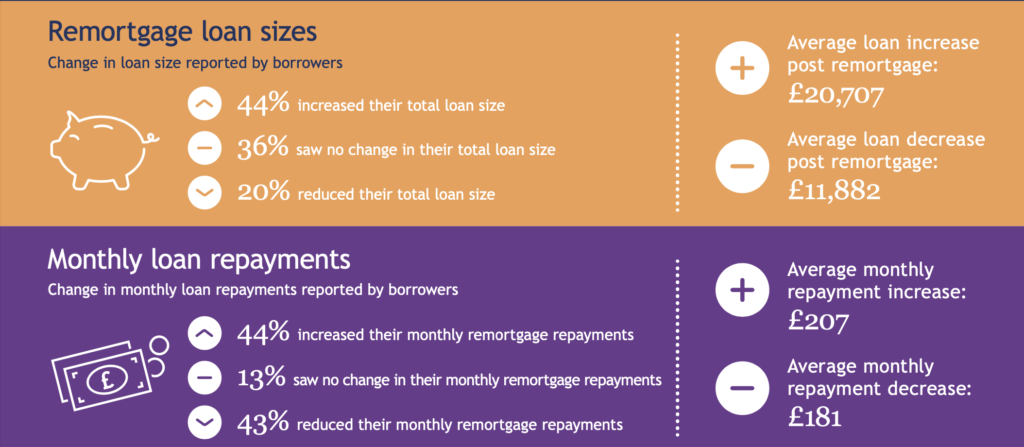

The average monthly mortgage repayment for borrowers who remortgaged in May increased by £207, according to the latest Remortgage Snapshot from LMS.

Some 44% of borrowers increased their loan size in May while 63% of those who remortgaged took out a 5-year fixed rate product, the most popular product during the month.

26% said their main aim when remortgaging was to lower their monthly payments, the most popular response.

The average remortgage loan amount in London and the South East was £308,432 while the average for the rest of the UK stood at £140,564 putting remortgage loan amounts 119% higher in London and the South East than the rest of the UK.

The longest previous mortgage length was found in the North East at 80.65 months (6.72 years) and the shortest was in the South East at 70.13 months (5.84 years), putting the longest previous mortgage term 15% longer than the shortest.

“With the deepening cost of living crisis, consumers need competitive longer-term fixed rate products”, said Nick Chadbourne, CEO of LMS. “The figures show that there has been a substantial increase in instructions indicating higher consumer demand and increased market activity, as predicted last month.

Consumers are looking to make savings in light of the cost of living crisis and further base rate rises, trying to lock in competitive, longer-term fixed rate products ahead of the next ERC date at the end of June.

“This was also reflected in the way 5-year fixed rate products not only remained the most popular product in May, but the amount of people taking them out, compared to other products, was up by nearly 10% from April.

“This is because, in addition to offering longer-term financial security, many fixed rate products for five or more years are now cheaper than two-year fixed rate products.

As such, lenders will try to remain competitive and even consider the possibility of widening their range to include 7-year or 10-year fixed rate products.

“That said, uncertain economic conditions make affordability much more of a prominent factor. We should expect lenders to become more cautious when it comes to their risk profile, and rightly so.”