Government proposals around EPCs continue to shape behaviour across the BTL sector, even though these remain in the consultation phase.

So, let’s focus on two elements of the government’s Improving Energy Performance Certificates action plan which represent a huge part of the green conversation for all landlords.

The reality is that whilst a provision for exceptions has been included based on affordability, the terms “practical,” “cost-effective” and “affordable” have yet to be defined and there are no specifications in place as to whether these terms apply to both new and existing tenancies.

This means that some question marks remain for landlords in terms of how to tackle existing and potential EPC ratings.

However, if this bill does become law, landlords of properties rated D and E will need to bear the cost in order to improve the property to meet the new minimum standard.

Thankfully, heightened awareness around this topic has become increasingly evident, with our trade press, lenders and intermediaries all playing a key role within this.

A factor apparent in the latest BVA BDRC Landlord Panel research for Q3 2022 which outlined that almost nine in 10 landlords (86%) were fully engaged with minimum EPC standards, although full awareness and appreciation of these regulations dropped slightly for landlords with a single property.

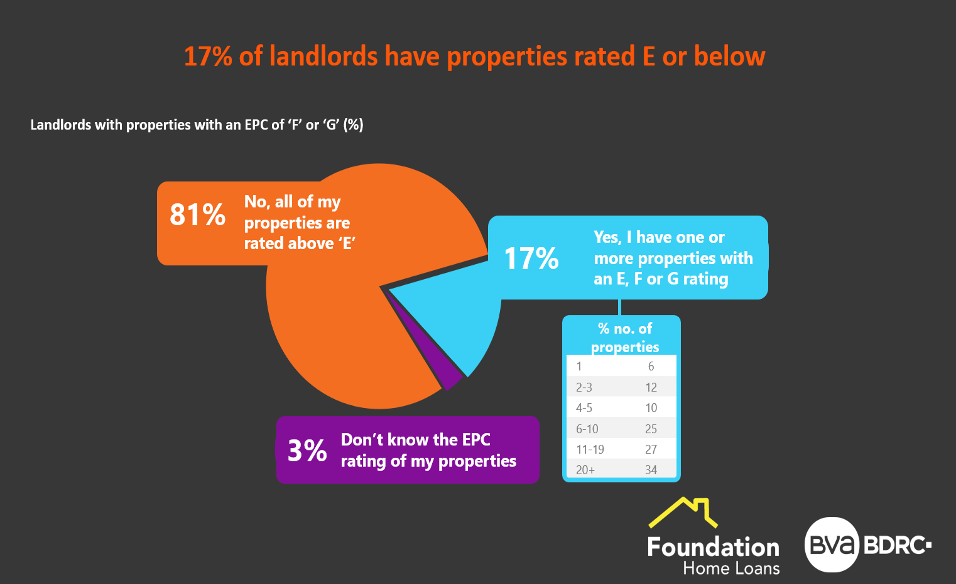

When it came to the type of property owned by landlords from an EPC perspective, the incidence of landlords with a property rated at E or below was suggested to be 17%.

The incidence of properties rated E, F or G within landlord portfolios increased in-line with portfolio size. Fewer than one in 10 single property landlords have a property that is rated E, F or G, rising to over one in three landlords with 20+ properties in their portfolio.

In addition, 3% of landlords who took part in the survey didn’t know the EPC rating on any of their properties.

Staying on this topic, over seven in 10 landlords (71%) who have a property that doesn’t meet the energy efficiency requirements have carried out works in response to these new energy efficiency proposals.

Breaking down the reasoning behind this, 38% of landlords have carried out works to maximise the long-term value of the property, with 37% carrying out works at the minimum cost required.

Almost a third of landlords (31%) who have a property that doesn’t meet the requirements have yet to carry out any works thus far.

This data offers a great snapshot of the current trends being seen across the BTL sector and how landlords with different portfolio sizes are approaching EPC ratings.

From a lending perspective, as a provider who is committed to supporting the green agenda, it’s our job to encourage and reward those landlords who are making the conscious choice to buy energy-efficient properties or improving those which they currently own.

Whilst we remain in the early stages of the green journey, it’s vital for lenders in the BTL, mainstream and specialist residential areas to provide choice and drive positive change where possible to help more borrowers and intermediaries to understand and benefit from an array of green mortgage products. With a collaborative effort required for this important sector to gain the traction it needs and deserves.

Mark Whitear is director of commercial development at Foundation Home Loans