Zoopla has confirmed that it has updated the language used on its site around mortgages in principle (MIPs), following a discovery by The Intermediary that it could be misleading for prospective buyers.

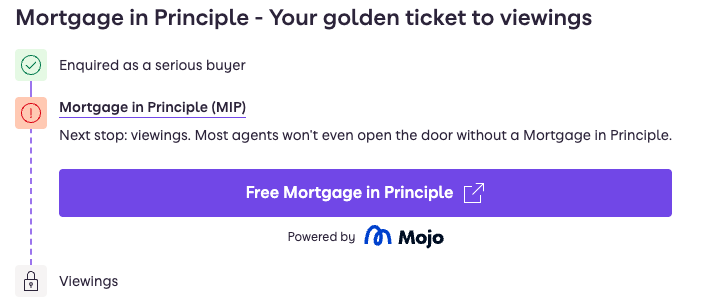

The update followed concerns raised by a journalist for The Intermediary over a page that suggested that “most agents won’t even open the door without a Mortgage in Principle.”

The page was navigated to as part of the process of booking a viewing for a property, and appeared in multiple tests across different listings, and linked to different estate agents.

This was used alongside visuals that could imply that the viewings stage of the process was in fact ‘locked’ from the buyer, until buyers completed the step of gaining a MIP, specifically from Zoopla’s own third-party provider, Mojo Mortgages.

Agents for the agency in question confirmed that this was not their policy, and that whether or not it is better for the buyer to have an MIP, they receive viewing requests – and act on them – regardless of whether one is in place.

The wording and imagery appeared in the same format on multiple instances of testing in different environments and in relation to a range of estate agencies and listings.

Earlier this year, a Panorama investigation alleged that Connells and Purplebricks used high-pressure tactics to push in-house mortgage and conveyancing services, raising concerns over ‘conditional selling’, though both firms denied treating customers unfairly.

In 2024, a survey by Access Financial Services found that 63% of its mortgage advisers reported client experiences of conditional selling, which CEO Karl Wilkinson condemned as a breach of Consumer Duty and industry codes.

Considering the environment of continued and heightened awareness of the issues with conditional selling – namely pressuring or implying to buyers that their offer or ability to view a property depends on using in-house services – The Intermediary raised concerns around the language and imagery with Zoopla.

A spokesperson for Zoopla said: “Our primary goal at Zoopla is to help consumers win at moving and make the home-buying process more efficient and easier for everyone.

“We are currently running a series of tests around affordability and the mortgage journey on our site to see what work best for consumers.

“This particular test was seen by a very small number of users.

“The language could have been clearer and we have now updated this based on the feedback received.

“Affordability is a key part of the home buying journey for the majority of home buyers who use a mortgage.

“In order to be best prepared, homebuyers should understand what they could afford before starting their search for a property, especially when competition is strong.”

Zoopla has updated the language on one of its site tests around affordability and the mortgage journey.

Following a further test, the wording has since been changed to “Mojo can help you understand what you could afford,” with further information about the service on offer, and the imagery of locked viewings has been removed.

The Intermediary has reached out to Mojo Mortgages for comment.