A leading economic consultancy has warned that house prices will fall by 4.5% in 2023 but said it will do little to make housing more affordable for young buyers.

Since at least November of last year, Cebr has stressed that 2023 would be a challenging year for the UK housing market.

It currently expect prices to fall by 4.5% on average next year, with a peak annual contraction of 6.2% expected in Q3 2023.

This comes amid sharp rises in mortgage rates, significant cost-of-living pressures, an impending recession, and anticipated resultant increases in unemployment.

It said the recently announced energy price cap will bring some respite to households and businesses, these forces are nonetheless set to plague the economy for at least the next year.

And it warned that while many of those eager but unable to reach the housing ladder – the so-called Generation Rent – may rejoice at the idea of falling prices, a contracting housing market will bring economic pain for everyone.

Property makes up an important proportion of national wealth. The latest English Housing Survey shows that two-thirds (65%) of households own their home.

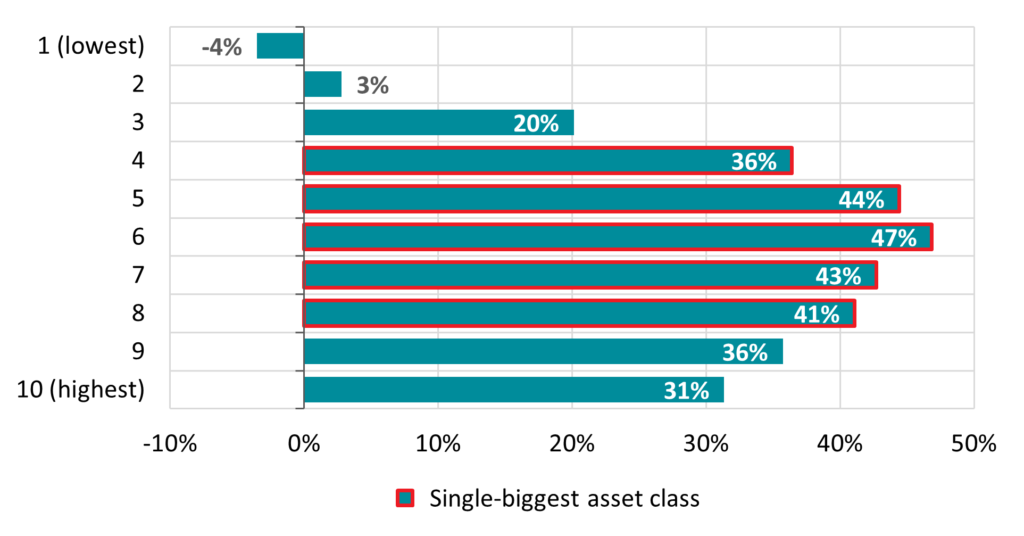

According to data from the ONS Wealth and Assets Survey, aggregate property wealth (net of mortgage debt) in Great Britain accounted for over a third (36%) of total wealth between April 2018 and March 2020.

Indeed for those in the middle and upper-middle of the country’s wealth distribution it represents the single most valuable asset class.

A briefing note from Cebr said: “Within the current climate of rising mortgage rates and falling real incomes, worsening mortgage affordability makes this unlikely.

“Given that frequently the biggest hurdle to get onto the housing ladder is the deposit, lenders’ tendency to push down loan-to-value ratios during periods of downturn means market accessibility at the lower ends is in fact set to worsen.

“More broadly, falling house prices pose an economic threat regardless of one’s homeownership status. Dynamics in the housing market are important for the broader economy, as falling prices dampen confidence, reduce perceived wealth, and increase mortgage defaults, thereby leading to lower consumer spending, deeper recessions, and higher unemployment.

“In fact, the latest data from Cebr’s and YouGov’s Consumer Confidence Index show that, behind worries about energy prices, concerns about home values were the second-most important factor driving consumer confidence into overall negative territory for the first time since May 2020.

“The impact of consumer sentiment on household expenditure is particularly important in the UK, where consumption makes up more than 60% of GDP. Moreover, the anticipated fall in incomes and increase in unemployment will likely be felt more acutely by those without a direct stake in the housing market, as this group tends to be more vulnerable to economic downturns of any kind.

“Within the current climate, therefore, there seem to be few advantages to the anticipated fall in house prices.

“In light of this, it may now be time to seriously consider reviving the Stamp Duty holiday – or even better yet, a complete overhaul of property taxation – in order to keep some life in the housing market and thus the UK economy more broadly.”