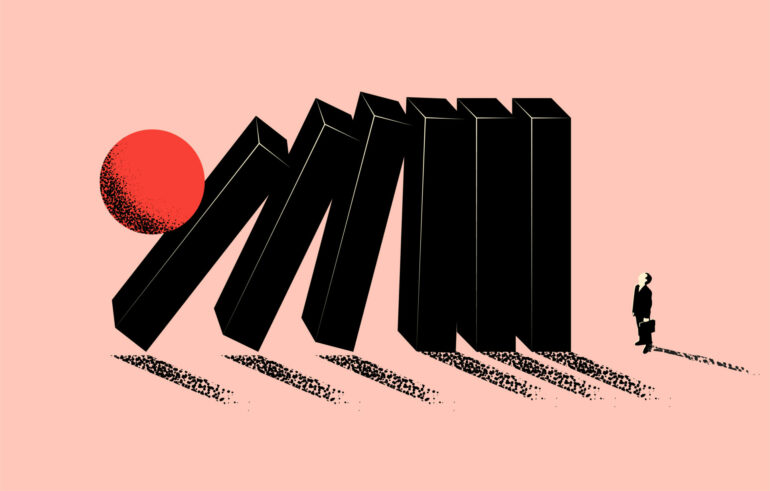

Almost half of experts (46%) believe that the UK could enter a recession during 2024 if the base rate does not come down before the end of the year, according to new research conducted by personal finance comparison website, Finder.com.

Finder brought together an expert panel of academics, economists, mortgage and savings experts, to ask them for their predictions on what will happen to the base rate for the rest of 2023, and the impact this will have on the UK economy.

David McMillan, professor in finance at the University of Stirling, thinks that a recession is likely, explaining that “the UK economy has essentially shown zero growth since emerging from the Covid-19 bounce-back.”

He outlined the various factors involved: “The unemployment rate is slowly ticking up and, as noted, the number of vacancies is declining.

“Pay growth may have already peaked, while tax thresholds result in falling disposable income.

“Combined with geopolitical tensions, there is likely to be an increase in energy (fuel) prices and less discretionary spending.”

With this in mind, McMillan argued that: “There needs to be a clear path to rate falls in order to encourage households and firms to spend and have greater confidence in the direction of the economy.”

On the other hand, over a quarter of the panel (27%) do not believe there will be a recession in 2024.

Stephen Sillars, savings and investments editor at Chip, is hopeful that the UK will be able to avoid this outcome.

He said: “One small positive for the UK economy in 2023 is it’s shown itself to be resilient, so I don’t feel that a base rate cut is needed imminently to avoid a recession.”

David Hollingworth echoed this sentiment: “There’s still so much uncertainty that I think a cut before the end of the year could result in markets feeling that policy is being loosened too soon, which could derail the improvements to mortgage rates.”

A further 27% of the expert panel believe that it could go either way.

Kate Steere noted that “economic growth has been weak, essentially showing zero growth for most of this year.”

She added: “We are still waiting for the increased rates to properly trickle through into the economy, with many households coming off fixed terms and going on to higher mortgage rates over the coming years.

“While the UK economy is resilient, there is a danger that this will tip the balance and push what slow growth it has had into a decline.”

Luciano Rispoli, senior lecturer in economics at the University of Surrey agreed that he could not be sure on the outcome for the UK economy next year, claiming that: “It would depend on the “knock-on effect” of past cumulative interest rate rises. The danger is that these have not yet transmitted fully to the real economy”.

10 of the 11 experts (91%) expect that the base rate will now remain at 5.25% until the end of the year, with just one expert predicting it will fall to 5% in December.

Paul Dales, chief UK economist at Capital Economics, believes that the base rate will hold at its current rate, and offered his thoughts on the longer-term picture.

He said: “The Bank seems intent on keeping rates high for long rather than taking them higher and cutting them again.

“Our forecast that core inflation and wage growth will fall only slowly suggests that the Bank will keep interest rates at their peak for a long time – perhaps until late in 2024.”

Luciano Rispoli added: “I believe the Bank will want to wait for further inflation data before committing to a change of policy.

“Therefore, I believe that interest rates will be on hold for a while.”

Alan Shipman, senior lecturer in economics at the Open University, was the only expert to predict that the BoE will lower rates once more before the end of the year.

He added: “Falling inflation, slower fourth-quarter GDP growth, and signs of private-sector debt problems will persuade the MPC to start reducing interest rates by year-end.”

Almost three quarters of the experts (73%) believe that house prices will fall between 5% – 10%, with more than half expecting prices to fall between 5% – 7.5%, and 18% predicting a more substantial drop of 7.5% – 10%.

Charles Read, fellow in economics at the University of Cambridge expects house prices to drop by 5% – 7.5%.

He explained that: “Sharp rises in interest rates since the end of 2021 has reduced affordability of mortgages and new house purchases, pushing down prices.”

David Mcmillan, professor in finance at the University of Stirling expects a more severe reduction of 7.5% – 10%.

McMillan explained that household incomes will be “squeezed in several ways” next year and “as much as these economic conditions will lead to price falls, they will also likely lead to a fall in the volume of transactions.”

Despite a rather dire outlook for house prices in 2024, experts are confident that a housing market crash is not on the horizon, with 8 out of 11 (73%) predicting the UK will avoid a crash of this kind.

Rispoli said: “Despite higher interest rates, housing demand is still strong and supply structurally low.”

Sam Miley, managing economist and forecasting lead at CEBR was the only expert who anticipates that a housing market crash is on the horizon, citing high borrowing rates and a downward pressure on demand as the key causes: “Interest rates are expected to remain higher than their pre-crisis levels well into the mid-2020s.

“This makes borrowing more expensive, putting downward pressure on demand from buyers.

“It also makes debt servicing costs more expensive for those on flexible tariffs, which could encourage forced selling and hence an expansion in supply.”