Our criteria can be a bit of an eye-opener and we’re continually evolving to help your landlord clients.

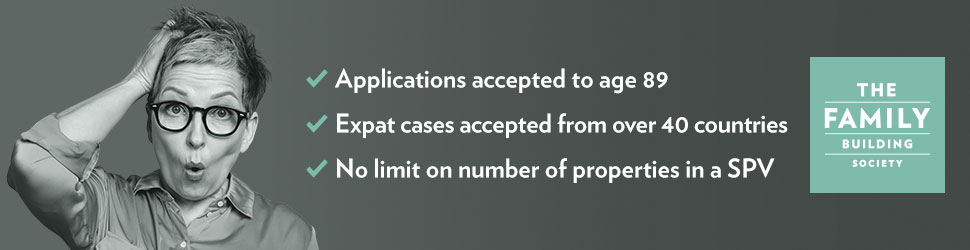

To open up new avenues for a growing Expat community, we’ve just launched 2-year and 5-year fixed rate products for Expats who own and operate a UK registered Limited Company.

Our reduction of Interest Coverage Ratios (ICRs) to 125% for Limited Company applications now allows for a more generous loan calculation for affordability assessments – making our Buy to Let products more accessible for your Limited Company landlord clients.

In recent years, houses in multiple occupation (HMOs) have gained significant traction in the rental market, reflecting evolving tenant demand and the increase in professional landlords wanting to diversify. Earlier this year, we launched an HMO offering and we’ve recently improved this by increasing LTVs up to 75%. This is a natural progression in our journey, establishing our strong position in the market.

Improvements to our products and criteria to help landlords in a challenging environment:

- New 2-year and 5-year Expat Limited Company BtL products

- ICR reduced to 125% for Limited Company applications

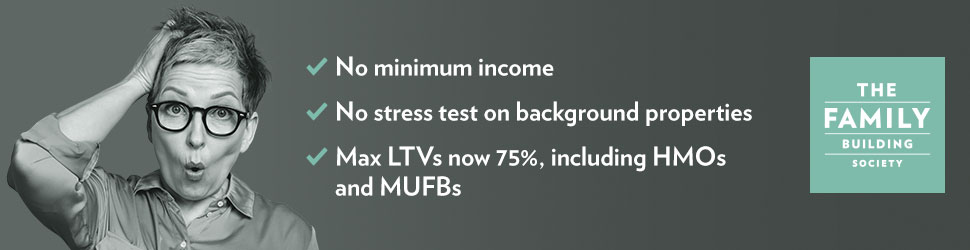

- HMO and MUFB applications now accepted up to a maximum of 75% LTV

- HMO products available for Limited Company and personal name BtLs, plus UK Expats abroad.

Buy to Let lending is a significant part of our business. And with around 95% of our business coming through intermediaries, we are continually evolving to help you to help your clients.

We don’t require landlords to have a minimum income, we don’t stress test on background properties held and there is no limit to the number of properties held in a portfolio. And with our manual underwriting approach, we consider each application on a case-by-case basis and make a common-sense decision for your client.

An optimistic outlook for a resilient sector

We know that with increased regulation, the approaching budget and looming Renters’ Rights Bill, landlords are facing a more complex landscape than ever before.

However the market is still strong. UK Finance shows a positive start for the year – in Q1 2025 there were 58,347 new Buy to Let loans in the UK, worth £10.5 billion. Compared to the same period in 2024, this was up 38.6% in volume and up 46.8% by value.

Rental yields are also strong with the average gross Buy to Let rental yield in Q1 2025 at 6.94%, compared with 6.88% in the same quarter in the previous year.

Interest rates are stabilising and recent clarification from the FCA has led to improved mortgage affordability. The housing market is proving to be resilient with stable house price growth and activity. We’ll continue to adapt to changing customer wants and needs to help your clients.

How can we help?

In line with our mission to provide support to landlords whether they’re large or small, our criteria is intentionally flexible. We have very generous terms when it comes to age and accept applications up to the age of 89 – a major differentiator that extends the helping hand to a wide range of clients.

A reminder of our criteria

- No stress test on background properties held (only self-financing properties required)

- Max LTV for BtL products now 75%

- Applications accepted up to the age of 89

- Expat cases accepted from over 40 countries, plus more through agreed packagers

- HMO products for up to 4 bedrooms

- Personal guarantees not required up to 65% LTV

- A common-sense approach to lending with real human beings to underwrite each mortgage case.

Our team of BDMs cover the whole of the UK so brokers always have a personal contact they can speak to. The close relationship between our BDMs and underwriting team is so important when dealing with complex cases, as applications can be discussed before submission. If a BDM can’t agree a case straightaway, they can discuss it with an underwriter who potentially may be able to agree an exception. This speeds up the process and adds a human touch which mainstream lenders are unable to offer.

This is how we, at Family Building Society, underwrite our mortgages. Case by case, story by story – catering for accidental landlords with one or two properties, to professional landlords with large portfolios.

We take great pride in the how we do things, and it works.

To contact our Mortgage Desk or your local BDM,

CALL US ON: 01372 744155

OR EMAIL: mortgage.desk@familybsoc.co.uk

| FAMILY BUILDING SOCIETY, EBBISHAM HOUSE, 30 CHURCH ST, EPSOM, SURREY KT17 4NL Family Building Society is a trading name of National Counties Building Society which is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. National Counties is on the Financial Services Register Firm Reference Number 206080. |