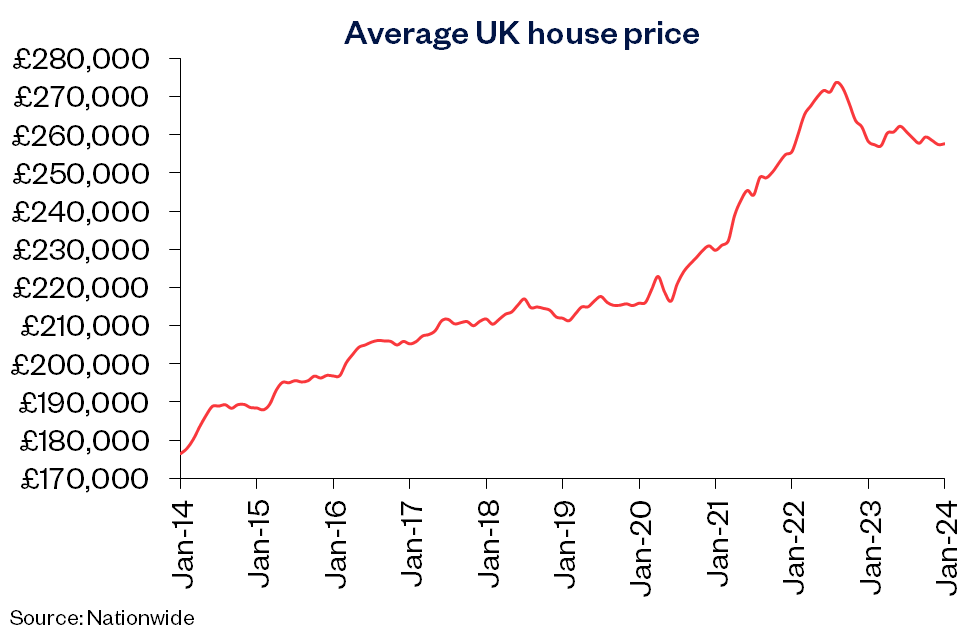

UK house prices experienced a 0.7% increase in January 2024, showing a slight recovery with a 0.2% annual decrease, according to Nationwide. The average price reached £257,656, reflecting a cautious optimism in the property market.

Robert Gardner, Nationwide’s chief economist, said: “UK house prices rose by 0.7% in January, after taking account of seasonal effects.

“This resulted in an improvement in the annual rate of house price growth from -1.8% in December to -0.2% in January, the strongest outturn since January 2023.”

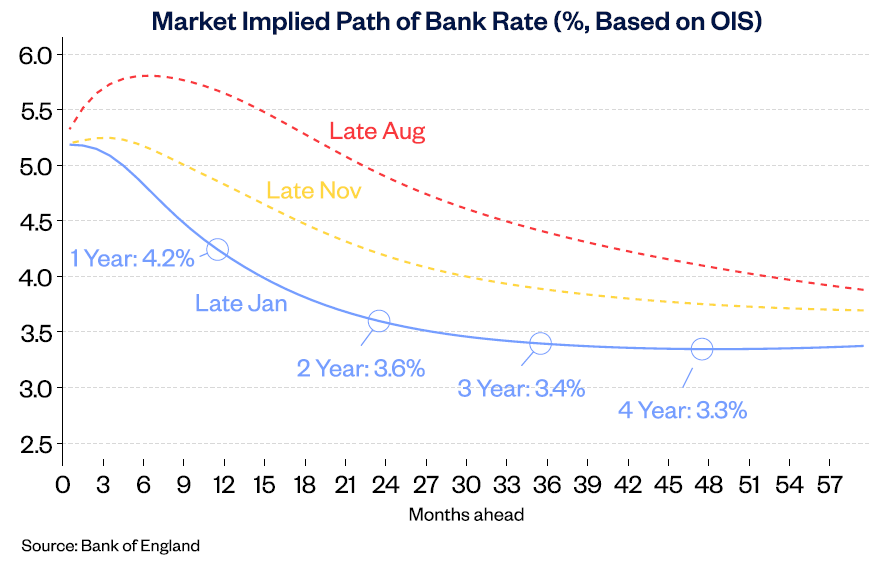

Gardner noted the recent dip in mortgage rates due to a changing investor outlook on the Bank of England’s future rate decisions. Despite this, he warned that the interest rate outlook remains uncertain due to recent economic data.

He emphasised the importance of mortgage rates for the housing market, stating that the high mortgage payment burden was a key factor limiting market activity in 2023.

A decrease in average mortgage rates to 4% could reduce the burden to 34% of take-home pay, closer to the long-term average.

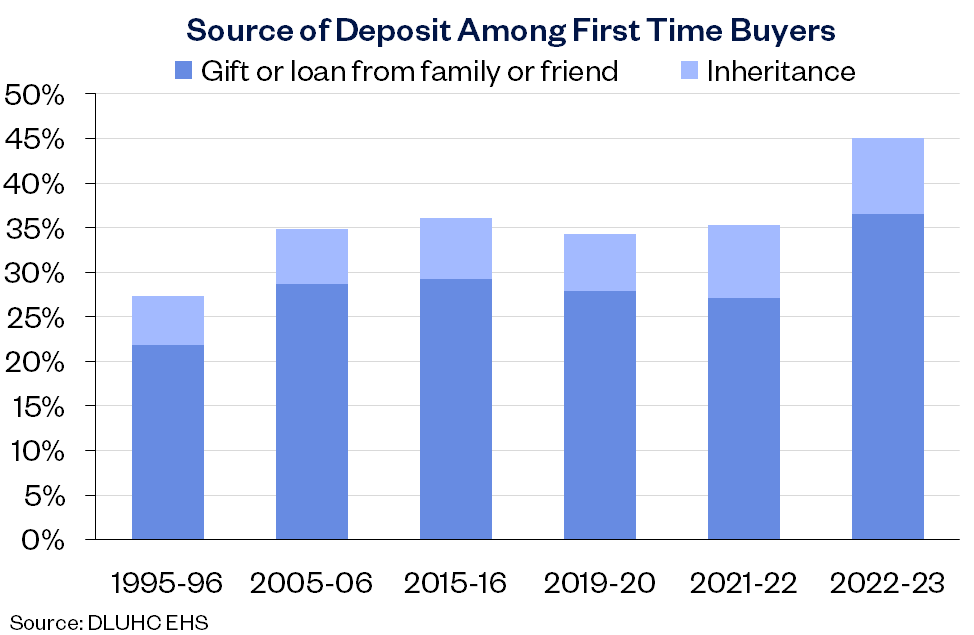

The challenge of raising a deposit continues, with a 20% deposit on a typical first-time buyer home now equal to about 105% of average annual gross income.

The high house price to earnings ratio, at 5.2 at the end of 2023, means many first-time buyers still need financial help from family or inheritance.

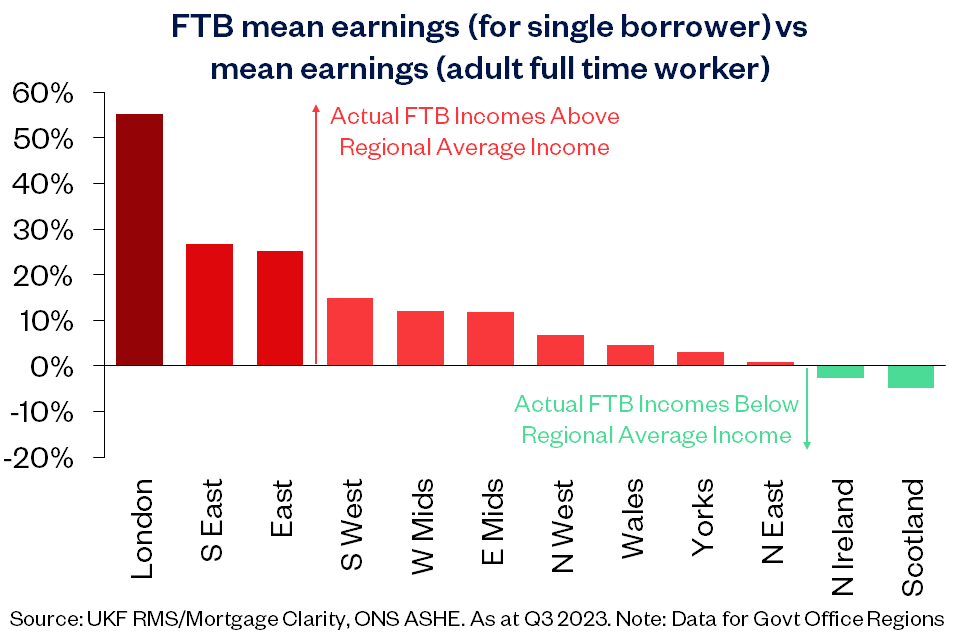

Affordability varies significantly across the UK, with the most acute pressures in London, the South of England, and East Anglia.

In contrast, Scotland and the North are more affordable. Gardner highlighted the income disparity between actual first-time buyers and regional averages, particularly in London and the South East.

Reaction

Jake Stott, founder at Manchester-based Mondo Mortgages:

“January has been an absolute belter for the housing market. The Nationwide House Price Index for January highlights the optimism that is emerging after a turbulent 2023. Since lenders decided to slash rates right from the start of the month, we’ve seen first-time buyers popping up like daffodils in spring.

“They’re not just window-shopping now but are serious, with a mortgage in principle clutched in their eager hands and ready to haggle. Confidence is sky-high. Even those houses that have been languishing on the market are finally getting a second glance. Buyers are swooping in, backing themselves to secure a discount off the asking price. If January’s anything to go by, the property market is in for a corker of a year.”

Steven Hargreaves, mortgage and protection adviser at Leeds-based The Mortgage Co:

“It’s been a positive start to 2024. New enquiries have been brisk, with a surge in first-time buyers keen to get onto the ladder. Interestingly, we have also seen fewer sellers accepting reduced offers, which was widespread in the last quarter of 2023.

“The dynamics of the market are changing. In comparison to the latter half of last year, there are many more buyers in the market. Ahead of the Bank of England base rate decision, quietly confident is our overall verdict. But the swap rate volatility of the past week or two shows we are not out of the woods yet.”

Stephen Perkins, managing sirector at Norwich-based Yellow Brick Mortgages:

“All the mortgage rate cuts we’ve seen in January have bolstered confidence and lit a fuse under activity levels. We saw a real surge in property purchase enquiries in January, both from first-time buyers and home movers. The property market is bouncing back now and there’s now a growing sense of optimism in the air. Yes, there are still some possible road bumps ahead, and swaps have been volatile, but currently things are looking much brighter.”

Denni Tyson, mortgage broker at Chatham-based Henchurch Lane Financial Services:

“January has seen buyers enter the new year with more optimism due to mortgage rates falling, especially at the higher loan-to-values that apply to first-time buyers. Though it’s still probably a buyers’ market, enquiries are on the rise and the balance of power could shift soon enough. Home mover enquiries have increased, but with a sense of caution and seeing where their figures take them as they are acutely aware of the increased costs to homeownership. Hopefully we will see a steady period for the housing market that it so desperately needs.”

Graham Cox, founder at the Bristol-based broker, Self Employed Mortgage Hub:

“Demand from buyers in January has picked up where December left off, with a noticeable improvement from last Autumn. In my view, it’s still very much a buyers’ market, but we’ve noticed first-time buyers in particular are prepared to get much closer to the vendor’s asking price than they were. As ever, affordability is the main problem. House prices haven’t fallen nearly enough to compensate for the massive increase in mortgage costs.”

Harps Garcha, director at Slough-based broker, Brooklyns Financial:

“January has seen a significant upswing in activity, surpassing the levels observed during Autumn 2023, as enquiries evolved into concrete applications. Almost daily rate reductions by lenders have motivated numerous potential homebuyers to act on plans they had deferred in 2023. This uptick in activity reflects a heightened confidence within the market, accompanied by awareness of the economic landscape. This increased activity is evident across various segments, including first-time buyers and home movers.

“Zoopla’s latest report further validates the current surge in purchase activity, showing a notable 13% year-on-year increase in buyer demand during the first month of 2024. However, despite these positive trends, conversations with local estate agents indicate that it remains a buyers’ market. Sellers are still finding themselves compelled to adjust their asking prices downward during negotiations.”

Chris Schutrups, founder at Southampton-based broker, The Mortgage Hut:

“Compared to this time last year, we have seen roughly double the number of enquiries from people looking to buy. I think people have now become used to the new rate world that we’re in and expect the Bank of England base rate in the short- to medium-term to sit between 4% and 5%.

“People now understand how much things will cost but have factored it all in and the result is more confidence. People are making decisions based on the long-term, rather than the short term. Rents are also going up, so people are seeing the value of owning their own property where they at least control their own destiny. Rising rents are driving first-time buyers to quickly capitalise on the buyers’ market while it still lasts.”

Ross McMillan, owner at Glasgow-based Blue Fish Mortgage Solutions:

“December saw the Scottish housing market take a breather, with purchase activity in hibernation but remortgage activity holding steady. Fast forward to January 2024, and the market has exploded into action. Mortgage enquiries are soaring, signalling a resurgence in buyer confidence.

“First-time buyers are the driving force, injecting life into the sub-£200k market in Scotland. Moreover, those higher up the property ladder are emerging from the shadows and exploring mortgage options for upward or downward moves. With limited supply and strong buyer demand, competition for properties in Scotland remains fierce. In most areas, purchase prices continue to exceed home report values significantly. Unless we see any unexpected disruptions, 2024 looks poised to be another robust and positive year for the Scottish market.”

Justin Moy, managing director at Chelmsford-based broker, EHF Mortgages:

“We have seen a significant shift in purchase enquiries, which have outnumbered remortgages and product transfers for the first time in 18 months. Many are first-time buyers taking advantage of the better rates on offer, as rents remain high and ownership can be cheaper, even with a small deposit.

“There has also been an uplift in enquiries from those with existing mortgages still with a few years to run on cheaper rates, looking to port their current deal in the short term. Even the Let-to-Buy option has been a topic of discussion with a handful of clients, as they look to buy without selling if the finances allow.”

Gary Bush, director at the Potters Bar-based MortgageShop.com:

“House purchase activity really started to increase towards the end of January with Monday of this week seeing three times the level of new mortgage application enquiries than usual. We expect property indices to reflect this upward movement of sentiment and activity in the coming months and to see a busy spring. We’re predicting that 2024 will see house price growth of 5%-7%.”

Ranald Mitchell, director at Norwich-based broker, Charwin Private Clients:

“Confidence among new buyers and home movers has improved noticeably as they sense opportunity in the current market. With rates having fallen to a more digestible level, property prices remaining relatively low, and a lot of pent up demand, the number of buyers is on the up. There is a good window of opportunity for people to negotiate and execute their plans. But a warning: as buyer numbers increase, the pendulum could quickly swing in favour of sellers again. With increased interest and demand for their property, they’ll be less inclined to discount the asking price.”

Ying Tan, CEO at London-based broker, Habito:

“Demand has been explosive in January as lenders have jostled for position. We have seen enquires double, which has translated into more applications. Buyer confidence is returning to the market, albeit with one eye on the wider macro-economic environment. Sentiment on the ground is positive but this needs to be sustained if it’s to have any material impact on house prices.”

Michelle Lawson, director at Fareham-based broker, Lawson Financial:

“We have seen a surge of new business and, alongside the usual remortgage applications, an influx of first-time buyers and home movers itching to buy. We’ve also seen green shoots of investors looking at their options to expand their portfolios in what, for now, remains a buyers’ market. These signs are vital and the tide has to change at some point. With all the data that is starting to trickle through, this could be the beginning of the end of tough times.”

Darryl Dhoffer, director at Bedford-based The Mortgage Expert:

“Early indicators for January show demand for houses is still stable rather than booming, and did not plummet as was expected at various points last year. There’s no doubt that lenders launching rate cuts very early in January provided a much-needed boost to buyer sentiment. Further rate reductions could increase buyer enthusiasm in the coming months. We could see a switch back to a sellers’ market, particularly for properties in high demand. Things can turn on a dime in the current environment.”

Nathan Emerson, CEO of Propertymark:

“The reported month-on-month increase in house prices will start to encourage homeowners to feel more confident that they can potentially make their next move. 2024 seems to be starting off more positive for the housing market, and let’s hope that trend continues.

“If the Bank of England decide to bring down interest rates too, this should give sellers even more confidence and ease the pressure on affordability. Hopefully this is the start of a period of economic recovery for the nation.”

Daniel Austin, CEO and co-founder at ASK Partners:

“Today’s data shows that the property sector is beginning to show signs of recovery. With a decline in inflation YoY and the peaking of interest rates, the overall outlook has considerably improved. Rent values have seen sustained growth, positioning real estate as reasonably valued in comparison to gilts and presenting growth potential. In the realm of commercial real estate, factors like physical condition, location, and age significantly influence a property’s value. Well-maintained properties boasting modern amenities tend to command higher prices, while neglected ones may struggle to attract tenants or investors. In the current market, the emphasis has shifted towards the importance of location and quality over the yield on debt or cost. We anticipate opportunistic acquisitions of prime properties in prime locations.

“A survey conducted by the Royal Institute of Chartered Surveyors (RICS) uncovered that non-traditional market segments, such as aged care facilities, student housing, data centres and life sciences real estate are yielding the most robust returns. Although the lead-up to the general election may pose some uncertainty, a subsequent boost in productivity and a decrease in interest rates are expected. The hope is that any new government can address local planning issues to stimulate construction and guide the economy out of the downturn.

“As a debt provider, at ASK our focus will be on supporting the best sites in prime locations with well-capitalised sponsors who understand their product. Following this strategy, we aim to bolster developers’ initiatives by adopting a flexible underwriting approach, thereby continuing to offer opportunities for the growing number of private individuals opting to invest in property debt.”

Alan Davison, director of customer sales at Together:

“House prices have continued to rise with falling mortgage rates giving a boost to buyer demand at the start of the year. While sellers may still be getting largely cut-back offers on listings, market for first-time buyers and home-movers is certainly picking up momentum. There are also opportunities in the residential property market for buy-to-let investors.

“That said, there are still lingering challenges property professionals will need to contend with for much of this year. According to our research, 30% think inflation and the high interest climate (27%) will be the biggest deterrent to plans this year. All eyes will be on the Bank of England’s interest rate announcement tomorrow and whether there is any indicator of cuts to help ease some of these market tensions.

“However, the defying optimism of the sector – 58% would recommend investing now, combined with the beginning green shoots of economic recovery, means both commercial and residential property investors who are well poised (with the right finance support in place) will ultimately be in the best position to capitalise on market opportunities first.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“In the last quarter, we were receiving interest in property but many buyers were uncertain as to whether they may be overpaying if prices continued to fall.

“However, lower inflation and mortgage repayments combined with new year optimism has changed the picture, as shown in these figures. Prices are starting to pick up but we are not getting carried away.

“Increased supply and affordability concerns mean the market remains price-sensitive.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“Although the Bank of England is expected to hold base rate again when it meets this week, there is a growing feeling that it is only a matter of time before rates start to come back down, bringing further relief to borrowers.

“Those in London and the southeast continue to find it difficult to get on the housing ladder and move up it, thanks to the higher cost of housing. First-time buyers are calling upon the Bank of Mum and Dad more than ever.

“Despite Swap rates, which underpin the pricing of fixed-rate mortgages, moving up and down a bit, the general trend is still downwards. Selected mortgage rates from lenders such as Santander, Coventry and Skipton have increased but many others have reduced as lenders compete for business.

“While falling mortgage rates provide some relief, borrowers must still get used to a higher interest rate environment.”

Karen Noye, mortgage expert at Quilter:

“According to the latest figures from Nationwide, house prices have begun to show signs of increasing once more. Prices rose by 0.7% in January, suggesting the housing market started the year off on a more positive note compared to the end of 2023 when prices remained stagnant. There was also further recovery in the annual rate of change, with house prices down just 0.2%.

“Just yesterday, the Bank of England’s Money and Credit statistics revealed net mortgage approvals for house purchases rose from 49,300 in November to 50,500 in December. While this is only a slight improvement, the increase suggests there is a little more optimism for the upcoming year in comparison to the more dreary outlook for the housing market seen throughout 2023.

“The BoE’s monetary policy committee is due to meet tomorrow and is widely expected to hold interest rates at 5.25%. The Bank’s ‘higher for longer’ stance has resulted in a tricky landscape for prospective buyers, and it is unlikely to lower rates for some time yet – potentially not until the second half of 2024 unless inflation lowers rapidly. However, mortgage deals have been looking a little more palatable as lenders have consistently cut mortgage rates as swap rates have lowered, particularly on fixed rate deals. This is likely to continue as the still low transaction levels feed into a healthy competition between lenders which have been left vying for business.

“The precarious nature of the economy had left many prospective buyers in ‘wait and see’ mode, reluctant to buy a new home in the hopes of securing lower rates further down the line, but we are now seeing tentative signs that people are making a return to the market. Should mortgage rates continue to fall then more may be lured back to the market sooner which would help to buoy prices further.

“For those who are looking to purchase a new property in 2024, seeking professional mortgage advice will be vital. A mortgage adviser can help you navigate what remains a relatively unpredictable market and will ensure you make the best possible decisions for your personal circumstances and goals.”