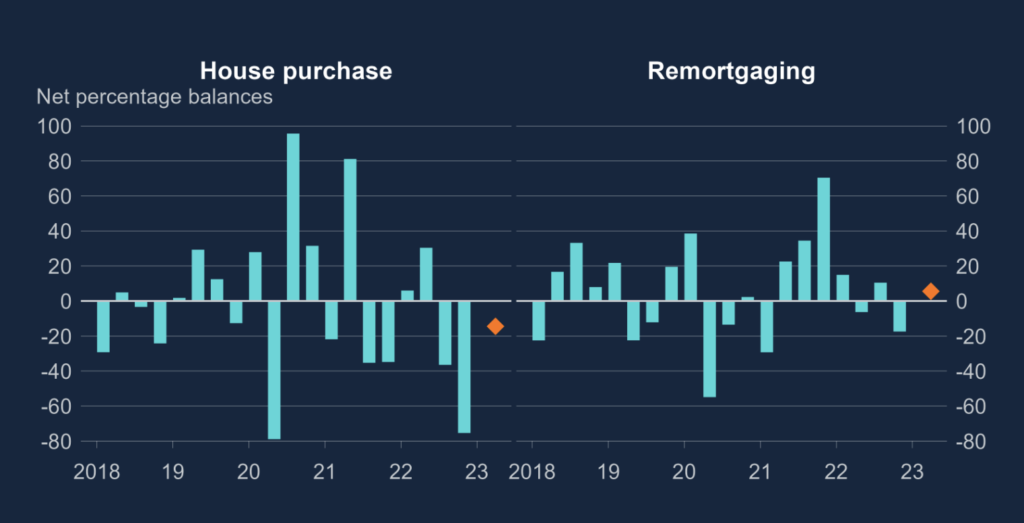

Unsurprisingly lenders have confirmed that following the botched mini-Budget demand for mortgages decreased in Q4 2022, and was expected to decrease further in Q1.

The Bank of England said that demand for secured lending for remortgaging also decreased in Q4 2022, but was expected to increase slightly in Q1 2023.

Meanwhile, mortgage defaults were stable, but the Bank of England said they are expected to rise between January and March.

Sarah Coles, senior personal finance analyst, Hargreaves Lansdown, said: “Mortgage demand dropped like a stone in the wake of the mini-Budget, as rampant rate rises forced buyers to flee the market in droves.

“And despite rates falling back in recent weeks, the damage has been done – demand isn’t expected to recover in the next few months.

“Meanwhile red flags have been raised on debt. Defaults on unsecured lending like credit cards and loans were up at the end of 2022, and are expected to keep climbing in the first three months of this year.

“Mortgage demand plummeted at the kind of rate we saw when the market was effectively shut at the start of the pandemic.

“The shock of the mini-Budget, and the carnage it caused in the mortgage market, meant buyers faced massive rate hikes that left their plans in tatters.

“More recently rates have been dropping, but they remain significantly higher than before the chaos unfolded.

“Buyers are also reeling from the shock of the rate rises, which put a real dent in their confidence.

“So although the fall in mortgage demand isn’t expected to be anywhere near so dramatic in the first three months of the year, it’s still expected to be down again.

“It will take a while for all of this to feed into the figures on house prices, but when it does, we can expect some significant changes.”