.7%), compared to -3.6% for detached, -4.6% for semi-detached and -5.3% for terraced properties.”

Reaction

James Briggs, head of intermediary sales at Together:

“The Bank of England halting base rate after 14 months of consecutive increases, will undoubtedly serve as a confidence booster for those sitting on the fence about taking the step from renting to buying.

“In the same week a number of high street lenders have launched sub 5% mortgage deals, aiding one of the biggest challenges in the space over the past 12 months, affordability. The softening of swaps pricing in recent weeks has fuelled talk in the industry of sub 4% products.”

Anna Clare Harper, CEO of sustainable investment adviser GreenResi:

“Softer pricing is unsurprising as higher interest rates have a much larger impact on affordability than asking prices. Last year’s pricing levels, which were buoyed up artificially by policies such as the stamp duty holiday and very low interest rates, are no longer achievable.

“However, unlike commercial property such as offices, which in many cases have fallen in value by 20-30%, it’s unlikely that we experience a full house price crash. Firstly, this is due to the ‘necessity’ of housing. We all need a roof over our heads. Secondly, a large proportion of the market are owned outright, and they are unaffected by mortgage interest rates. For this reason, fears of a ‘house price crash’ are unrealistic.

“The challenge is less around house prices and more around the shortage of rental homes, which are in ever greater demand due to reduced affordability of buying a home. The relative stability of house prices combined with a growing supply shortage in rental is encouraging new institutional investment, and this is essential for ‘Generation Rent’.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“While a trend is developing among lenders with regard to mortgage rate reductions, pricing is still rather higher than many have grown used to over the past few years. Those buyers relying on mortgages are inevitably going to be more price sensitive on the back of ongoing affordability concerns.

“That said, the welcome hold in interest rates at the Bank of England’s September meeting will help buyer confidence, hopeful that the worst is behind us and that if inflation continues to decline, so too will the base rate.

“Lenders are keen to do business before year-end, which should be reflected in improved mortgage pricing in the final quarter of the year. However, the days of rock-bottom rates are long gone and borrowers need to get used to paying more for their mortgages.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Although the Nationwide house price index is a historically-reliable indicator of market health, broader economic factors are just as compelling. Successive increases in base rate and lender nervousness have meant those with cash have been playing a more significant role now that buyers continue to hold sway.

“In our offices, we are not seeing talk of a market correction – rather, promising signs of falling mortgage rates, though modest so far are encouraging viewings and helping to keep existing sales alive.”

Emma Jones, managing director of Manchester- and Frodsham-based independent mortgage broker, When The Bank Says No:

“Prices were flat in September and that word accurately sums up the current state of the property market. It’s also no surprise that demand for flats has held up, as they are typically less expensive and many people are now buying cheaper properties due to the higher cost of borrowing.

“The fact that flats have also seen the largest year-on-year fall in prices is also making them more attractive to people, especially first-time buyers. Yes, swap rates that affect fixed rate mortgage pricing slowly edged down throughout most of September but we all know that things can turn on a dime.

“If the next set of inflation data comes in worse than expected, they could start rising again. Based on the recent Bank of England mortgage approvals data, it’s going to be a challenging fourth quarter and we may not see activity levels pick up until the spring of 2024.”

Simon Bridgland, director at Canterbury-based mortgage broker, Release Freedom:

“The first three weeks in September were simply awful in terms of activity. Paralysis defined the property market. Everyone, from the markets to the consumer, waited for the outcome of the inflation data and Bank of England base rate decision.

“The hold in the base rate and the reduction in inflation quickly saw activity levels start to pick up. Now is a window of opportunity and I expect the fall in property prices to level off by the new year.

“If the next set of inflation data shows a similar trend and the base rate is once again held, happy days. If inflation rises and rates are hiked further, come January I can see estate agents’ windows filling up and the number of active buyers drying up. This will especially be the case for amateur landlords who are under pressure from lenders’ stress testing.”

Graham Cox, founder of the Bristol-based broker, SelfEmployedMortgageHub.com:

“While September saw an increase in activity, compared to the traditionally quiet August, demand for property purchases in the South West remains weak. There are two reasons for this: first, mortgage rates, despite falling over the past month, are still high at well over 5% for most people.

“Second, there seems to be widespread acceptance now that house prices are falling, and the rate of decline is accelerating. This is causing many buyers to put things on hold and wait for house prices to become even more competitive. With both mortgage rates and house prices expected to be lower this time next year, the property market is in limbo.”

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions:

“Steady would be the best description of activity in the Scottish housing market during September. As the leaves have begun to fall, sellers have reluctantly started to understand that asking prices need to fall, too.

“First-time buyers purchasing in the sub-£250,000 bracket are one of the few areas to remain active. Falling asking prices, mortgage rate reductions, lender incentives and ever-increasing rents are incentivising many first-time buyers to make their move.

“The middle market continues to be extremely sluggish, however. As for landlords, with further Scottish Government rent control proposals announced recently, you are more likely to spot the Loch Ness monster than a mortgage-funded landlord purchase in Scotland these days.”

Jamie Lennox, director at Norwich-based mortgage broker, Dimora Mortgages:

“The property market in September was more subdued than usual. The pause in the Bank of England’s rate rises has left both buyers and sellers in a state of anticipation. Despite falling mortgage rates, the higher cost of borrowing overall continues to deter would-be buyers, putting downward pressure on activity levels.

“Looking ahead to the fourth quarter and the first quarter of 2024, we’re likely to see a growing number of properties come onto the market. Homeowners who are still on ultra-low fixed rates might opt to sell as they face remortgaging at potentially much higher rates, which will really hit household finances. This could lead to increased supply in the property market, squeezing prices even further.”

Riz Malik, director of Southend-on-Sea-based independent mortgage broker, R3 Mortgages:

“As much as it pains me to say this, the market is as good as done for 2023 and will limp into 2024. The Nationwide suggests that the base rate won’t come down significantly and they may not be wrong unless the economy really starts to deteriorate. People need to recalibrate to the new norm in rates.

“Even if the Conservatives announce new stimulus measures at its conference this week, that will have little impact on completions or house prices this year as sentiment has been hit for six.

“There wasn’t much confidence among buyers despite the fact that mortgage rates consistently edged down during September. Amid all the uncertainty, people are sitting on their hands.”

Adam Smith, Founder at Northampton-based Alfa Mortgages:

“In our experience, the property market in September was even quieter than in August. This was particularly the case within the embattled buy-to-let sector. The realisation of the new cost of borrowing is really now starting to dawn on buyers and many haven’t adjusted to the new norm yet. Towards the end of September, there was a little more momentum but people remain cautious.”

Jamie Alexander, director at Southampton-based Alexander Southwell Mortgage Services:

“The final days of August and the initial three weeks of September were challenging to say the least. It was like the entire residential property market was apprehensively waiting for the inflation data and base rate decision, and when the outcome was positive, sentiment and activity levels soon started to pick up.”

Sarah Coles, head of personal finance at Hargreaves Lansdown:

“The property market paused for breath in September. The question will be whether it’s going to plummet, bounce back, or plateau, and on balance, there’s a good chance it’s going to hold tight.

“We have had some positive news in the past week or so. The Bank of England paused rate rises, and we’ve seen the major lenders cut their mortgage rates slightly. However, this isn’t enough to see demand rebound significantly. We’re not expecting massive cuts in the coming weeks. The Bank warned that rates were likely to at least hold at this level for some time, and may have to rise again if inflation gets beyond its control. We’re still seeing average rates way higher than they were in the spring, so it’s still going to be a drag on demand.

“Meanwhile, relatively strong employment and sky-high rents may well keep a floor under house price falls. So rather than crashing or bouncing back, prices could plateau for a while. In markets like this, we can see a gradual drift south, but right now we’re not expecting anything dramatic.

“Some stability could be more positive news for renters who had given up on the dream of owning a home of their own. When prices are rising faster than you can build a deposit, it feels hopeless. So now that prices are holding steady there’s the chance for more optimism. Of course, it’s still a huge stretch for renters, so it’s worth getting all the help you can – and it’s worth considering a Lifetime ISA so the government helps boost your deposit too.”

Karen Noye, mortgage expert at Quilter:

“The economic events of the last year have taken their toll on the housing market and according to Nationwide, September saw no house price growth at all and remain 5.3% down over the year. This should come as no surprise given the affordability pressures that people are under given elevated interest rates and the cost of living.

“However, there might be a glimmer of hope on the horizon now that we should have reached or neared the peak of interest rate rises. This means that people who have seen significant wage growth over the last year can now better plan their finances for a property purchase amidst this new more stable interest rate environment. That said, we are not likely to see a great decline in mortgage rates any time soon and as such many will remain priced out the market despite higher wages. Mortgage rates though will start to slowly edge downward as lenders compete for custom in a tight market.

“Recent mortgage and property transaction data shows that the market is incredibly subdued for this time of year and things may continue to stay quiet as we head into the winter months. This could also cause sellers, who need to move as quickly as possible, to trim their asking prices which will lure more people to market in pursuit of a good deal.

“The housing market remains in flux at the moment, any apocalyptic predictions for a huge price crash so far look unlikely to materialise but the market is still by no means out of the woods. Prices may continue to edge downwards or stay flat as they have done this month for the next few months before the road to full economic recovery becomes clearer.”