A third of over-50s have concerns about being able to put enough food on their tables if the country slips into the recession predicted by the Bank of England.

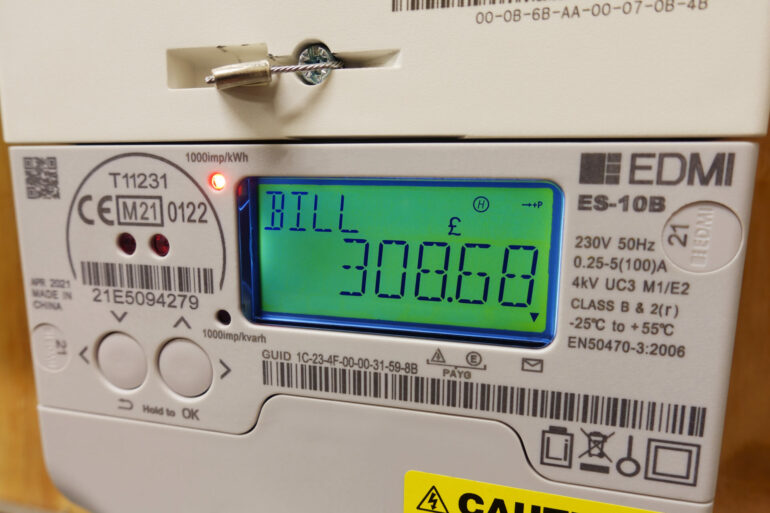

New data from LiveMore also shows more than half of 50-90 year olds fear that they will not be able to heat their homes or pay other vital bills as the economic downturn continues.

For many who voiced their individual concerns, the biggest issue was that increasing prices were already eating into their savings.

This leaves them with “no extra cash for anything” like travelling to see grandchildren, going on holiday or taking part in the hobbies which make their lives worth living.

Others said they were worried that the worsening economy would make mortgage rate rises unmanageable, force them to put off their retirement date or stop them from helping their children get on the property ladder.

The Bank’s latest forecast is that the UK will enter recession during 2023.

Leon Diamond, CEO of LiveMore, said: “There is a misleading perception in the UK – particularly among younger people – that the majority of over-50s have had it easier financially and are comfortably off.

“The LiveMore Barometer dispels that myth and gives us insight into the very real concerns which drive their financial priorities.

“It is clear that many of the UK’s older people are being hit hard by the cost-of-living crisis and are already close to the edge financially – and now fear that its effects will continue to get worse if the UK dips into recession.”

The LiveMore Barometer was carried out by Censuswide and saw 2,041 UK respondents questioned across 12 UK geographical regions about the state of their financial lives and how they were being affected by the economy.