Introduction

It’s been just over a decade since pension freedoms and the retirement income market in the UK continues to grow and evolve. What has stayed constant is the important role of advice in helping clients achieve a sustainable income in retirement.

This article explores some of the key trends seen, what this means for the advice market and how Drip-feed Drawdown can help you to support clients.

Retirement income key trends

Drawdown is still number one

A decade on from freedoms and the shift to drawdown feels something close to permanent. Even with the recent return in popularity of annuities, drawdown is still far and away the number one choice for retirement income. With drawdown sales increasing by 27.9% from 2022/23 to 2023/24.[1]

The appropriate solution to deliver a sustainable retirement income for your individual clients is unlikely to be so clear cut, with both the flexibility of drawdown and the certainty of an annuity having roles to play. The desire to combine flexibility and certainty can be seen through the continued popularity of smoothed fund investment options, however, there has been little overall demand in the market for truly blended products. The popularity of smoothed funds is such that the Platform market is slowly starting to take note of what has been, to date, a primarily off-platform solution.

Retirement is a misused term

The number of people in the UK aged 65+ is growing faster than other age groups. In 1999 only one in six in the UK were aged 65+, by 2039 this is projected to be one in four.[2] Whilst based on current life expectancy someone aged 55 accessing their pension benefits can expect to live for c.30 years.[3]

This means ‘retirement’ is less a fixed one-way point and is now more a journey, with people working longer to fund the cost of these extra years. Alternatively, they may be able to transition into retirement by reducing their hours or taking a part time role.

As much as Covid led to a wave of over 50’s exiting the labour market, there has been signs of a converse ‘great unretirement’. With the volume of people not working, despite not having reached their State Pension Age reducing, with high inflation and cost of living pressures the main drivers.[4]

It’s clear that for those approaching the age that they can access pension benefits, a less fixed retirement journey lies ahead. This has implications on how and when clients access retirement income versus other sources of wealth. With a need to be as tax efficient as possible, to ensure income lasts throughout a potentially longer retirement.

Focus on complexity

Market volatility can be the mortal enemy of a retiree’s pension pot, with people entering retirement over the last decade having experienced several periods of financial turbulence. With investment and longevity risks amplified by the ability to take flexible income, it’s no surprise the regulator has kept a close eye on how the advice market deals with these clients. The recent FCA Thematic Review Of Retirement Income Advice being a case in point, which highlighted the need to take a more consistent (albeit personalised) approach to ongoing reviews, cash flow modelling and retirement investment solutions.

It seems likely the most significant change to the retirement market in over a decade may once again be driven by a Chancellor. The impact of the proposed inheritance tax change is still unclear but has the potential to drive significant changes in behaviour. Pensions may become less attractive as an estate planning vehicle, which could instead mean pensions are accessed earlier and more often. These changes suggest opportunities for firms to show the value of their advice, but a challenge in how to deal with increased client demand.

What do these trends mean for advisers?

These trends suggest advisers will face a future conundrum: how can you profitably support long-term clients and meet their increasingly complex retirement income needs – especially if those valued clients have pension assets that they reduce at a greater pace in the future?

One way of achieving this is by using technology to streamline the advice process, reducing the time and therefore cost to serve existing clients. There needs to be an obligatory mention of A.I. here, technology that has a future scope to transform back-office servicing. In the here and now, the best adviser Platforms can help streamline your processes by offering straightforward digital functionality, which can integrate with key back-office systems and tools. A good example of how platform functionality can support you in helping manage clients’ income requirements is Drip-feed Drawdown.

Tax benefits of Drip-feed Drawdown

Drip-feed Drawdown is functionality that can help your clients take regular pension income in a tax efficient way. Rather than taking all their tax-free cash lump sum at once, smaller, regular portions of tax-free cash or a mix of tax-free cash and taxable income can be taken. This can help to to optimise a client’s tax position, make their pension more sustainable.

Drip-feed can be beneficial for clients in retirement who are close to the basic rate tax threshold, but also be of benefit to those who are near the higher or additional rate tax thresholds, especially as they transition into retirement.

Other benefits

Automated but flexible: In many cases the functionality provided by platform providers is fully digital and automated, helping save you time. Once regular payments are set up, they can be adjusted as required, giving future flexibility to better match clients’ future income needs.

Remains invested longer: Retirement pots that remain invested longer can potentially continue to grow, which may enable your client to accrue additional tax-free cash and helping with income sustainability.

Drip-feed Drawdown in practice

(three options to help deliver for a client)

- An adviser is contacted by Debbie, a senior manager aged 60 who wants to partially retire, but continue to work 4 days a week.

- She has been earning £60,000 per annum and wants to maintain her standard of living.

- Working four days a week means her new salary will be £48,000.

- Debbie has a Personal Pension on Scottish Widows Platform worth £600,000, which her adviser identifies as the best source to make up the £12,000 shortfall. She hasn’t previously taken any money from her pension.

- The £12,000 income previously received gave rise to £4,346 in tax (£2,270 taxed at 20% and £9,730 taxed at 40%). Meaning it generated a net income of £7,654 that broadly needs to be replaced.

Utilising Drip-feed Drawdown on the Scottish Widows Platform, the adviser identified three potential options:

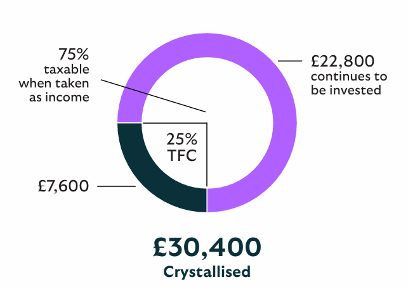

| Option A: Using only tax-free cash to replace the net income shortfall Debbie could set up Drip-feed Drawdown to crystallise £30,400 per annum. Withdrawing £7,600 as tax free cash and take no other income (meaning no tax would be payable). The remaining crystallised money would remain invested on the Platform until she needs to take further taxable income. Debbie wouldn’t trigger the Money Purchase Annual Allowance (MPAA) as she hasn’t taken any taxable income. |  |

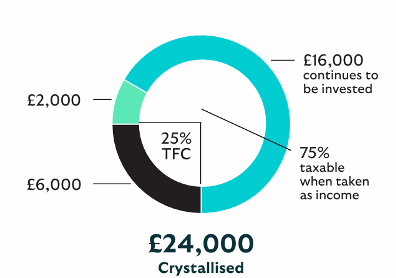

| Option B: Blending tax-free cash and taxable income to minimise higher rate tax on income payments Debbie could take just enough tax-free cash from her pension savings to minimise her tax bill and ensure none of her income payment falls into the higher rate tax band. Crystallising £24,000 per year via Drip-feed Drawdown, this will generate £6,000 of tax-free cash and then she can draw £2,000 as income which will be taxed at 20% (£2,000 at 20% = £400) for a net income of £1,600. When added to the tax-free cash this gives rise to a total net payment of £7,600. This leaves Debbie with broadly the same amount of income but reducing the amount of tax that she would have to pay. Debbie will trigger the Money Purchase Annual Allowance (MPPA) by taking taxable income from her pension. |  |

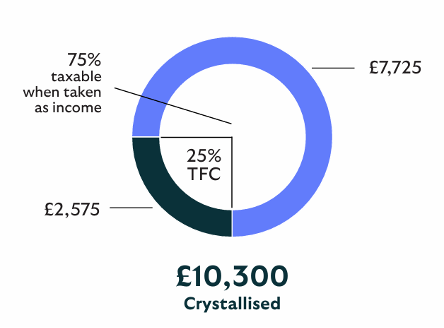

| Option C: Crystallising the minimum amount when taking income from her pension to replace the earned income By setting up Drip-feed Drawdown for £10,300, Debbie can withdraw £2,575 as tax-free cash and an associated income of £7,725. The tax on the £7,725 will be £2,636 (£2,270 will be taxed at 20% = £454 tax and £5,455 at 40% = £2,182). Giving a net income payment of £5,089. The tax-free cash and the income payment together will give Debbie a net annual payment of £7,664 covering her net income requirement. Debbie will trigger the Money Purchase Annual Allowance (MPPA) by taking taxable income from her pension. |  |

These examples are for illustrative purposes only and use the income tax rate bands that apply to England, Wales and Northern Ireland. National insurance contributions are not included in the examples.

How the Scottish Widows Platform can help

To learn more about Drip-feed Drawdown and how the Scottish Widows Platform can support you and your clients, visit our website or contact your Business Development Manager.

[1] FCA Retirement Income Market Data 2023/24

[2] ONS Overview of the UK Population 2021

[3] ONS Life Expectancy Calculator 2025

[4] Age UK & PPI Research 2023