UK average house prices increased by 12.4% over the year to April 2022, up from 9.7% in March 2022, according to the latest figures from the Office for National Statistics (ONS).

That put the average UK house price at £281,000 in April, some £31,000 higher than the same time last year.

Average house prices increased over the year in England to £299,000 (11.9%), in Wales to £212,000 (16.2%), in Scotland to £188,000 (16.2%) and in Northern Ireland to £165,000 (10.4%).

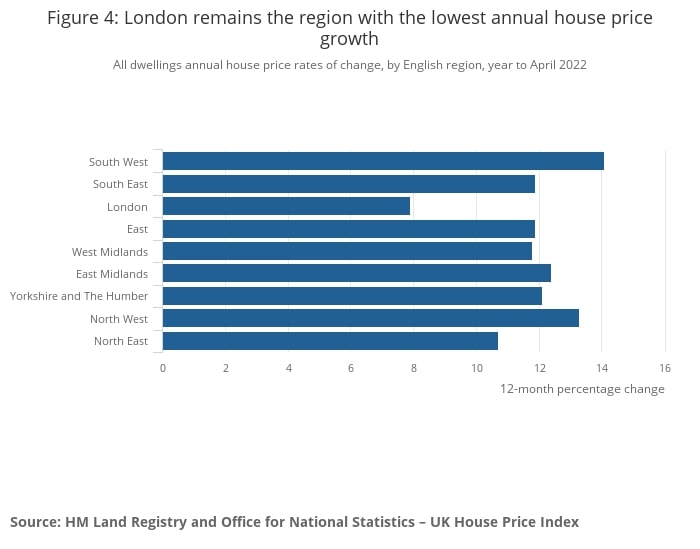

London continues to be the region with the lowest annual growth at 7.9%.

Reaction

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Price changes can reflect stock shortages as well as regional and house type variations, as reflected in this, the most comprehensive of all the market surveys.

“But its inevitable historic nature means it is not yet showing the softening in demand picked up by other reports over the past few weeks.

“We are seeing increasing nervousness about taking on debt at a time when buyers and sellers have no real clue as to when and how the rising cost of living will start to level out.

“Nevertheless, continuing lack of choice and strong employment prospects means there is still little chance of significant price changes over the next few months at least.”

Anna Clare Harper, director of real estate technology platform IMMO:

“UK HPI data shows annual house price growth of 12.4%, led by the South West, East Midlands and Yorkshire and the Humber.

“The natural next question is: why are house prices still booming in the context of post-Covid, post-Brexit and mid-Ukraine turmoil? The problem is much the same as that affecting the wider economy – shortage of supply. This is particularly acute for properties for sale and indeed for rent which are affordable, in places people want and need to live, and of good quality.

“Suitable, affordable housing shortages are being made worse by planning backlogs from lockdown alongside labour and material shortages and inflationary pressures, alongside the fact that many new build schemes are unaffordable to local people.

“The result is an ongoing and growing constraint on the affordability of home ownership. In England, full-time employees could expect to spend 9.1 times their annual earnings on purchasing a home in 2021, and this figure is not improving with the latest HPI data highlighting that house price growth continues to outpace wage growth.”

James Briggs, head of personal finance intermediary sales at specialist lender Together:

“The housing market continues to show how unpredictable it can be, as property prices rose to 12.4% in April, despite wider economic turmoil and inflationary pressures., However, I’d expect to see the increased cost of living, leading to squeezed household finances paving the way for a more sluggish housing market this summer.

“The Bank of England’s decision to withdraw their stress testing recommendations this August has had mixed reviews. While this could mean more first-time buyers are able to overcome strict lending criteria barriers, there are fears this move will only further inflate the market as demand outstrips supply and wage growth.

“With consumer confidence at an all-time low and mortgage rates on the rise, buyers may be more hesitant in increasing their debt and instead may shift their financial priorities towards battling rising household costs.”

Peter Beaumont, CEO at The Mortgage Lender:

“The property market continues to defy laws of financial gravity as house prices continue to increase year-on-year. However, the market faces strong headwinds in the form of rising interest rates, inflation, and cost of living, all of which puts considerable affordability constraints on home buyers. This may set the scene for a cooling of the market, but the imbalance of supply and demand still pushes against this trend.

“As the Bank of England also announced its fifth consecutive interest rate rise, existing home owners and prospective home buyers will be looking to lock in fixed rate deals in order to shelter them from any further rises that are expected for the year ahead.

“That said, there is also a growing trend for people taking tracker mortgages with no early repayment charges in case the base rate doesn’t increase as high as predicted. For those looking to re-finance or step foot on the property ladder, looking beyond traditional lenders who offer alternative options might better help support consumers with their property ambitions.”

Gareth Lewis, commercial director of property lender MT Finance:

“While house prices have gone up again, there are glimmers of a softening in the south east and east Midlands, even if only marginally.

“One would expect this trend to be reflected more widely in subsequent surveys as the cost of everything goes up and buyers haggle more for a deal. With some chains collapsing because of rising costs, it will be interesting to see what will happen in coming months as the squeeze on incomes continues.

“While the lack of stock means the best houses are always going to sell, and sell well, the price rises we have seen are not sustainable.”

Paul McGerrigan, CEO at national fintech broker Loan.co.uk:

“The strong price growth figures for April, of 12.4% over the year and 1.1% month on month, show there are no signs of the property market slowing, which is remarkable considering the forces pushing against it.

Lack of supply, the continued trend toward remote working and the need for extra space are still outweighing the negative factors of inflation, rising mortgage rates and uncertainty but the question is for how long.

“The softening of stress test rules for mortgage lenders, is an attempt by Government to combat the impact of inflation on affordability and grease the wheels of the lending market to maintain a healthy property market in the second half of the year. Lenders will proceed with caution.

“The ongoing war in Ukraine continues to play a large part in driving living costs upward which will inevitably impact borrowing and therefore property prices in the future. Rising interest rates may start to deter the cautious and price growth will slow in the coming months.

“With the changing market, the role of mortgage brokers is ever more vital to assist those seeking to enter the market or climb the property ladder.”

Kay Westgarth, head of sales at Standard Life Home Finance:

“Today’s news is another unmistakable sign that whilst the UK property market is resilient, there may be changes on the horizon, with prices dipping slightly from the highs seen earlier this year.

“As demand continues to outpace supply and homeowners weather the cumulative effect of creeping base interest rate increases, alongside a spiking cost of living, it’s hardly surprising that many would-be homeowners may be delaying their plans to purchase a dream property.

“Although some aspiring buyers are delaying their homeowning dreams, the Bank of Granny and Grandad is still very much open for business and keen to support where possible.

“Indeed, with increasing numbers of over-55s considering what role housing equity can plan in their later life financial planning, almost one in five equity release customers also used the proceeds to support their wider family.

“In a market where lenders are increasingly offering new and fresh products, advisers can access a range of tools to help older clients understand how they assist younger relatives to step onto the competitive housing ladder.”

Karen Noye, mortgage expert at Quilter:

“The government’s UK house price index for April shows that while the steady march of increasing house prices finally looks set to be slowing, it has not been completely stifled, with the average house now costing £281,161.

“The average house price increased by 12.4% in the year to April 2022, up from 9.8% in the year to March 2022. Month on month the average price increased by 1.1%, up from a monthly price change of 0.3% in March. This uptick in house prices is likely due to a number of factors, including people pushing to buy ahead of any further Bank of England rate rises as a result of soaring inflation.

“Just last week the Bank of England hiked interest rates to 1.25% as it now predicts inflation to hit more than 11% later this year. Soaring inflation, the rising cost of living, high energy bills which are set to increase even further in October and minimal support from the government mean many people are feeling the pressure financially.

“What started out as a ‘pinch’ on people’s finances is now a heavy burden on an increasing number of households. With wages failing to keep up, the high costs of moving home will put off prospective buyers and first-time buyers will see their hopes of getting a foot on the property ladder pushed further out of reach.

“As of this morning, inflation now sits at 9.1% and people are struggling with the worst food and energy price hikes for decades. As such, the housing market could see a slowdown in the coming months as the cost-of-living crisis further takes its toll, and house prices could fall as a result.

“The UK continues to face a severe financial problem and while the housing market managed to defy expectations and overcome the immediate problems of the pandemic, the cost-of-living crisis will no doubt be its biggest challenge yet.”

Kevin Roberts, director, Legal & General Mortgage Club:

“Even following last year’s frenetic levels of activity, it is clear to see that the UK housing market hasn’t yet run out of steam, even if there are signs that momentum is starting to stabilise. One of the major groups driving activity, and with it house prices, are first-time buyers.

“Despite the rapidly approaching deadline for the end of the Help to Buy scheme, there are still a lot of options for borrowers with smaller deposits to take their first step on the property ladder. The availability of high LTV mortgages, for instance, has been vital to supporting these would-be homeowners.

“The wide range of the products on offer, as well as the prospect of further rate rises and frequent re-pricing of existing offers by lenders, mean that the role of the adviser in this environment is crucial.

“Following the fifth consecutive interest rate hike, borrowers are likely to need the support and guidance of an adviser to source a mortgage that aligns with their financial needs. This is a clear window for advisers to show that they’re truly worth their weight in gold, during what may be a confusing and stressful time for prospective buyers.”

Nicky Stevenson, managing director of national estate agent group Fine & Country:

“Few were predicting that house price growth would rally amid all the pessimism in the broader economy — but that’s exactly what has happened.

“Gains are being driven in part by equity-rich homeowners looking to trade-up, with prices of detached homes surging faster than any other property type.

“Though London remains the slowest of the regions, annual growth in the capital has almost doubled compared to the previous month’s data and prices of apartments are spiking too following a lull witnessed during the pandemic.

“While there has been a sense for some time that the housing market is approaching a crossroads, forecasts of a correction are so far proving very premature indeed.”

Alex Lyle, director of Richmond estate agency Antony Roberts:

“Put an ambitious price on a property with a smart address and it will be met; do the same with a ‘B grade’ property and you won’t get the same result.

“Large family houses in the £1.5m-plus bracket are still going to best-and-final offers but things that need work are more of a struggle as people are nervous about rising building costs. Flats are also sticking, especially those with no outside space.

“Areas such as Richmond are doing well for many reasons but good schooling is key – the cost of private education is now so high that many buyers are leaning towards state schools, with several outstanding examples in the borough.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“With inflation soaring to a 40-year high of 9.1%, cost of living increases and a string of rate rises from the Bank of England, there is growing concern around affordability and borrowing potential, as well as the potential knock-on effect to house prices.

“Mortgage rates remain competitive although they are on the rise. Borrowers need to move quickly to secure the best fixed rates as they are often pulled at short notice. With service levels varying considerably between lenders, it may take longer than borrowers anticipate, particularly if their case is complex.”

Colin Bell, Co-Founder and COO, Perenna:

“Today’s news that the UK average house price has risen by 12.4% over the year to April 2022 will make for concerning news for first-time buyers, many of whom are already facing higher interest rates and a rising cost of living that could scupper their chances of stepping onto the property ladder.

“With the Help to Buy scheme coming to an end soon, the sector needs to rethink how it supports first-time buyers, now more than ever.

“Flexible long-term fixed rate mortgages offer protection from interest rate rises and they can provide a solution to some of the barriers facing those looking to buy their first home.

“They allow individuals to better manage their monthly outgoings, while offering the peace of mind, during this tough economic climate, that the monthly mortgage bill will remain unchanged.”

Iain McKenzie, CEO of The Guild of Property Professionals:

“Just when it seems that house price growth is starting to slow, along come these figures showing an almost 3% rise on last month.

“The average home now costs over £30,000 more than it did this time last year, but with sluggish wage growth and lower disposable income, it may feel like the goal posts have been moved for first-time buyers.

“The market may not be running away for everyone though, with parts of Scotland and Northern Ireland experiencing lower house price inflation.

“Estate agents are still seeing an imbalance between supply and demand, with potential buyers queuing up as soon as properties come up for sale. When this eventually begins to narrow, we may see house prices cool down to more achievable levels.”

Nitesh Patel, strategic economist at Yorkshire Building Society:

“Annual house price growth further accelerated from 9.7% in March to 12.4% in April. This rise comes on the back of strong mortgage volumes at the end of 2021 and early this year.

“The average UK house price was £281,161 – a record high – in April 2022; in cash terms this represents an increase of £30,951 in the past year, which is more than what many earn.

“Across the country prices performed strongly, particularly in Wales and Scotland growing by 16.2% since last April, followed by the South West (14.4%). Even in London, which had the slowest price growth, saw property prices grow by a chunky 7.9% in the past year.

“A key challenge in the current housing market is the lack of supply of homes for sale whilst demand continues to remain strong – there are some tentative signs that this imbalance may be easing.

“Low borrowing costs and a strong jobs market are key drivers but in the coming months a further deterioration in household finances may take some of the heat out of the market.

“With the Bank Rate now at 1.25% this will mean mortgage rates will also rise, though not to levels seen before the Financial Crisis. As a result, we expect market activity and price growth ease in the coming months.”

Michael Bruce, CEO and founder of Boomin:

“It’s important to remember that while sold prices provide the most concrete health check of the UK property market, they are reported on a lag.

So while the market remains apparently unphased by a spate of base rate jumps and consequential impact this is likely to have on the spending power of UK buyers, the reality is that this declining market sentiment is yet to bubble to the surface.

However, while these growing economic headwinds may rock the boat of house price growth, sustained and robust levels of buyer demand, coupled with a shortage of stock, are sure to prevent a significant drop.”

James Forrester, managing director of Barrows and Forrester:

“We can expect to see UK property values continue to hold their own over the coming months, as the supply demand imbalance continues to negate any wider economic influence.

For every one buyer struggling with the financial task of climbing the ladder, there are three or four with a mortgage in principle and an existing property to act as financial collateral in order to fund their ongoing purchase.

It remains an incredibly competitive market and while we’re unlikely to see these extraordinary rates of house price growth persist in the long-term, bricks and mortar continues to provide a very sound investment.”

Geoff Garrett, director of Henry Dannell:

“Many prospective buyers are now finding that they simply aren’t eligible for the same level of mortgage financing that was available to them just a few short months ago, with many more struggling with affordability due to a squeeze on their disposable household income, coupled with increasing mortgage rates.

This has led to a small but gradual reduction in the number of buyers entering the market. Whilst this is yet to translate to a softening of prices, it is inevitable that property values will start to reduce as demand subsides.”

Jonathan Samuels, CEO of Octane Capital:

“A reduction in the range and affordability of available mortgage products means that many homebuyers are now having to reevaluate their purchasing power in the current market.

While this won’t make them any less determined, it will impact the number of buyers entering the market and the price they are willing to pay, which in turn, will inevitably curb the buoyant rates of house price growth seen over the last two years.”

Marc von Grundherr, director of Benham and Reeves:

“The London property market looked set to perform very well in 2022, but this performance has been somewhat inconsistent of late.

“This unpredictable performance has been no doubt influenced by the Ukraine conflict, with Russian demand for London’s most sought after properties remaining muted following a string of government sanctions.

“However, with the financial pedigree of homebuyers in the capital amongst the strongest in the world, rising inflation and the increasing cost of buying are far less likely to act as a deterrent and we expect the London market to stand firm over the coming months, as dark clouds gather across the rest of the UK.”

Nathan Emerson, Propertymark CEO:

“The cost-of-living pressures will inevitably start to show up in the housing market, however, our member agents are saying buyers continue to outnumber available properties by around 10 to one, and that 80% of accepted offers are at or over asking prices.

“Mortgage rates are rising but from an historically low base so we are not seeing a major impact just yet. It looks likely that there will be more increases in the coming months so there will be buyers who may want to enter the market before rates go even higher.

“That’s going to continue to fuel demand and keep sold prices well up year-on-year for a little while yet.”