Despite Bank of England Governor Andrew Bailey’s assertion that “it’s much too early to be thinking about rate cuts,” nearly 70% of readers anticipate a reduction by the end of next year.

Yesterday, the Bank of England’s Monetary Policy Committee (MPC) opted to maintain the interest rate at 5.25%, marking a second consecutive hold following a series of 14 successive increases.

Before the announcement, The Institute of Economic Affairs’ Shadow Monetary Policy Committee (SMPC) highlighted the risk of a recession prompted by excessively high interest rates and advocated for an immediate reduction.

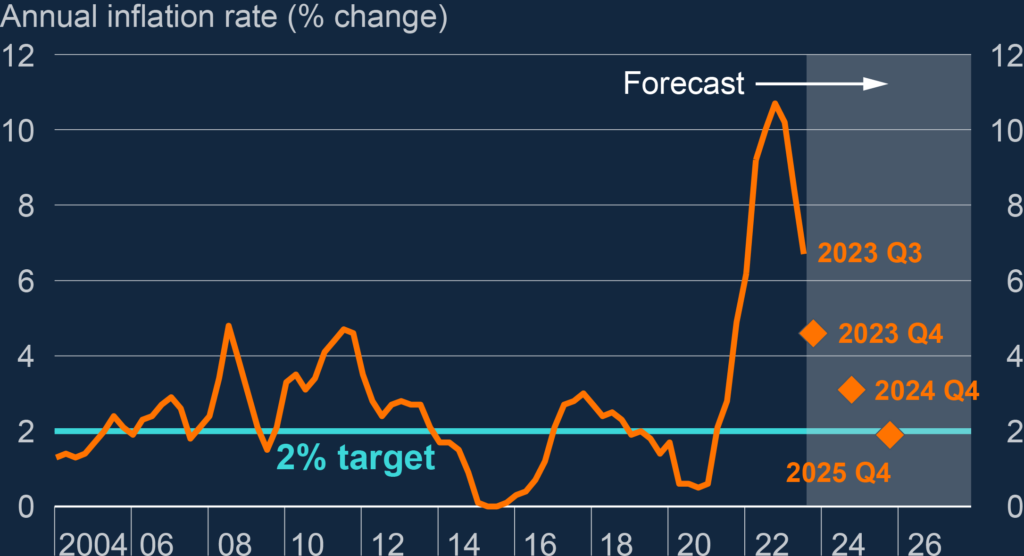

However, Governor Bailey remains vigilant, advising the market not to anticipate rate cuts soon. “Let me be clear, there is absolutely no room for complacency. Inflation is still too high. We will keep interest rates high enough, for long enough, to ensure we get inflation all the way back to the 2% target,” Bailey stated.

Bank of England forecasts suggest that inflation may remain above the 2% target until Q4 2025, and the Governor has not discounted the possibility of further increases. “We’ve held rates unchanged this month, but we’ll be watching closely to see if further rate increases are needed,” Bailey remarked.

Nevertheless, a poll conducted of readers during yesterday’s live feed (recap here) found that 68.67% predict a rate cut before the year’s end. Meanwhile, 24% do not foresee a drop, and 7.33% were unsure of the Bank of England’s next move.

Felix Blakeston, associate publisher at The Intermediary, said: “Governor Bailey is exercising caution, but our readers, largely mortgage brokers, are reading the market differently.

“They’re seeing mortgage rates fall and understand that housing is a significant driver of the UK economy.

“Their anticipation of a rate cut by the end of next year reflects a practical stance on the need to support a sector that benefits from more accessible borrowing costs.”