The latest example of alleged conditional selling, and a particularly egregious one, was doing the rounds on social media on Thursday following a post on LinkedIn by Malcolm Davidson of Hull-based broker, UK Moneyman.

The post said:

“Oh dear Spicerhaart – didn’t this email just end up in the inbox of the one #mortgagebroker you didn’t want it to!

Financial Conduct Authority please feel free to contact me for further details, I’ll be waiting for your call!

Attached to the post was the screengrab below.

Spicerhaart moved to distance itself from the agent’s actions pointing out that conditional selling was against its internal policies and that it would be conducting an urgent investigation into the allegations.

A spokesperson for Spicerhaart said: “We take this allegation of conditional selling very seriously as this is completely against our company policy.

“We will investigate as a matter of urgency and any individual found to have behaved in this way will face disciplinary action and retraining.

”We provide compulsory training to all estate agents when they join our organisation and annually retest them to ensure they comply with the law.”

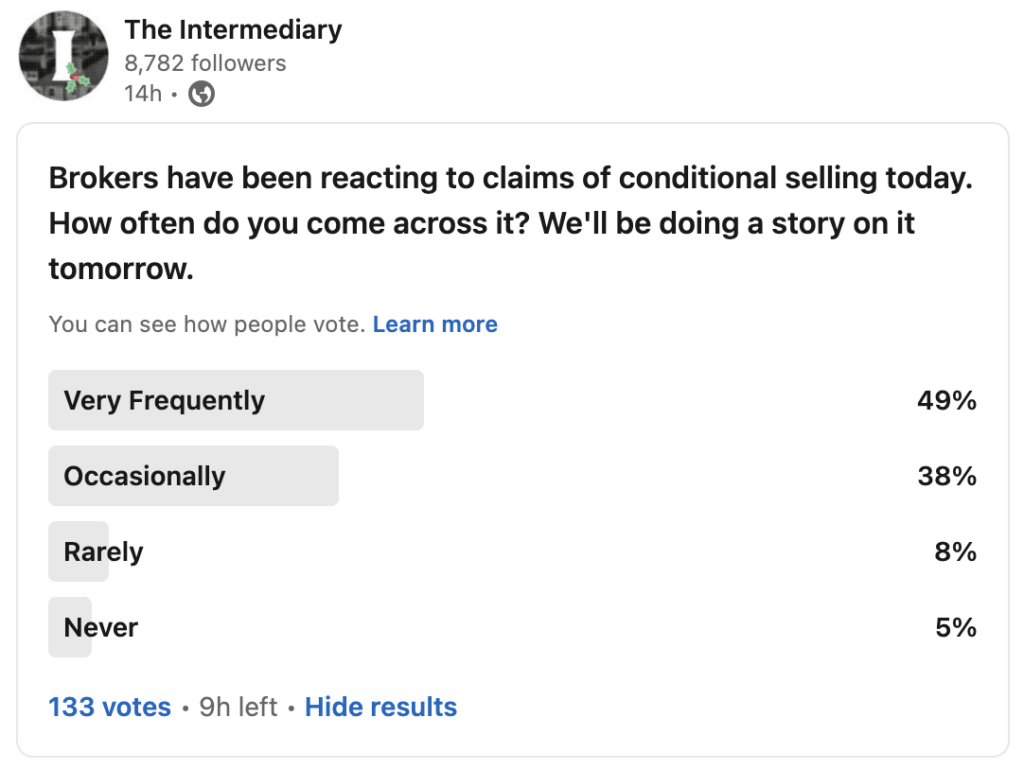

The Intermediary put a snap poll live late last night, asking brokers how often they come across the practice of conditional selling in the wider market. At the time of writing this story, with 133 responses in, the results were:

Newspage asked brokers for their thoughts on whether the screengrab posted by Malcolm Davidson constituted conditional selling. Their views came thick and fast and the conclusion was unanimous: yes it did.

Malcolm Davidson, director at UK Moneyman, who sparked the debate, said simply: “It’s quite incredible that this is still going on after all these years and I’m growing weary of calling it out. The FCA have been advised (again) and if they want to talk they know where to find not just me, but the dozens of broker peers who raise this issue on a regular basis.”

Others said much the same thing, but were less diplomatic. According to Imran Hussain, director at Harmony Financial Services: “This is another example of those involved in property transactions applying undue pressure on ordinary people who are simply looking to purchase a home. No vendor in their right mind will stipulate that you use an agent’s in-house broker; they just want their house sold for the best price and most people don’t wish to use a person who knows how much they can borrow in the same room as the person who is trying to get the most amount of money out of them for a house they are selling. How many times have we heard that it’s a one-off and branch-specific? The culture of trying to get every last penny out of a transaction in this manner needs to be called out.”

Matthew Jackson, director at Mint FS, was taken aback by the arrogance that this was even put in writing: “The fact that a member of staff at this large corporate estate agency has the confidence, or arrogance, to put in writing to an applicant that they intend to conditionally sell this property tells you how rife this practice is. More worryingly, firms and individuals that engage in this practice are not at all frightened of the consequences of breaching The Estate Agency Act and see the regulator as toothless. Until one of these firms is made an example of with a fine of significant proportions they will continue to stick two fingers up to the law.”

Justin Moy, managing director at EHF Mortgages, questions if this practice comes from the alleged companies involved or from an individual level: “What is disturbing about this, is the estate agent has knowingly prayed on the vulnerable buyer, giving them no other option but to play along or lose their dream home. Whether this comes from a company or individual level, I have never heard any vendors specifically request the use of the in-house adviser, so to see this used as justification every time suggests it’s pushed from a higher echelon.”

Rowan Frayling, managing director at J Finance Ltd, delivered the following verdict: “I see agents have gotten wise to the issue of them insisting on in-house services and pivoted to now saying it’s the seller’s request. I can almost guarantee no seller has ever requested this, nor would they welcome selling to someone with a lower offer just because they’re using XYZ Mortgages not ABC Mortgages. This absolutely has to stop, and buyers be allowed to exercise freedom of choice.”

Anil Mistry, director at RNR Mortgage Solutions, observed that it is not consistent with Consumer Duty: “It is about time the Property Ombudsman and FCA adopted a firm stance on this matter. The FCA must assert itself more strongly, particularly in light of the introduction of Consumer Duty. It raises questions about where this duty applies when clients are compelled to use a specific broker. There is a pressing need for improved public awareness, and it should be mandatory for estate agents to include a warning in their marketing or literature stating something along the lines of “You are not obligated to use our mortgage/financial services.” Without such measures, this practice is likely to persist.”

Charles Breen, director at Montgomery Financial, went one further and said the FCA and Trading Standards are about as useful as a chocolate tea cup: “This is blatant conditional selling. It is an attempt by them to steal the freedom of choice that any consumer has and is a blatant play on the emotions of buyers, and all of this for maybe £50 commission at most. It’s absolutely disgusting. The more that this is called out, the better. But the real issue is when these blatant acts are caught and called out, what action does the FCA and Trading Standards take? Despite hearing claims of this practice from numerous agencies you never hear of any punitive action being taken against the maligned actors in the industry. You can have as many rules as you like but without enforcement and punishment they are as useless as a chocolate tea cup.”

Gareth Davies, director at South Coast Mortgage Services, said it’s madness that this still happens: “This is the oldest trick in the book and somehow it’s still peddled out. Pretty much everyone within the industry knows this is nonsense, yet still it continues. I guarantee the vendor isn’t even aware. At a time when every other trade involved in house sales is regulated, how can agents not be? Utter madness.”

Kylie-Ann Gatecliffe, director at KAG Financial, suggested the quiet market conditions of 2023 have seen conditional selling ramp up: “This is without doubt another episode of conditional selling. Will anything be done about it? Probably not. We have seen this for years, and unfortunately, as estate agents have been quiet, their aggressiveness has ramped up. We have challenged many agents this year on their communications with our clients and how they have tried to force them into using a broker they didn’t want to. In no other industry would this be allowed to happen. More than ever, Consumer Duty needs to be taken seriously and estate agents should be regulated much more tightly than they are. Clients build relationships with their broker, and trust them with their finances, so expecting them to drop this and go with a complete stranger just to boost the estate agent’s commission is bang out of order and needs to change.”

Katy Eatenton, mortgage & protection specialist at Lifetime Wealth Management, also suggested the current economic environment is playing a role: “Unfortunately when estate agents are seeing their commissions drop, they are going to push harder on the add-ons. I educate my clients how to deal with this very early on in the process so don’t get affected by it. It’s bad practice and not worth the aggro as they only get about £75 per lead they pass to the in-house adviser anyway. Why risk a sale or losing a vendor?”

Simon Bridgland, director at Release Freedom, said similar practices are used to flog conveyancing: “This isn’t a surprise, it’s been happening since estate agency existed with in-house advisers. It’s the worst-kept secret going. It’s quite surprising how stupid the agent has been to actually put it in writing. Shame on you Spicerhaart. The tactic has been used at scale by so many agents over the years, some subtly, some like this brazen attempt to “help the buyer”. Makes my stomach churn. The same tactic is also used to sell conveyancing services.”

Ken James, director at Contractor Mortgage Services, wasn’t impressed: “As a broker, it’s damn frustrating to have an unscrupulous estate agent. Lies are told time and time again but seemingly these firms appear untouchable. We look to educate our clients that they have a choice and not to feel pressured but invariably when they fall in love with a property they can be pressured to use all the services agents offer.”

Stephen Perkins, managing director at Yellow Brick Mortgages, also said this kind of sales technique does not sit well with Consumer Duty, but that nothing ever seems to be done about it: “It is pressurised selling and certainly not Consumer Duty. They haven’t outright said you have to use their broker to buy the property, but it is heavily implied. You can be certain that the vendor has never asked for the buyer to use the in-house broker, just wants it verified to ensure the potential buyer can get a mortgage or has an agreement in principle. This is an awful sales technique just to force people into using their in-house brokers to maximise their profits. This should not be allowed and technically is not allowed, but the same agents get away with it all the time.”

Lewis Shaw, owner at Shaw Financial Services, was non-plussed by the fact that this practice is allowed to continue: “If this isn’t a good enough reason for agents to be disallowed from referring to or having in-house brokers, I don’t know what will be. Time after time, we see conditional selling practices, often from large corporates, so it’s evident many aren’t able to self-regulate. Every broker I know can give you multiple examples of this sh*thousery from estate agency firms. Moreover, most of the businesses that engage in this type of behaviour have limited lender panels, loaded insurance premiums and higher-than-average broker fees. It’s almost never to a customer’s benefit to use an in-house broker because of the obvious conflict of interest. Estate agents should sell houses. That’s it. Nothing more, nothing less. The sooner estate agency is separated from financial services, the better. Unfortunately, nothing will happen and consumers will continue to be bullied into a decision against their will because it seems no one in the industry has the minerals to take the bull by the horns and do what is necessary.”

Jamie Thompson, director at Jamie Thompson Mortgages, concluded: “I recommend that Malcolm turns up to the meeting with his client and see how red the face turns of the in-house broker.”