At this time of year, it’s hard to ignore the media coverage speculation around the Budget and what Rachel Reeves may or may not announce, which differs depending on your preferred publication.

Anyone who knows me well knows I avoid any attempt at crystal ball gazing, but there’s no avoiding that the Budget is a hot topic, particularly when it comes to tax.

So, I asked fellow Landlord Leaders community member and Tax Expert, Simon Thandi from UK Landlord Tax about his thoughts on the current tax position and the likelihood of any changes – in particular, those that centre around property investment and which are important for brokers to be aware of and weave into their conversations.

Simon has kindly given his predictions from a tax perspective and has agreed to a Budget follow up to track any changes as well as discuss their impact.

Simon Thandi’s Tax Explanation

1. Tax considerations for when you buy

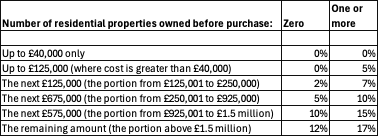

Stamp Duty Land Tax (SDLT): The current rates of stamp duty for UK residents in England are as follows:

Simon’s prediction:

“I’m anticipating that there will be no further increases in SDLT as it has become one of the most complex taxes for landlords and one that is stopping transactions that may otherwise have gone ahead.

“There have been some rumours of a complete overhaul of SDLT with a more graduated way to pay the tax, ie instead of paying all of the SDLT up front, you pay it in annual instalments over say five years with the full balance becoming due if you sell before the full period has passed.

“Other commentators have speculated that a more gradual rate of SDLT would be helpful. So instead of a cliff edge where the rate jumps enormously if you go £1 over a rate band, having a more graduated rate for a smoother less brutal increase.”

2. Tax considerations for when you receive rental income

Income Tax: If ownership is in personal names

Corporation Tax: If ownership is through a limited company

Other taxes are:

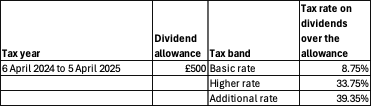

Tax on dividends: Payable when you extract profits from a limited company

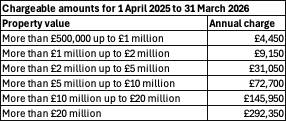

ATED (Annual Tax on Enveloped Dwellings): for landlords with property valued at over £500k in a limited company

VAT: payable by landlords who have furnished holiday lets or let property on platforms such as Airbnb

Personal tax rates are currently as follows:

| Band | Taxable income | Tax rate |

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | over £125,140 | 45% |

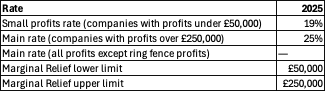

Corporation tax rates are:

Dividends

ATED

VAT

Simon’s prediction:

“When I first started writing this, the air was thick with rumours that there will be an increase in the basic income tax rate, meaning any increase will also therefore apply to profits made by landlords. However, just this week it has been reported that these plans have been scrapped, but one to keep an eye on!

“There have also been rumours of national insurance being charged to landlord profits.

This would be a major step and is one that has been rumoured before. I recall shortly after the famous Ramsey v HMRC case where the Court of Appeal judged Elizabeth Ramsey to be operating a business and was therefore eligible to claim S162 Incorporation relief in transferring her properties to a limited company.

“This was followed by some overzealous HMRC officers issuing national insurance contribution (NIC) demands to some of our landlord clients. It was done completely without any changes to legislation or government approval on the basis that rental income was now no different to trading income.

“We asked them that if they were going to treat the profits of landlords in the same way as sole traders, would they allow for any rental losses to be offset against other taxable income in the same way? At which point the NIC demands were removed and nothing was heard of again.

“The airwaves are once again noisy with speculation that the Chancellor may well impose NI charges on landlord profits. This will undoubtedly be a further blow to landlords who own property in their personal names and increase the use of limited companies as the way to invest in property.

“On corporation tax, there has been no indication of any changes in the offing. Given the NI increases last year and the dire economic growth rates since, I think even this Chancellor is not looking to make any changes here. There is still however the possibility that she may impose a restriction on tax relief on interest to the basic rate of corporation tax of 19%, for residential property investment activity, in much the same way as was done by the last Conservative government in restricting mortgage interest relief to the basic rate for private landlords.

“As to ATED and dividends, I do not expect any changes.

“VAT is one tax that might be looked at. Rumours have been afloat that the Chancellor may drop the VAT threshold to £50,000 in an attempt to level the playing field for small businesses.

It has been said that many self-employed people simply stop trading if their turnover reaches £90,000 to avoid having to register for VAT.

“By dropping the VAT registration threshold to £50,000 this would force a large number of small traders into the same position as larger businesses and take away the advantage of not having to charge VAT.”

3. Tax considerations for when you sell property

Capital Gains Tax (CGT): When you sell a property held in your personal name

Corporation Tax: When you sell a property held in a limited company

Simon’s prediction:

“Much to my surprise, and that of many other commentators, CGT was left completely untouched at the last budget except for changes to the rates under Business Asset Disposal Relief (BADR).

“The expectation was that CGT rates on the sale of second properties would be brought into line with income tax rates of 20%, 40% and 45%.

“This time around I would not be surprised if there was an alignment of the rates of CGT on the sale of rental property. There have also been rumours of an annual wealth tax applying to properties over a certain value. We could well see something of this sort being brought in together with a tax on the sale of some private residences too.”

4. When you pass away

Inheritance tax (IHT): Payable on the estate of a deceased person

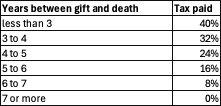

The nil rate band of £325,000 has not changed since 2009. The tax rate payable above this is 40%. If you are leaving a main residence, a further £175,000 nil rate allowance is available. A single person can therefore leave up to £500,000 and married couple £1m. IHT falls away if you make a gift as follows:

Simon’s prediction:

“I think one thing is for certain as far as I am aware: there will be no reduction in IHT.

As to whether there will be any increases, this is definitely something that would not come as a surprise. Some means of taxing landlords an additional amount would not be out of the question so I will be watching the Budget, as intently as everyone else.”

Conclusion

It’s worth mentioning the government’s initiative to modernise the tax system called Making Tax Digital, which is a huge change coming in in April 2026. Landlords with gross rental income of more than £50,000 will be mandated into reporting their income and expenses quarterly from April 2026. It does not apply to limited companies.

Finally, as with all Budgets, the devil is in the detail. Headline announcements in Parliament are often unravelled when the full details are published in the official Budget Report which runs to well over 100 pages.

I will be poring through this intensely and will publish a post budget update on all of the taxes mentioned above, setting out the changes and how these may impact the conversations brokers have with landlords.

Adrian Moloney is group intermediary director at OSB Group