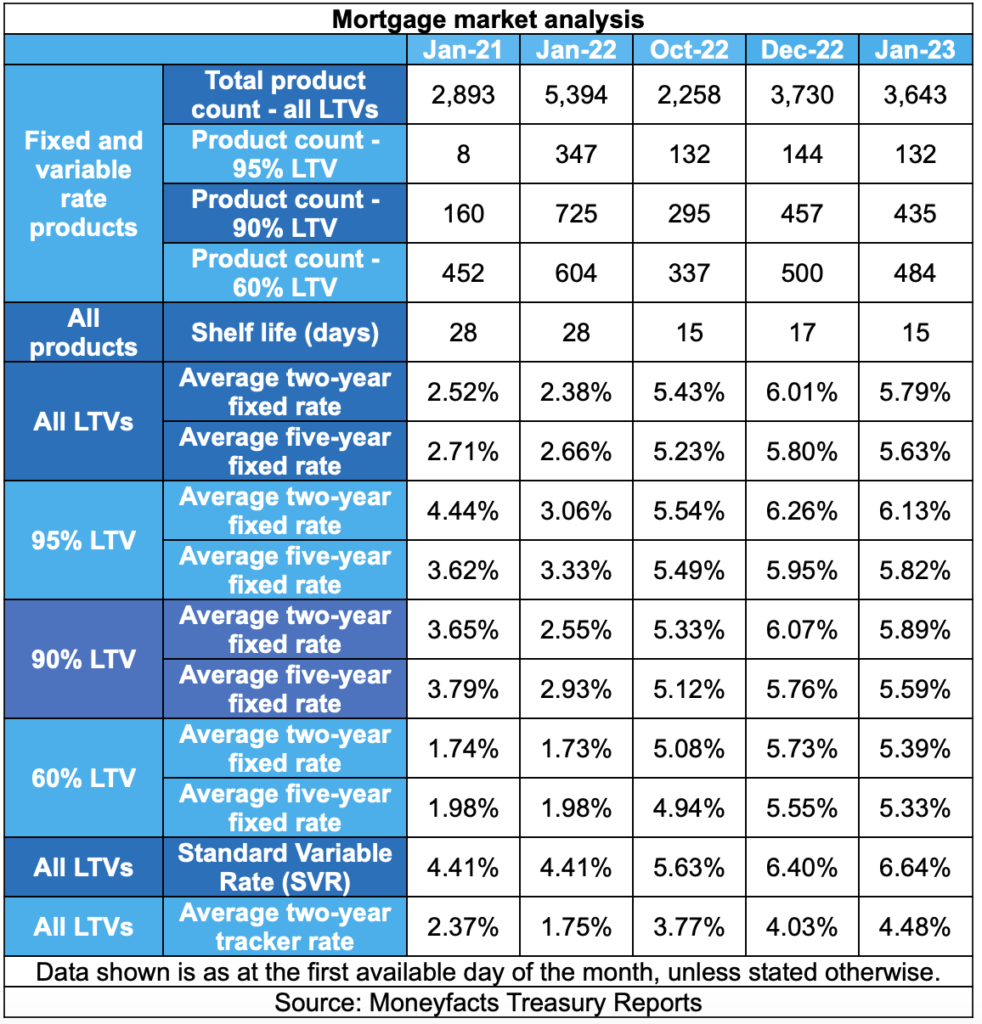

The average shelf life of a mortgage has dropped to 15 days as 2- and 5- fixed rates fell for a second month on the spin, data from Moneyfacts shows.

Meanwhile, product choice has also improved since October 2022, up from 2,258 options to 3,643.

Month-on-month, product numbers were much more stable, falling by just 87 deals, the smallest shift recorded since April 2022 (+87). Moneyfacts said this may well suggest stability has returned to the market.

Both the average 2- and 5-year fixed rates fell month-on-month for the second month running, down to 5.79% and 5.63% respectively, following 13 consecutive months of rises recorded up to November 2022.

At 5.79%, the average 2-year fixed rate dropped by 0.22% – falling below 6.00% for the first time since October 2022.

Following on from another Bank of England base rate rise in December 2022, the average ‘revert to’ rate or Standard Variable Rate (SVR) continued to climb. At 6.64%, this rate is now the highest on Moneyfacts records since November 2008 (6.77%).

The gap between the average 2-year fixed rate mortgage from two years ago (2.52%) and the current average SVR continues to expand (a difference of 4.12%).

Rachel Springall, finance expert at Moneyfacts, said: “Product choice within the mortgage market has improved in recent months, and the latest figures show volumes are at a much more stable level, however, the volatility with lenders adjusting such deals remains as the average shelf life of a mortgage product fell to 15 days, the joint lowest on Moneyfacts records. This activity has led overall fixed rates to fall and indicates the focus of lenders’ repricing strategies.

“Borrowers concerned over interest rates may well be relieved to see both the average 2- and 5-year fixed mortgage rates fell month-on-month, down by 0.22% and 0.17% respectively.

“However, it is clear that both these average rates stand higher compared to a year ago, with notable rises during the tail end of 2022 during a time of unprecedented uncertainty surrounding interest rates.

“Average rates at higher loan-to-value brackets are also falling, but more improvement would be welcomed for those with a limited deposit, considering the average 2-year fixed rate mortgage at 95% loan-to-value sits above 6.00%. The consecutive Bank of England base rate rises have fuelled a rise to the average SVR, which has now reached 6.64%, the highest on Moneyfacts records since November 2008 (6.77%), making it imperative for borrowers to check their rate and consider remortgaging.

“As existing mortgage holders weigh up their refinancing plans and others debate their home purchase desires in 2023, it is imperative they seek independent financial advice to go through the options available to them.

“The cost of living crisis and inflated interest rates over recent months may well impact borrowers’ intentions of getting a new deal. However, it is anticipated that fixed interest rates will fall further in the months to come to entice new business.”