As individuals, especially the younger generation, we have come to rely on technology being at our fingertips for our convenience.

For example, we expect our online banking to be accessible and easy to use and we can order food and goods on our phone and be updated on when they will arrive.

We can choose which film to watch on Netflix and if we miss our favourite TV programmes we just press the catch up button on our remote controller.

The older generation is also adopting these changes because new technology gives them benefits they didn’t have previously.

They are increasingly using mobile phones and mobile browsing to stay in touch with family members spread across the UK and the world.

They have access to services that would otherwise require trips to banks such as depositing a cheque just by taking a photo of it with your phone.

But it’s not necessarily the same in the business world, particularly the mortgage industry. The point I am making is that we should be able to bring what most people expect in their personal lives into their day-to-day working environment.

But so many mortgage businesses are stuck in old ways of doing things. A prime example is my own short-lived experience as an accidental landlord when I had to submit a paper-based form for my buy-to-let mortgage!

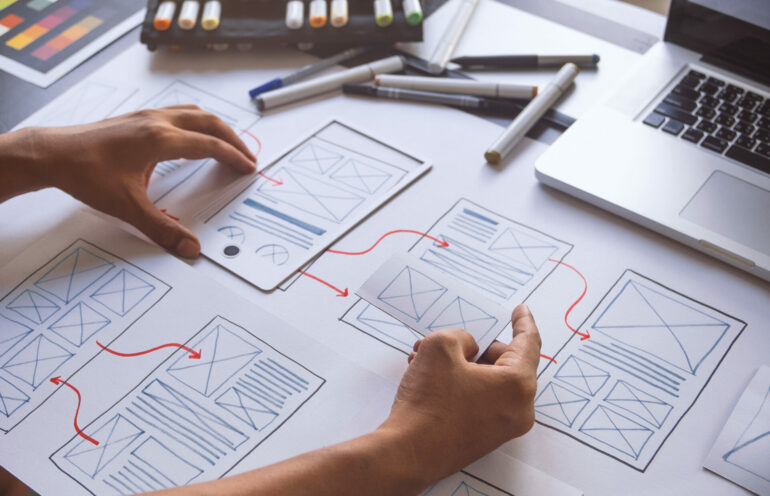

Our tech-focused world, both at work and at home, should be all about user experience (UX), speed and relevance. People are time poor so making things easy and fast is important, with the downsides being ‘creating frustration’, losing customers and risking a bad reputation.

So the challenge is “how do you build the fastest, easiest user-experience (UX) focused mortgage application system, whilst not wasting the time of brokers who may not have business for you today, but might have tomorrow”.

By reducing the time brokers need to deal with a lender on each mortgage application, the chance of them coming back increases, because it was made easy for them.

As one example, we run our credit policy (the rules around which we’re able to lend or not) every time a broker fills in a field. So rather than filling in 15-200 fields for a mortgage application, to then find out “sorry, we can’t lend to you”, we run a full credit policy decision each time a new field is entered on the data provided so far.

The other part of the challenge is to always have the right product in the market. There is no point being the fastest and easiest lender if you’re late to the party.

So we’ve invested internally to track our market position and funding environment, to be able to quickly launch new products in no more than a couple of days – unlike the weeks it used to take and may still take others.

We’ve invested in technology so that it only takes 6-8 minutes to deploy new features once they’re developed – rather than some organisations that might bundle up releases every quarter.

This enables us to stay on top of the game, adapt to customer needs and quickly respond to any emerging issues, scenarios and legislative changes.

We leverage cloud-native technology – so we’re not reinventing the wheel and our engineers focus on the real value-add. Building our broker portal benefitted from starting with a blank slate with no legacy systems to maintain or upgrade.

Whilst Landbay is way ahead in terms of technology, there’s so much more we can do to remove further hurdles, both in our platform and encouraging change with the intermediary partners we work with.

Chris Burrell is chief technology officer at Landbay