Life insurance firm, DeadHappy, known for its controversial ads — with one featuring Harold Shipman “because you never know who your doctor might be’ — has announced that it is unable to accept new life insurance customers.

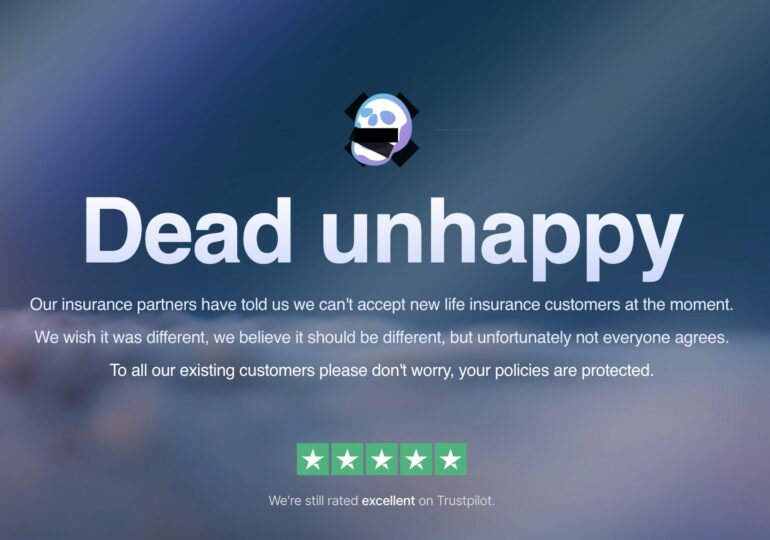

An announcement on its website reads: “Our insurance partners have told us we can’t accept new life insurance customers at the moment.

“We wish it was different, we believe it should be different, but unfortunately not everyone agrees. To all our existing customers please don’t worry, your policies are protected.”

Newspage asked insurance and protection brokers what they think is going on. Here’s what they had to say.

Simon Bridgland, broker/director at Release Freedom:

“With maverick advertising, DeadHappy have proved that pushing the boundaries of decency too far will be fatal to any business. Consumers voiced their anger very clearly in the short space of time that the business had a pulse. Now that their insurance partners have distanced themselves by demanding a stop to new business, DeadHappy are the ones flatlining.”

Dave Corbett, head of protection at Protection 1st:

“I liked the shock tactic advertising used by DeadHappy. I’d take that any day over the more banal and dour messaging that litters social media. But I appear to be in the minority and it is certainly risky to do anything too ‘out there’ currently for fear of causing offence. For me the issue here is more to do with the formulaic advice through technology. Protection planning is for the long term and I don’t think these gimmicky tech solutions drive good behaviours with the end client.”

Richard Jennings CeMAP, founder & managing director at Richard Jennings Mortgage Services:

“I wholeheartedly believe that life insurance should always be an advised process. I see so many clients with cheap policies bought online that are totally inadequate for their needs. There will always be client demand for cheap and simple policies but in chasing the saving of a few pounds per month they risk the very real possibility of losing out on thousands at the point of claim.

“What DeadHappy did do, however close to the line their adverts may have been, is take a serious product, and make it more lighthearted in an attempt to get more people discussing the topic. Whilst not the exact route I would travel, anything that gets the general public to address the insurance gap has to be commended for at least raising awareness.”

Katy Eatenton, mortgage & protection specialist at Lifetime Wealth Management:

“Without knowing the reasons they’ve closed, it’s hard to comment. I thought their advertising was a little too close to the line, but did the trick in getting people discussing personal protection. However, anything health- or life insurance-related needs a personal touch and bespoke advice, as no two people will have the same future wants for their families, the same needs for their protection or the same attitude to risk. Also, there needs to be a level of empathy and understanding when discussing any health issues or mental health disclosures.”

Ranald Mitchell, director at Charwin Private Clients:

“Looks like the final nail in the coffin for Dead Happy and without their suppliers, their business is buried. Insurers remain very active in the market, so reading between the lines, their unpaid indemnity debt liabilities have now exceeded their income. Insurers will kill agencies in this situation, refusing to deal any further until the debt is repaid.”

Bob Singh, founder at Chess Mortgages:

“The closure of DeadHappy, whilst sad for the employees, is a lesson to all business owners who fail to recognise the fine line between humour and bad taste in their branding or advertising. We are no longer living in the 80’s but in a world that is sensitive to such hurtful and insensitive campaigns. It remains to be seen if the advertising agency behind this campaign also dies a death.”

Chris Steele, founder at myTribe Insurance:

“Having seen some of DeadHappy’s ads on social media, I can undoubtedly say they were distasteful and, at times, offensive, but they got people talking and thinking about topics that are often brushed under the carpet.”

Ross Lacey, director & chartered financial planner at Fairview Financial Management:

“There are still many people out there who need protection but it’s not on their radar, so finding new ways to engage with them is important. However, there’s a fine line between tastefully disrupting and cheapening the message. The non-advised insurance sold through TV ads is often not fit for purpose but bought as it’s cheap (reviewable premiums for a shortish term) and can make someone feel like they’ve ticked it off their list by doing something sensible.

“Some cover is better than none, but only when insurance is arranged through an adviser can a package be perfectly tailored to match their circumstances. We’ve seen countless examples of insurance that was bought online that wouldn’t deliver the expected outcome in the event of a claim and more worryingly, perhaps not pay out at all due to non-disclosure.”

Scott Gallacher, director at Rowley Turton:

“The closure of Dead Happy highlights the need for substance over shock in the digital age. It reaffirms the timeless truth: “Life assurance is sold, not bought.” As a financial planner, I witness firsthand how many overlook the importance of insurance until they see the real-life implications of unforeseen events. Through lifestyle financial planning, I aim to make the case for protection by demonstrating its tangible impact on financial well-being. It’s about empowering clients to make informed decisions and secure their futures.”