Annual house price growth slowed again to 10.7% in June – from 11.2% in May, according to the latest house price figures from Nationwide.

Back in March, annual growth was at 14.3% – the highest level seen in almost eight years. During June, prices grew just 0.3% (seasonally adjusted) – the third consecutive month under 1%.

The past three months combined have seen growth of 2.6% with the average house price now standing at a record high of £217,613.

Robert Gardner, Nationwide’s chief economist, said: “UK annual house price growth slowed modestly to 10.7% in June, from 11.2% in May. Prices rose by 0.3% month-on-month, after taking account of seasonal effects, the 11th consecutive monthly increase.

“The price of a typical UK home climbed to a new record high of £271,613, with average prices increasing by over £26,000 in the past year.

“There are tentative signs of a slowdown, with the number of mortgages approved for house purchases falling back towards pre-pandemic levels in April and surveyors reporting some softening in new buyer enquiries. Nevertheless, the housing market has retained a surprising amount of momentum given the mounting pressure on household budgets from high inflation, which has already driven consumer confidence to a record low.

“Part of the resilience is likely to reflect the current strength of the labour market, where the number of job vacancies has exceeded the number of unemployed people in recent months. Furthermore, the unemployment rate remains close to 50-year lows.

“At the same time, the stock of homes on the market has remained low, which has helped to keep upward pressure on house prices.

“The market is expected to slow further as pressure on household finances intensifies in the coming quarters, with inflation expected to reach double digits towards the end of the year.

“Moreover, the Bank of England is widely expected to raise interest rates further, which will also exert a cooling impact on the market if this feeds through to mortgage rates.

Most regions see slight slowing in price growth

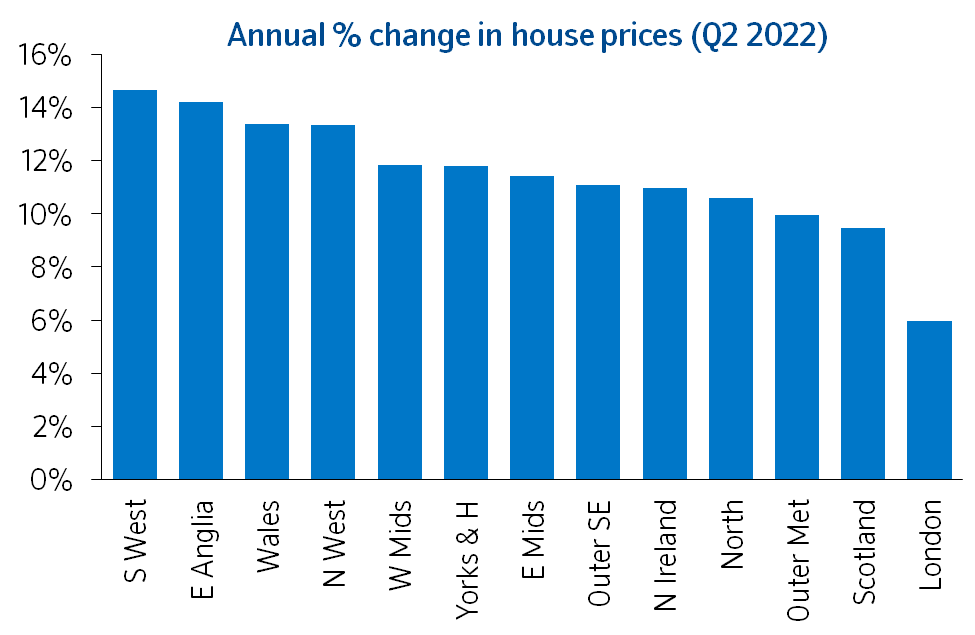

“Our regional house price indices are produced quarterly, with data for Q2 (the three months to June) showing a softening in annual house price growth in nine of the UK’s 13 regions (see table on page 4).

“The South West overtook Wales as the strongest performing region in Q2, with house prices up 14.7% year-on-year, a slight increase from the previous quarter. This was closely followed by East Anglia, where annual price growth remained at 14.2%.

“Wales saw a slowing in annual price growth to 13.4%, from 15.3% in the first quarter. Price growth in Northern Ireland was similar to last quarter at 11.0%. Meanwhile, Scotland saw a 9.5% year-on-year rise in house prices.

“There was a slowing in annual house price growth in England to 10.7%, from 11.6% in the previous quarter. While the South West was the strongest performing region, overall southern England saw weaker growth than northern England.

“Within northern England, the North West was the strongest performing region, with price growth picking up to 13.3% year-on-year, from 12.4% in the first quarter.

“London remained the weakest performing UK region, with annual price growth slowing to 6.0%, from 7.4% in the previous quarter.

South West strongest performing region through the pandemic

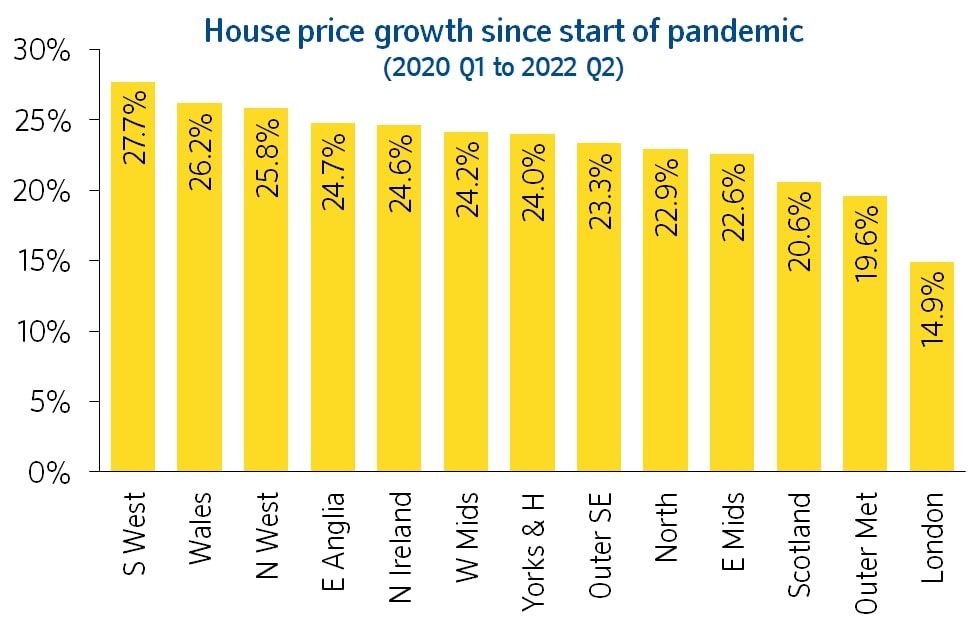

“Looking at house price growth since the onset of the pandemic, we see a similar pattern, with London also the weakest performing region. Since 2020 Q1, average house prices in the capital have increased by 14.9%, whilst all other regions, except the Outer Metropolitan, have seen at least a 20% uplift.

“The South West was also the strongest region over this period, with a 27.7% increase, after taking account of seasonal effects, followed by Wales, where average prices rose 26.2%. Meanwhile in the North West, prices were up 25.8%.

“These trends may reflect a shift in housing preferences; our housing market surveys have pointed to the majority of people looking to move to less urban areas.

“Our research found that predominantly rural areas have seen stronger price growth in recent years than predominately urban areas. We’ve also seen strong house price growth in a number of areas closely associated with tourism, including parts of Devon, South Wales, the Cotswolds and the Broads. This suggests some of the demand may be being driven by those buying holiday or second homes.”

Quarterly Regional House Price Statistics (Q2 2022)

Please note that these figures are for the three months to June, therefore will show a different UK average price and annual percentage change to our monthly house price statistics.

Regions over the last 12 months

| Region | Average Price(Q2 2022) | Annual % change this quarter | Annual % change last quarter |

|---|---|---|---|

| South West | £318,325 | 14.7% | 14.4% |

| East Anglia | £289,024 | 14.2% | 14.2% |

| Wales | £208,309 | 13.4% | 15.3% |

| North West | £213,888 | 13.3% | 12.4% |

| West Midlands | £244,167 | 11.8% | 11.7% |

| Yorks & the Humber | £205,714 | 11.8% | 13.5% |

| East Midlands | £234,828 | 11.4% | 13.5% |

| Outer SE | £348,564 | 11.1% | 12.8% |

| N Ireland | £181,550 | 11.0% | 11.1% |

| North | £159,283 | 10.6% | 10.6% |

| Outer Met | £433,558 | 10.0% | 11.4% |

| Scotland | £181,422 | 9.5% | 12.0% |

| London | £540,399 | 6.0% | 7.4% |

| UK | £270,452 | 11.4% | 12.6% |

UK Fact File (Q2 2022) | |

|---|---|

| Quarterly average UK house price | £270,452 |

| Annual percentage change | 11.4% |

| Quarterly change | 2.6% |

| Most expensive region | London |

| Least expensive region | North |

| Strongest annual price change | South West |

| Weakest annual price change | London |

Reaction

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown:

“House price rises have slowed to a crawl. The annual figures look impressive at 10.7%, but for the past three months we’ve seen less than 1% growth each month, and 2.6% growth in total. It’s like lunchtime for a mountain climber. If you focus on how far you climbed earlier, it’s easy to miss the fact you’re not going anywhere in a hurry right now. The question for any climber is what comes next: more slow progress or a fall?

“Annual house price growth hit a high point in March, but has been dropping back ever since. This isn’t coming as a shock to anyone, because we were just waiting for the huge challenges facing buyers to feed into the figures.

“Rocketing house prices themselves have taken a toll. Since the onset of the pandemic, every area apart from London and its immediate surroundings have seen prices rise by at least a fifth. In the South West, growth over this period has hit an eye-watering 27.7%, and in Wales it’s 26.2%. There comes a time when prices simply rise out of reach for anyone hoping to buy a first property or move significantly up the ladder.

“At the same time, inflation is inflicting incredible pain on buyers. They don’t just face the problem that the rising price of everything from energy to food and fuel makes it difficult to stretch to a bigger mortgage, they also face the concern of mortgage lenders, who feed these figures into affordability calculations and conclude that they can’t afford the move.

“It doesn’t help that wages have fallen so far behind inflation. Lenders prefer to take into account your usual salary – without bonuses – and after inflation these have dropped 2.2% in a year.

“As the Bank of England raises rates to keep inflation under control, this also puts a dent in buyer enthusiasm. Mortgage rates are still low by historic standards, but they are rising every month, which raises the spectre of much higher payments further down the line.

“The question is whether we will see prices slow to a crawl, stagnate, or start to drop if we see a recession. An awful lot depends on things we don’t yet know – including how high interest rates will go, how deep any recession might be, the impact it could have on jobs, and whether this is serious enough to cause real damage to the property market.

“Certainly the risks on the downside are starting to build. We’re seeing the first predictions of price drops, and while these are currently a few voices in the crowd, they’re highly unlikely to be the last.

“For anyone planning to buy right now, it’s going to give them pause. The desperate dash for property at a time of rocketing prices may be over. Buyers have time to consider whether this is a move they can really afford, and whether they’ll still be happy they made it if prices pull back later in the year.”

Geoff Garrett, director of Henry Dannell:

“There’s no doubt that increasing interest rates have dampened buyer appetites during the second quarter of this year and this is starting to show in the form of a more modest rate of house price growth.

“Despite this tightening of the belt, a robust level of market activity coupled with ongoing stock shortages has seen house prices continue on their upward trajectory to hit record highs.

“While property price performance is impressive given the wider economic backdrop, we expect this trend to subside in the relative short term, with some adjustments likely to materialise throughout the remainder of the year in the form of a reduction in property values.”

Roxana Mohammadian-Molina, chief strategy officer at Blend:

“Despite the general slowdown in UK house price growth, what’s really interesting is to observe the regional divergence.

“Today’s data shows that London remains the weakest performing region for house price growth since the start of the pandemic, while other regions such as East Anglia and the Southwest – two of the regions where we have recently funded a number of development schemes – saw more than double the growth seen in the capital.

“These numbers are very much in line with the trends we observe, and as specialist development finance lenders, it remains our priority to continue to support SME property developers and small construction companies who have the capacity and the commitment to deliver the houses the country needs.”

Chris Hodgkinson, managing director of HBB Solutions:

“There’s no doubt that the property market has performed impressively during the pandemic but this rate of growth simply isn’t sustainable in the long-term and we’re now seeing early signs that the winds of change are beginning to pick up.

“We’ve already seen mortgage approval levels start to slide and the lagged nature of the transaction process means that it won’t be long before this materialises in the form of both a reduction in transactions and the price paid in the process.”

Marc von Grundherr, director of Benham and Reeves:

“We’re yet to see any notable decline in the rate of house price growth across the UK market and, despite a serious strain on household finances causing consumer confidence to plummet, these stronger economic headwinds are yet to blow the house down.

“In fact, UK bricks and mortar is far from a house of cards ready to topple at the first sign of uncertainty and we’ve seen a royal flush of house price growth continue to sweep across all regions of the market.

“London remains the jewel in the crown where outright property values are concerned and even though the capital has seen the lowest rate of growth of all UK regions, a six per cent jump is still considerable when you consider the pounds and pence return that homeowners have enjoyed over the last year.”

James Forrester, managing director of Barrows and Forrester:

“We’ve come accustomed to some quite remarkable rates of house price growth during the pandemic property market boom and while this has been replaced by more incremental growth rates in 2022, an 11th consecutive month-to-month increase demonstrates an extremely resilient market.”

Tomer Aboody, director of property lender MT Finance:

“With interest rates rising along with inflation, a slowdown in growth is not surprising. However, there is still evidence of confidence in the market due to the desire to buy and take advantage of mortgage rates before they increase further.

“The south west saw the biggest increase in prices due partly to comparatively lower values to start with but also down to the extra space which house buyers are able to buy in these locations compared with London. The capital remains the most expensive part of the country in which to buy property, which is why it is seeing the slowest growth due to problems with affordability and relative lack of buyers able to buy.”

Jeremy Leaf, north London estate agent and a former RICS residential chairman:

“Even though prices are not rising quite as rapidly as they have been, property market resilience continues to defy the laws of economic gravity.

“We are finding that activity is more determined by lack of choice than recent cost-of-living and interest rate rises. There is no question that increasingly-stretched affordability is holding back some, as well as slowing house price growth and the number of transactions. But there is still demand for correctly-priced properties, underpinned by low unemployment and a race for space which is still not satisfied.”

Angus Dixon, director of private clients at property consultants INHOUS:

“There is still a real lack of stock, which is driving growth in prices. It will be interesting to see how this pans out over the summer with overseas travel back in vogue, rather than staycations; will it impact demand during July and August, and what will that do to pricing?

“The outlook remains relatively bullish as the fundamentals of the wider UK economy and the London market still ring true, even though there are macro-economic headwinds which may halt buyers slightly, rather than completely put them off. There are people who have to move, whether that’s to upsize of downsize, and they are undeterred.

“We have seen a couple of clients move to cash purchases to avoid interest rate fluctuations because they have the ability to do so. For the majority buying in prime or super-prime London, a few rate hikes will not impact them too much, proving to be more of a speed bump than a roadblock.”

Mark Harris, chief executive of mortgage broker SPF Private Clients:

“While some of the heat has come out of the market as we approach the traditionally quieter summer months, there are still plenty of people keen to move although rising interest rates may temper the ambitions of some as to what they can afford.

“What has changed for all borrowers is the rate environment – gone are the sub-1 per cent deals available nine months ago. Now, mortgage products are in the 3 to 4 per cent range depending on their length and loan-to-value.

“These rates available today reflect not only the increase in cost of funds but also lenders’ desire to moderate volumes, with many of the high street banks still sitting on large balances or even cheap Bank of England funds. Specialist lenders are repricing upwards and/or streamlining their product ranges, meaning borrowers need to move quickly to secure rates.”

Charlotte Nixon, mortgage expert at Quilter:

“Nationwide’s latest UK house price index for June shows the pace of house price growth finally looks set to be slowing, with annual growth dipping to 10.7% in June, down from 11.2% in May. However, month-on-month we are still yet to see a decrease in house prices as June saw a seasonally adjusted 0.3% uptick, with the average house now costing £271,613.

“We are continuing to witness the impacts of soaring inflation which now sits at 9.1% and is expected to run into double figures later this year, the rising cost of living, increasingly high energy bills and minimal support from the government – all of which are causing people to tighten their purse strings.

“What began as a ‘pinch’ on people’s finances has fast become a heavy burden on an increasing number of households. What’s more, the Bank of England recently hiked interest rates to 1.25% and is expected to increase them further still to tackle inflation, which will reduce people’s spending power and cause the already dwindling number of cheap mortgage rates to quickly disappear. With wages failing to keep up, the high costs of moving home will put off prospective buyers and first-time buyers will see their hopes of getting a foot on the property ladder pushed further out of reach.

“This reduction in demand could soften house prices as we move further into the summer, and we could see a reversal of prices coming into the autumn when the true scale of the energy crisis is laid bare as temperatures drop.

“The UK is facing a severe financial problem and while the housing market managed to defy expectations and overcome the immediate problems of the pandemic, the cost-of-living crisis will be its biggest challenge yet.”

lan Davison, personal finance distribution director at specialist lender Together:

“House price growth slowed to 10.7% in June from 11.2% the previous month, which once again demonstrates the remarkable resilience of the property market despite continuing economic uncertainty and a cost-of-living crisis hammering household expenses.

“The Stamp Duty holiday saw UK house prices rise at their fastest annual rate in nearly two decades and we are still seeing a continuation of this trend, albeit at a slower rate. The Bank of England has hiked interest rates five times in recent times in a bid to cool rampant inflation, which stood at 9.1% in May – a 40-year high. I’d expect that this and the fact that housing demand still outstrips supply in most areas of the country should lead to more of a slowdown in the coming months.”

Yann Murciano, CEO at Blend:

“Data released today by Nationwide shows that UK house price growth continued to slow in June as the weakening economy, the cost-of-living squeeze, and rising interest rates cooled the market.

“The slowdown was expected and undoubtedly, we have started to see a turning point in the housing market which in our opinion is a healthy correction of the previous sharp increase in prices over the past two years.

“However, the UK housing market has always been a two-speed market and we continue to see some strong pockets of growth within the UK market and as lenders, it is our job to support those experienced housebuilders who are ready to take advantage of the opportunities arising in the current market.”