The Money Charity’s November 2023 statistics reveal an uptick in mortgage arrears across the UK.

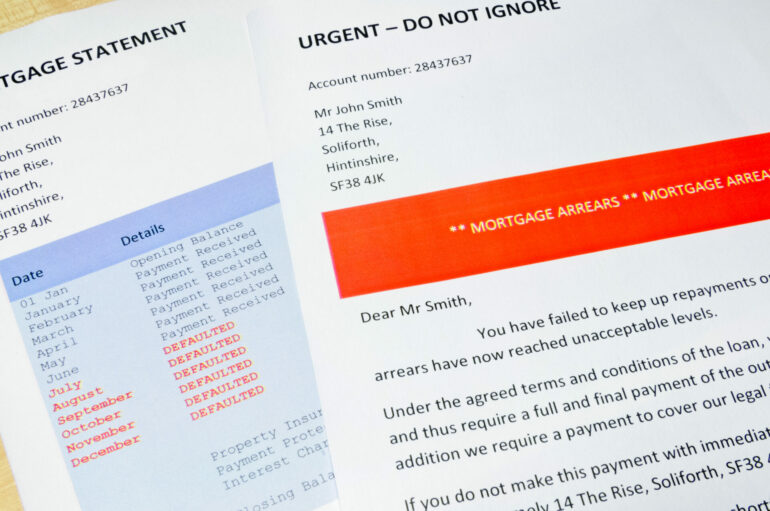

At the end of Q3 2023, the Financial Conduct Authority noted 175,825 mortgage loan accounts were in arrears, surpassing 1.5% of the current loan balance.

This marks a 5.1% increase from the previous quarter and a 16.9% rise from Q3 2022. The payments received for these arrears accounted for just 42.3%.

UK Finance data shows that 87,930 homeowner mortgages, equating to 1.00% of the total, were in arrears of at least 2.5% of the outstanding balance in Q3 2023.

This is a 7.4% increase from the previous quarter. The year-on-year data indicates a daily increase of 37.0 mortgages falling into arrears.

Repossessions, meanwhile, have decreased slightly to 630 homeowner properties in Q3 2023, down from 700 in the same period in 2022.

This translates to an average of 6.8 properties being repossessed daily, or one property approximately every three hours and 47 minutes.

These numbers are gradually returning to pre-pandemic levels after being initially suppressed due to a moratorium on forced possessions during the pandemic.

Reaction

Darryl Dhoffer, mortgage expert at The Mortgage Expert:

“On the one hand, we close the year with inflation down to 3.9% with pressure on The Bank Of England, to reduce the base rate sooner than expected, which in turn will drive down interest rates from lenders – with inflation reducing this should reduce standard living costs for many consumers, and if we see a reduction in mortgage interest rates for renewals, this again will ease the burden for consumer spending – I expect arrears to ease for consumers as we forge through 2024. That said we have a Government that has an election to win, which could put a spanner in the works.”

Patricia McGirr, chief marketing officer, Finanze Group at Finanze:

“Whilst recent drops in interest rates are welcome for all households trying to balance the family finances, the wider cost of living increases continue to bite hard.

“With many borrowers due to come off fixed rate deals onto the new rates it’s almost inevitable we’ll still see arrears rising into 2024.

“The sad fact is that those with poor credit are offered the worst deals at a time when every penny counts. It’s counterproductive but sadly an industry norm. Schemes to help tackle financial problems have helped but there’s a long way to go.”

Justin Moy, managing director at EHF Mortgages:

“These figures unfortunately will get worse before they improve, While mortgage rates are improving they will still push up the household costs along with food and fuel.

“Around 50% of mortgage borrowers haven’t felt that increase yet as they hang onto their cheap legacy rates, they could be masking a multitude of financial problems.

“Even if borrowers haven’t renewed yet it’s important to make a start planning for the next 12 months at least.”

Graham Cox, founder at Self Employed Mortgage Hub:

“The mortgage charter offers some respite for homeowners in financial difficulty, and mortgage rates look set to continue falling next year.

“This means ‘rate shock’ for those remortgaging will be less, well, shocking. Nevertheless, how the economy performs in 2024 is unclear, and a mild recession is still quite possible.

If people start losing their jobs, arrears could soar. Keep everything crossed for a soft landing.”

Adam Smith, founder at Alfa Mortgages:

“Undoubtedly, as we step into 2024, there is a clear indication that repossessions will surge. This surge is anticipated to be predominantly driven by individuals transitioning from ultra-low interest rates to current rates, having already reached their affordability limits.”

Elliott Culley, director at Switch Mortgage Finance:

“Although mortgage rates and inflation are now reducing, they are still high. This has led to and will unfortunately result in more mortgage holders going into arrears. Lower mortgage rates may give some respite, but it won’t be enough to rescue everyone from a dire situation.”

Scott Taylor-Barr, principal adviser at Barnsdale Financial Management:

“Whilst these numbers are never nice to read, it is important to look at them in context. We are coming out of a prolonged period of record low interest rates, which have been dubbed ultra-low interest rates.

“As rates increased arrears were inevitable, some people will cut their cloth based on that level of interest rates and have no capacity to pay more, and others will be the victims of unfortunate circumstances with health or employment.

“However, if we go back and look at the arrears figures for Q3 2008, just prior to the financial crash and the beginning of the ultra-low interest rate period, the base rate was at a slightly lower level (4.5%) and arrears for that year were around 340000 (FSA data), so we are still well behind the level of arrears that we saw when the base rate was previously around this point.

“The key advice for anyone who finds themselves struggling is to contact their lender as soon as possible, they will help and have teams set up to do just that.”